Recent Developments in Goodwill Impairment Testing

Post on: 31 Май, 2015 No Comment

In a previous Alert we discussed step 1 goodwill impairment testing and the appropriate test level, i.e. (i) enterprise (or invested capital) level, (ii) total asset level, or (iii) equity level, in response to comments by an SEC staff member at the 2009 AICPA conference. As a result of the SEC staff members comments and the recognition of diversity in practice, this issue was further discussed by the FASB as part of its deliberations in EITF 10-A, When to Perform Step 2 of the Goodwill Impairment Test for Reporting Units with Zero or Negative Carrying Amounts. The FASB provided comments on the method for determining the carrying value for a reporting unit and how to test for goodwill impairment in reporting units with zero or negative carrying amounts. The FASB also started a new project on goodwill impairment assessments.

BACKGROUND

EITF 10-A resulted from questions pertaining to whether a reporting units carrying amount should be based on an enterprise value (EV) premise or an equity level value premise. Although this is a significant issue on its own, especially in situations where the fair value of debt differs from its book value, this issue was further magnified by situations where the carrying value of equity was zero or negative. In these instances, the method for calculating the carrying value would result in different conclusions in a step 1 test; either goodwill impairment is indicated and step 2 is needed or no goodwill impairment is indicated. The EV is commonly defined as debt plus equity, or total assets less debt-free current liabilities adjusted for deferred taxes. The enterprise level test is completed by comparing the carrying value of the enterprise with its fair value. Conversely, the equity level test is completed by comparing the carrying value of the equity with its fair value. While there are advantages to each method, we believe the EV level to be the most appropriate for determining whether goodwill impairment may be indicated, because it is neutral to the reporting units capital structure, it is an entity level test for an entity level asset, and it provides a better measure of whether goodwill is impaired.

Whether debt is included in a reporting units carrying amount can lead to different step 1 conclusions, depending on how debt is accounted for — its carrying value, its fair value or the current obligation — which then impacts whether the second step of the goodwill impairment test is performed. The EITF did not reach a consensus on which method for calculating the carrying value was appropriate, and decided not to mandate an approach. However, the method used to determine the fair value of the reporting unit should be consistent with the manner in which its assets and liabilities are included in determining the carrying amount of the reporting unit. Regardless of the method used to calculate the carrying amount, a reporting unit with zero or negative carrying amount must perform step 2 of the goodwill impairment test, if qualitative factors indicate it is more-likely-than-not that goodwill impairment exists.

EITF 10-A became effective for public companies for interim and annual reporting periods in fiscal years beginning after December 15, 2010. The effective date is deferred for nonpublic entities to all reporting periods in fiscal years beginning after December 15, 2011.

NEW GOODWILL PROJECT

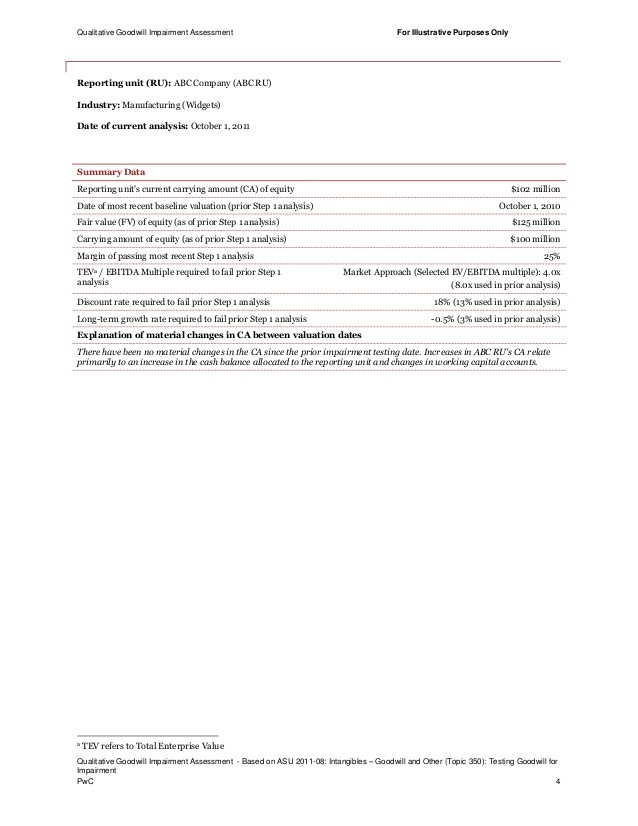

The FASB has started a new project, Goodwill Impairment Assessments, which proposes a three-step impairment test. This project proposes changing the current two-step goodwill impairment test to a three-step test, by adding a qualitative assessment as step 1. The new first step would be a qualitative assessment of whether it is more-likely-than-not that the carrying amount of a reporting unit is greater than its fair value. Step 2, consistent with the previous step 1, compares the fair value of the reporting unit with its carrying value to determine if goodwill impairment exists, and step 3, consistent with the previous step 2, compares the fair value of goodwill with its carrying value, to determine the level of goodwill impairment. The insertion of the qualitative test, as step 1, puts further emphasis on the ability to first qualitatively review a reporting unit for impairment prior to the undertaking of a fair value based test. It should be noted, the ability to test qualitatively already exists, but FASB hopes to put increased emphasis on it with this project. Based on the conclusion reached in step 1, an entity would either take no further action or proceed to step 2 and, if necessary, step 3. The option to proceed to step 2 or 3 would be based on a review of the individual qualitative factors and the probability of goodwill being impaired.

In Appendix B of its proposal, the FASB includes the following examples of events and circumstances which may indicate that it is more-likely-than-not that the fair value of a reporting unit is less than its carrying amount:

a) Macro-economic conditions such as a significant deterioration in general economic conditions or an adverse lending environment that limits access to capital;

b) Industry and market considerations such as a sustained deterioration in the environment in which an entity operates, an increased competitive environment, a decline in market-dependent multiples of metrics, a significant change in the market for an entitys products or services, or an adverse regulatory development;

c) Cost factors such as a significant increase in raw materials, labor, or other costs that adversely affect earnings;

d) Overall financial performance such as a significant decline in actual or planned revenue or earnings, or sustained negative cash flows;

e) Entity-specific events such as changes in management or strategy, an unfavorable change in customers, contemplation of bankruptcy, or significant adverse litigation;

f) Other events such as a more-likely-than-not expectation of selling or disposing all, or a portion of a reporting unit, or the testing for recoverability of a significant asset group within a reporting unit; and

g) If applicable, a sustained decrease in share price

The Board proposed an effective date of fiscal years beginning after December 15, 2011. The FASB is preparing an Exposure Draft with a comment period ending on the later of May 31, 2011 or 45 days after issuance. For more information, contact your VRC representative. VR

Recent Developments in Goodwill Impairment Testing