Research on Reducing Portfolio Volatility

Post on: 27 Июнь, 2015 No Comment

Michael Kitces and I have completed a new research article called, Retirement Risk, Rising Equity Glidepaths, and Valuation-Based Asset Allocation. Its now available as a working paper at SSRN.

This morning, as well, Michael has written a detailed overview of the research at his Nerds Eye View blog. A funny point about that. With our last article, I think a lot of people became familiar with it from Michaels blog post. Twice now, Ive been speaking to groups of financial planners, and someone has asked me if Im aware of the recent research about rising equity glidepaths in retirement. Everyone gets a good laugh as I awkwardly answer that I am aware of the research, since Im actually one of its co-authors.

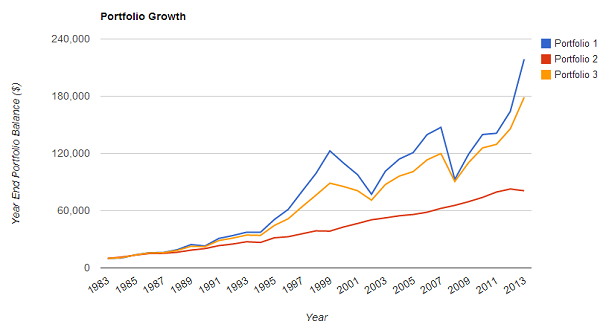

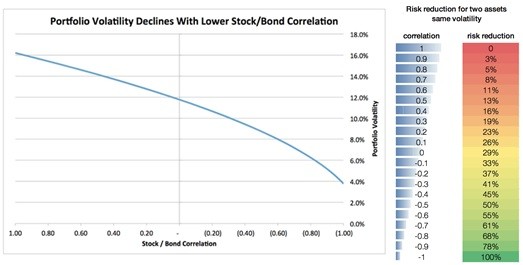

In order to avoid overlapping too much with Michaels excellent overview, let me take a different angle in an attempt to summarize this new research article. It all begins with sequence risk, which is the idea that even if the average market return is decent, retirees are especially vulnerable to the impact of bad market returns in the early part of their retirement. Sequence risk is uniquely caused by the attempt to (1) spend a constant amount each year from (2) a volatile investment portfolio. Sequence risk can be dampened by either letting spending fluctuate or by reducing portfolio volatility. For this research, we are focused on the reducing portfolio volatility side of the equation.

Outside of just using a low equity allocation throughout retirement (which leads to its own sets of risks in terms of potentially being locked out of any possibility to meet ones spending goals), we can identify three major ways to reduce portfolio volatility when it counts the most:

(1) rising equity glidepath: reduces portfolio volatility in the pivotal years near the retirement date when a retiree is most vulnerable to losing the most dollars of wealth with a given market drop. People are most vulnerable and have the most at stake when their wealth is the largest.

(2) valuation-based asset allocation: reduces the stock allocation when the portfolio is the most vulnerable to experiencing a big decline in value, which historically has happened when Robert Shillers cyclically-adjusted price earnings ratio has risen to levels well above its average (i.e. 1929, the mid-1960s, and 2000).

(3) funded ratio: Reduces portfolio volatility when the retiree has enough assets to just get by with meeting their retirement spending goals using a low-volatility portfolio. Once the retiree has excess discretionary wealth beyond what is needed to safely lock in their goals, thats when they can invest more aggressively with a volatile portfolio. In other words, reduce volatility when you are most vulnerable to a transition from being able to meet your goals to not being able to meet your goals.

This new research focuses more on the interplay between using different glidepaths and using valuation-based asset allocation.

We clarify that the rising equity glidepath does not necessarily have to be used as a universal situation. However, todays investing environment does reflect the circumstances when the rising glidepath is most useful. That is, the stock market is overvalued and is more vulnerable to a significant drop. This is when the rising glidepath works best: it lowers the stock allocation to help guide through the environment when the retiree is most vulnerable to a market drop, and presuming such a drop happens at some point, it will then be shifting to a higher stock allocation later in retirement when markets are more fairly valued. In other words, it approximates a valuation-based asset allocation strategy.

When markets are not overvalued, which does not reflect the situation today, then retirees might look more carefully at just holding a higher stock allocation, or at using a valuation-based asset allocation strategy. If markets are undervalued, the traditional type of declining equity glidepath in retirement can actually look more attractive, as it provides a closer proxy to what would be done with a valuation-based strategy.

