Reset Your Investment Cost Basis With Charitable Donations

Post on: 22 Июнь, 2015 No Comment

Today, I want to share a tip that will help you avoid future taxes on the taxable portion of your investment portfolio. As youre no doubt aware, when an investment in a taxable account goes up in value and you sell it, you have to pay taxes capital gains taxes on your gain.

So What would you say if I told you that you could make just as much money while minimizing your apparent gain, and thus your tax bill? Well, you can. Read on for details.

Understanding capital gains

Capital gains are calculated as the amount you sell an investment for minus your cost basis (i.e. the amount you paid for it). If you held the investment for less than 12 months, you have short-term capital gains. If you held the investment for more than 12 months, you have long-term capital gains.

Short-term capital gains are typically taxed as ordinary income, whereas long-term capital gains are typically taxed at a favorable rate. But thats not the only difference Your holding period also affects the tax treatment of your investment if you choose to donate it.

Donating appreciated assets

Its well known that charitable contributions are tax deductible. But did you know that you can donate investments without selling them first? Not all charities accept such donations, but many do. If your preferred charity doesnt accept appreciated investments, you can always funnel your donation through a donor-advised fund .

This is where it gets interesting As noted above, the tax treatment of your donated investment depends on how long you held it.

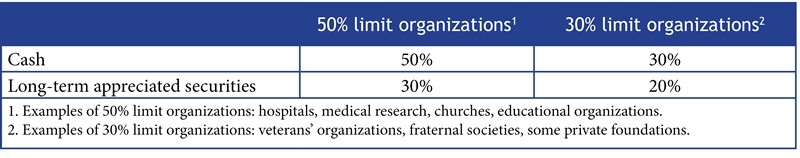

If you held it for less than twelve months (i.e. its a short-term capital gain property), then you can only deduct what you paid for it. If, on the other hand, you held it for more than twelve months (i.e. its a long-term capital gain property), then you can deduct the fair market value as of the date of your donation.

Resetting your cost basis

So How can you use this information to your advantage? Simple. If an investment that youve been holding for more than 12 months has gone up in value, and if youre planning making a charitable contribution, donate some or all of your investment instead of cash. Next, use the cash you wouldve donated to buy back the investment at the current price.

Consider the following scenario:

A few years ago, you bought 1000 shares of ABC at $5/share. Thus, your cost basis is $5k. In the time since you bought it, the share price has doubled to $10k. Further assume that youre looking to donate $10k to a certain charity. Instead of giving cash, donate the shares of stock.

Next, take the $10k that you would have donated and buy back $10k worth of shares of ABC. The net effect is that youve donated $10k to your charity of choice and youve increased the cost basis of your investment from $5k to $10k.

Now, when it comes time to sell, your capital gain will be figured as the sale price minus $10k instead of sale price minus $5k. Pretty slick, huh?

Oh, and just in case youre concerned about the wash sale rule Dont be. The wash sale rule applies only to sales that result in a loss. If you make a donation and then re-buy, your basis gets reset with no downside.

Published on April 30th, 2010