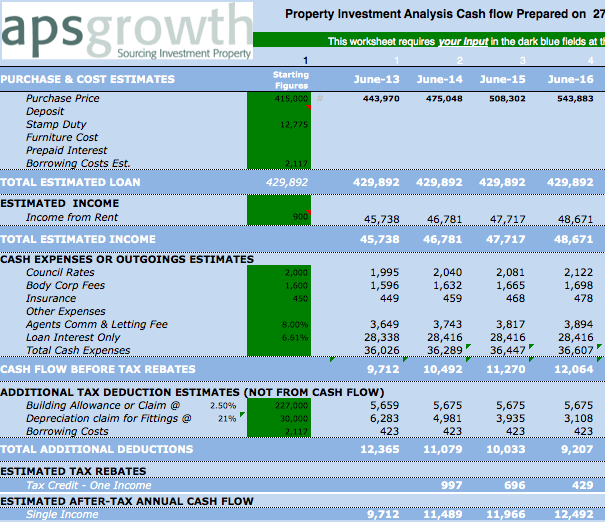

Rental Property Cash Flow Analysis

Post on: 9 Июнь, 2015 No Comment

Your monthly rental property cash flow analysis is calculated by subtracting monthly expenses from monthly rental revenue. As long as you’re left with a positive number, no matter how small, you’ll be in good shape.

Assuming you used conservative assumptions when you did your real estate analysis and did not overpay for the multi family property, it should already be carrying itself. In other words, you should be at least breaking even right out of the gate.

Keep in mind that your rental property cashflow will always be tightest in the beginning. Usually the first year is particularly tight as you recover from making the acquisition, replacing tenants, completing deferred maintenance, etc. After this first year, your rental property cash flow position will gradually improve over time.

USE CASH FLOW TO BUILD A RESERVE ACCOUNT

By now you realize that buying rental property is a long term investment strategy. As such, monthly cashflow should not be the primary objective. the goal is to cash out when you sell in 10 or more years. Therefore, the best thing to do is to keep any extra monthly cash in a reserve account for future purposes.

The reserve account will come in handy when a tenant moves out – you’ll need extra cash to cover 1 month of lost income and to prep the apartment for the next tenant (if you’re lucky this would only entail spackling and painting, as well as a thorough cleaning). It will also help when the inevitable surprise expense comes up – for example, if a pipe bursts or a hot water heater unexpectedly fails.

IMPROVING YOUR CASH FLOW POSITION

Ok, if you’re paying attention then you already know that there are 2 things you can do to improve your cash flow analysis:

Your strategy and focus must be on making small, incremental improvements in these areas over time. It will NOT happen overnight. Eventually, in a couple of years, you should begin to see a small cashflow or profit each month – perhaps a couple hundred bucks or more.

Be patient and follow the course. Raising rents over time in particular will pay huge dividends down the road, because the higher the rent-roll, the higher the price you’ll get when you sell.

MANAGING CASH FLOW ANALYSIS

Doing a monthly cash flow analysis is easy with Excel or some other spreadsheet tool. Click here to download a copy of the spreadsheet I use for this purpose (note: you’ll need Adobe Reader. to download a copy, click here ).

Every month, input your rental revenue and expense items, and subtract one from the other to monitor cashflow performance. This will also come in very handy around tax time for itemizing deductions.