In conclusion, in todays overvalued market environment, retirees can reduce their vulnerable to the effects of a big drop in the stock market by using a lower equity allocation. This can be accomplished either by using a pre-set rising equity glidepath (as an inverse of what todays target date funds do for the pre-retirement period), a valuation-based strategy, or even a combined rising equity glidepath with a valuations overlay. This is the subject of our new article at SSRN .

Share this:

10 thoughts on Retirement Risk, Rising Equity Glidepaths, and Valuation-Based Asset Allocation

- 3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D44&r=G /% Larry Frank September 17, 2014 at 4:10 pm

Hi Wade. A stimulating research project. However, as I mentioned in our prior email conversation. the results are from static periods.

As the retire dynamically ages from a longer period into a shorter period, the allocation goes down for the shorter period relative to the longer period, not up as suggested by the static perspective. Your graphs for the different periods show this.

Should the retiree accumulate excess resources, as you state, then increasing the allocation may be applicable.

I think the findings are influenced a bit by the design of the experiment that being static snapshots versus incorporating the aging process. This said, your results still suggest that aging through the shorter periods retains keeping stock exposure lower for older ages.

We all learn more from each other through the results and conversations that ensue. Great stuff Wade!

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D44&r=G /% Larry Frank September 18, 2014 at 3:39 pm

www.amazon.com/Rational-Expectations-Allocation-Investing-Adults/dp/0988780321/ref=sr_1_2?s=books&ie=UTF8&qid=1411053962&sr=1-2&keywords=Bernstein ). This said, what do your results show for SHORTER periods representing older retirees that have less than 30 years left?

This gets to Bernsteins point that all data is dynamic and the future data points adjust all the past data accordingly. Since most practitioners use Monte Carlo versus the static SafeMAX approach, how would those MC results be adjusted according to valuation in a rational, predictive, manner? As well as over actual time periods based on actuarially determined expected longevity (or adjusting that longer using Annuity or a longevity percentile value) versus set static periods?

Circles back to static versus dynamic experiment design. In my humble opinion, people age dynamically and market as well as longevity data also update dynamically. The Static approach provides insight and is instructive. But the dynamic application piece is missing for real life.

The paper gets the thought-juices flowing!

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D44&r=G /% John D Craig September 18, 2014 at 4:38 pm

I think that most people will agree that valuations matter. It is best to buy low and sell high. Michael Kitces references Graham and tactical asset allocation from 75 years ago. Although the principles are sound, market timing in practice has proved difficult. There have been hundreds of asset allocation mutual funds that use many different quantitative approaches; these have had little if any proven success. Why do you feel this TAA approach will work better than those of the past?

Larry said: Since most practitioners use Monte Carlo versus the static SafeMAX approach, how would those MC results be adjusted according to valuation in a rational, predictive, manner? He suggests that the historic data input into MC may well not represent the future because the data pattern changes over time. Another sound principle.

Actually Michael Kitces did suggest an answer to Larrys question:

I find virtually all of the Monte Carlo tools built into todays financial planning software packages to be too limited. My main gripe in particular is the limitations in modeling varying return assumptions over time. Even just a simple model of for the next decade, bonds with have a lower return of X% and a standard deviation of Y%, and then for the remaining years well assume long-term historical averages and standard deviations would be a better framework given todays initial market conditions (and the same could be done for equities, as weve shown in JFP research that the return/SD parameters for a Monte Carlo projection are VERY different depending on starting market valuation.

In other words, if you dont like the MCS results using historical data, change the inputs so that you get the expected (desired) outputs.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D44&r=G /% Wade Pfau September 18, 2014 at 9:10 pm

Larry,

Thanks, youre making a good point. These matters definitely need to be analyzed with the dynamic approach you suggest.

Larry and John, in practical terms, Monte Carlo inputs for average stock returns could be adjusted according to the predictions from the Campbell and Shiller model which shows how subsequent 10-year real stock returns have related to PE10.

John, about why this is different, I dont want to start at the very beginning. If you click on the Articles and Columns above, there are links to these two articles in which I attempt to make this case:

Valuation-Based Asset Allocation

Long-Term Investors and Valuation-Based Asset Allocation. Applied Financial Economics (August 2012). [P] [WP]

Safe Withdrawal Rates, Savings Rates, and Valuation-Based Asset Allocation. Journal of Financial Planning (April 2012) [P] [WP]

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D44&r=G /% Isaac Cheng September 20, 2014 at 5:55 pm

Hi Wade. Great work as always! Thanks for sharing it. I particularly like your unique angle of introducing the article. Im also interested in how (3) funded ratio stacks up against the competition. Do you have links for me to read up on that?

