Reporting Your Child s Income on Your Return

Post on: 16 Март, 2015 No Comment

Updated March 5, 2009

You may be able to avoid filing a return for your child by reporting the child’s income on your return.

For any year the kiddie tax applies to your child, you may be able to report the child’s investment income on your tax return. (The kiddie tax applies to certain children with investment income above a threshold amount, as explained here .) This may cause the total amount paid to be higher or lower, but most people think about doing this mainly because of the convenience: it means preparing and filing one less tax return. You’re never required to do this, so you shouldn’t make this election if it will cost you more than the benefit you get from avoiding paperwork.

The amount of paperwork you avoid by doing this isn’t much. If you make the election you have to fill out a special form and attach it to your own tax return. That’s likely to be about the same amount of work as preparing a separate return for the child.

Who can do this

Not everyone can make this election. You can do this only if all of the following are true:

- The kiddie tax applied to your child for the year. The kiddie tax can now apply to students up to age 24.

- The child’s only income was from interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends. If your child has any other income, such as a capital gain or loss from selling shares of stock, the election is not available.

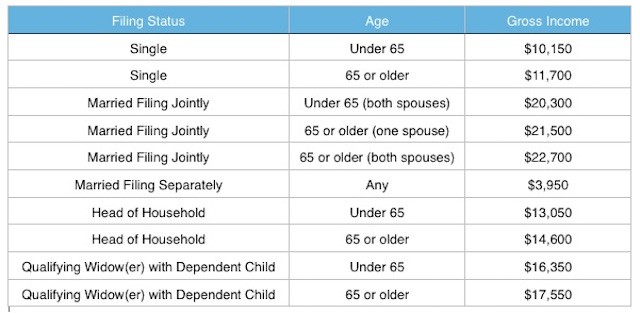

- The child’s gross income for the year was less than $9,500. (This is the number for 2009; it is adjusted from time to time for inflation.)

- The child is required to file a tax return for the year. If the child’s income is too low to require a tax return, you probably don’t want to report the income on your tax return, but even if for some strange reason you want to do so, the IRS says it isn’t allowed.

Probably the key point here is that the election isn’t available if your child has capital gains or losses, other than capital gain distributions. Many people wonder if they can use this rule to move a child’s capital losses to the parents’ return, but this isn’t possible. (Click here for more on capital losses of minors.)

How it’s done

You don’t simply add the child’s income to your own income on your tax return. Instead, you report the child’s income on a special form and attach it to your return. Click here to download the form and instructions.

Effect of the election

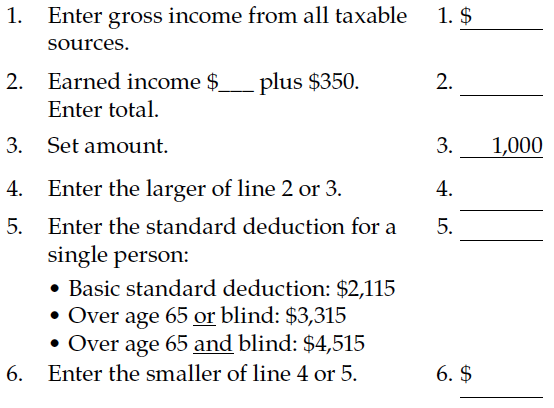

If you make this election, you still get the benefit of the child’s $950 standard deduction. You also get to apply the child’s tax rate to the next $950 of income. (The tax rate at this level is 10%.) It’s only when the child’s investment income exceeds $1,900 that the parents’ tax rate applies.

Example: In 2009 your child has $2,900 of interest income and no other income. The first $950 of investment income escapes taxation: your child’s standard deduction takes care of that. The next $950 is taxed at the child’s rate of 10%. That leaves $1,000 to be taxed at whatever rate would apply if this income were added to the income reported on your tax return. Suppose you’re in the 28% tax bracket. The tax on your child’s income would be 10% of $950 plus 28% of $1,000, for a total of $375.

This is the same example we used in explaining the kiddie tax, because you end up with the same result either way. As explained below, however, there are some ways you can end up paying more tax (or possibly less tax) as a result of reporting this income on your return instead of a separate return for the child.

Certain benefits not available

Some benefits that might be claimed on a child’s separate income tax return are not available if you report the child’s income on your tax return. Here are some examples:

- If your child forfeits interest for withdrawing money from making an early withdrawal from a savings account, a deduction is allowed on a separate tax return but not if you report the child’s income on your tax return.

- If your child has itemized deductions such as investment expenses and charitable contributions that add up to more than $950, tax savings from those itemized deductions would potentially be available, but only on a separate tax return for the child.

- If your child is blind, a larger standard deduction is available, but only on a separate tax return for the child.

In addition, the tax on the child’s income may be somewhat higher if the child received capital gain distributions. You get the benefit of the capital gains rate on any portion of the child’s income that is taxed at your rate, but lose the benefit on any portion that is taxed at the child’s rate. The maximum amount that is taxed at the child’s rate is $950, and at this income level the difference in rates is 10% (the regular tax rate is 10% and the capital gains rate at this level is 0%), so the difference can be as much as $95.

Investment interest expense

There’s one place where you can come out ahead by including the child’s income on your tax return. When you determine how much investment interest expense you’re allowed to deduct, the IRS says you can add the child’s investment income to your own. Having a larger amount of investment income sometimes allows you to claim a larger deduction for investment interest expense. If you have investment interest expense that isn’t deductible because you don’t have enough net investment income, you may benefit by making the election to include your child’s investment income on your tax return.