Restricted Stock

Post on: 28 Май, 2015 No Comment

How they’re different and what their increasing popularity means for your incentive plan.

Restricted stock programs have been in existence for years and, at least initially, were primarily tied to compensation for upper-level management. However, with the advent of mandatory stock option expensing in 2006, and with companies such as Microsoft changing their compensation mix from stock options to restricted stock units (RSUs), many companies have started issuing restricted stock and RSUs to lower-level management and entry-level employees.

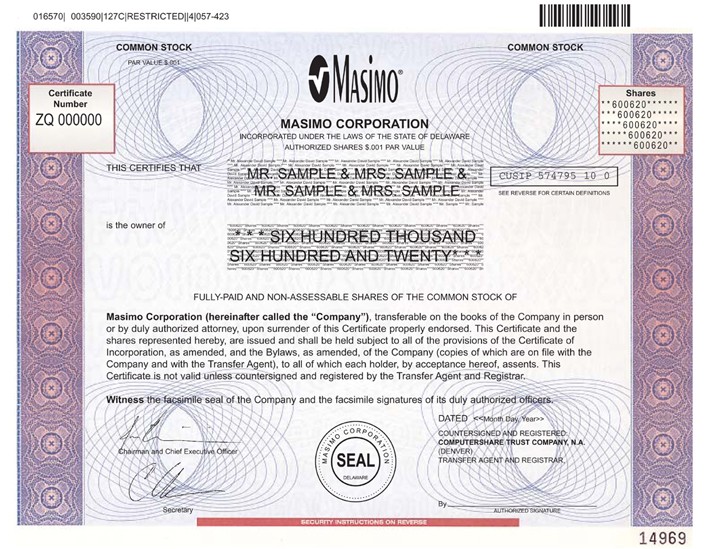

Restricted stock and RSUs are similar but there are some basic differences between the two. Restricted stock is an actual grant of shares to a participant, while an RSU is the promise of issuing stock or cash at a specific lapse or vest date. The main distinction between the two is that, with restricted stock awards, awardees are considered to own the stock, have voting rights and are entitled to corporate dividend payments, while with RSUs, awardees do not own the shares, do not have voting rights, and they may or may not receive dividend payments, depending on the RSU structure.

Another major difference between restricted stock and RSUs is that a restricted stock holder can make a Section 83(b) tax election at the time of grant but an RSU holder cannot make such a selection. With a ‘normal’ restricted stock award, the tax consequences are based on the fair market value (FMV) of the number of shares that lapse/vest. For example, if an awardee was given a restricted stock award for 1,000 shares and the stock price at the time of grant was $20, that award would have an initial FMV of $20,000. If 25% of the award lapses or vests after one year, and the price of the stock increased to $25, then the FMV of the lapsed/vested portion would be $6,250 (25% of 1,000 shares X $25).

The 83(b) election (which needs to be made within 30 days of the grant) allows the awardee to pay for applicable taxes based on the FMV at the time of the grant. In the above example, the awardee would pay taxes on taxable compensation of $20,000, but then would have no further tax consequences as later lapsing/vesting occurs.

However, there is some risk/reward with filing an 83(b) election. If the company stock decreases in price, the awardee would have paid too much tax and the overpayment would be non-refundable. Likewise, if the awardee leaves the company for whatever reason and the restricted stock award is forfeited/canceled, then any previously paid tax from the 83(b) election is not refunded. For the above reasons, many awardees are somewhat hesitant to undergo an 83(b) election, unless the stock price is extremely low.

An additional difference with RSUs is that they can have a tax-deferral feature attached to them which can make them much more attractive to certain groups of awardees. With a restricted stock award, this deferral feature is not an alternative.

Furthermore, depending on the country-specific tax regulations, RSUs can be advantageous over restricted stock when you’re issuing awards outside of the U.S. because some countries tax-restricted stock awards at the time of grant, not at the time of lapse/vesting. RSUs can get around this hurdle and are primarily taxed at the time of lapsing/vesting.

Companies are also looking to grant more performance-based awards for which it is fairly easy to use an RSU structure. No company shares are issued with an RSU grant and it is easy to cancel the RSU if the performance criteria are not met. These types of performance-based RSU awards are becoming much more common.