Intuitively, it seems to be a good idea to determine the appropriate asset allocation based on personal needs and goals, rather than trying to predict the future based on the past and the current market conditions. If there is science that backs or disproves this belief, I want to know.

- 3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D44&r=G /% Wade Pfau September 26, 2014 at 7:13 pm

Isaac,

For those willing to make the effort to do the funded ratio approach (as it requires making a detailed budget and understanding how to match assets and liabilities), it is certainly probably the best approach to take. Our rising glidepath research is more about what should default glidepaths be for people uninterested in such matters.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D44&r=G /% Isaac Cheng September 27, 2014 at 5:49 pm

Wade,

We can perhaps get most of the benefit from the funded ratio approach without the effort of detailed budgeting. We can simply track spending loosely. Instead of ratio (analog), Im thinking levels (digital). Let me explain.

How well I am funded (at any point in time) can simply be described by one of these three levels: SURVIVAL, COMFORT, and FREEDOM. When Im seeking survival, my portfolio is all equity. When Im seeking comfort, my portfolio is equity heavy. When Im seeking freedom, I have a balanced portfolio. When money is no object, I lock my wealth in a conservative portfolio.

The approach can be made simple and practical. Determining how much I need to survive and how much I need to live comfortably does not require detailed budgeting. Two levels are enough (for 99% of us). Based on which level Im at, I can simply pick a prefab efficient portfolio without the need for a deeper understanding of MPT. I dont even need to rebalance my portfolio except when it is the most vulnerable (only at the level when my portfolio is supposed to be balanced). Last year, Paul Merriman found that rebalancing an all-equity portfolio would make it less efficient. I later found out that rebalancing an equity-heavy portfolio has no effect on its efficiency when compared with a simple buy-and-hold strategy.

To implement this level-triggered glidepath, I just need a handful of trades per my entire life, not per year. Each trade is triggered by comparing my personal net worth against a real dollar amount that is meaningful to me. It probably beats comparing the current PE ratio against PE10.

Like the valuation-based approach, this funded level approach would naturally end up in a U-shaped lifetime glidepath if I happened to retire at a time when the equity market happened to be over-valued. In general, the approach makes no assumption on the market, my age, and whether Im accumulating or decumulating at any point in time. Under most market conditions and personal circumstances, this simple level-triggered approach seems to be more robust than either simple U-shape or pure valuation PE10 (ignoring personal needs and goals). Can you think of any scenario under which the level-triggered glidepath would do worse?

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D44&r=G /% Larry Frank September 21, 2014 at 3:49 am

Hi again.

I agree with Johns lament about current MC software not having flexibility with changing returns and standard deviations over time. Our work (link to it by clicking on name and then SSRN papers Appendices) is a first step towards that by simulating each period separately and summing cash flow and portfolio value results through a serial connection of all of them. The next step would be as John suggests, changing the risk/return assumptions for each separate simulation. Although the danger there is willy-nilly timing changes versus something more thought out.

Reason for the new comment though Wade is pointing out that a properly diversified portfolio includes NON-US holdings too, both stock and bond. Purpose isnt so much about returns (your paper in Advisor Perspectives March 4, 2014 looks at international returns); no, purpose is really about how adding other asset classes to a portfolio enhance the volatility lower volatility given even the same returns improves withdrawals as well (another great paper of yours Wade relevant to volatility insights Capital Market Expectations, Asset Allocation, and Safe Withdrawal Rates, JFP Dec 2013 and also seen in our paper series data too).

Thus, assuming CAPE is a possible tool (Im still tending to agree with Bernstein that evidence isnt all in yet), it would only apply to part of the portfolio that being US holdings. Secondly, returns have volatility and those give and take from withdrawals as well.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D44&r=G /% Brad Case, PhD, CFA, CAIA September 26, 2014 at 6:52 pm

- 3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D44&r=G /% Wade Pfau September 26, 2014 at 7:18 pm

Brad,

The Arnott research is about the pre-retirement phase. We are looking at post-retirement. I disagree with the idea that you should have a rising glidepath for pre-retirement, though thats not the issue in this paper. We support a U-shaped lifetime glidepath, with the minimum stock allocation for the period right around the retirement date.