Rental Property vs REIT

Post on: 16 Июнь, 2015 No Comment

Off and on, Ive been thinking about buying a rental property but for some strange reason, the idea of Real Estate Investment Trusts (REIT) never crossed my radar. Over the weekend, a conversation with a former coworker sparked my interest in this sector again, and this time, I decided to compare a rental property with REIT. After a bit of research, let me share with you what I learned.

First, The Real Estate Conversation

Over the past year, one of my co-worker bought an income property for $140,000. According to him, he is getting $1,500+ in rent a month and after calculating all the association, property taxes and such, he is getting a 9% return on investment. With a strong cash flow like that, he can afford to wait until prices of housing finally go back to a normal upward trajectory, which is rather impressive. (now you know why I was interested)

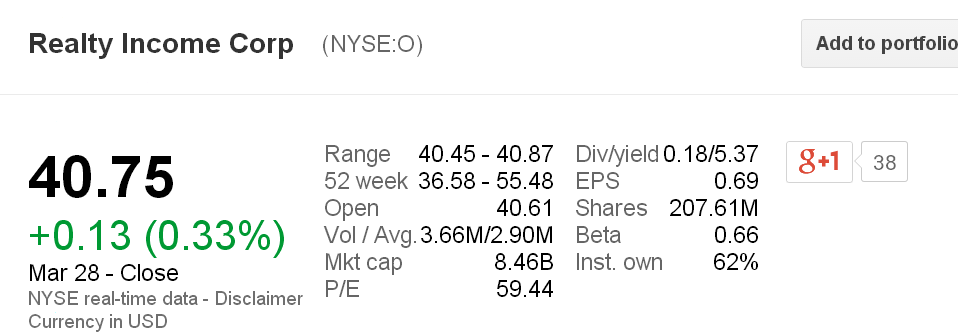

But REITs seem to be a good alternative too. With a bit of digging, I found was that investing in a REIT is similar to investing in an individual stock in that the performance (and risks) are very dependent on the company that owns the actual properties. Therefore, investing in a particular REIT meant that I had to keep up with research and make sure Im not investing in a dud. Thats too much work, so I turned to ETFs. Luckily, Vanguard has a pretty attractive ETF in this area Vanguard REIT ETF (VNQ).

At first glance, VNQs 4.8% yield is not as attractive as a 9% return, but 9% comes with more hassle and risks. They include:

- Possible Tenant Troubles They may call you for something that needs to be fixed, which costs you time and money.

- Tenant Payment Issues If the tenant decides to live there rent free, it takes months to properly evict them.

- Tenant Changeover Every time the original tenant moves out, you have to pay for cleaning, possible remodeling as well as the down time of having no tenants for a while.

- General Maintenance of the Properties Houses need fixing as they age, and everything is a cost.

- Soft Costs Cell phone costs for talking to the tenants, gas to go check out and manage the properties are all costs that add up over time.

On the other hand, REITs offer:

- Liquidity The ETF can be bought or sold at any time.

- Compound Interests Dividends are distributed quarterly and if you reinvest it back into the ETF, the returns are higher than the stated 4.8%

- Historically, the yield is higher than 4.8%, but with a sagging economy, vacancies are high. Over the long term, this yield should increase faster than the rent that my coworker is getting.

- Small Barrier of Entry The reason why my friend is able to buy these condos at such a low price is because he is paying cash. How many of us really have $140,000 lying around? With VNQ, you can start with $50.

Other Factors to Consider

- Taxation In general, dividends from REITs are taxable as ordinary income. Since this is the same as the income generated from an income property, it becomes a wash. However, REITs sell buildings from time to time, forcing investors to take capital gains, which can erode some gains. With REITs, you can put it in retirement accounts to shelter the income from taxes while its not possible (at least from what Ive read so far) to do so with a real property.

- Appreciation Rental properties obviously can gain in value, and so will REITs. I consider this a wash because I, or anyone else for that matter, cannot accurately predict which investment is going to appreciate more in the future.

Since Im striving towards passive income, a REIT ETF seems like the way to go, especially if Im thinking long term and planning to make investments in my retirement accounts.

What do you think? Do you own either of these and have some suggestions for a novice like me? Anything else you want to add about these?