Reasons to Avoid Actively Managed Funds

Post on: 1 Апрель, 2015 No Comment

I was chatting with a colleague over lunch and she mentioned that she does most of her investing through mutual funds. I suggested to her that she should closely monitor her holdings and consider replacing the chronic losers with the equivalent index fund.

While there are some excellent fund managers, the vast majority of mutual funds simply under perform the market over the long-term. Such long-term underperformance is lethal to a portfolios total return. A portfolio of $10,000 grows to $68,500 over 25 years at an annualized return of 8%. If expenses run at 2% of assets per annum, the portfolio grows to just $43,000 and fees have consumed over a third of the returns. Here are some reasons to avoid actively managed funds:

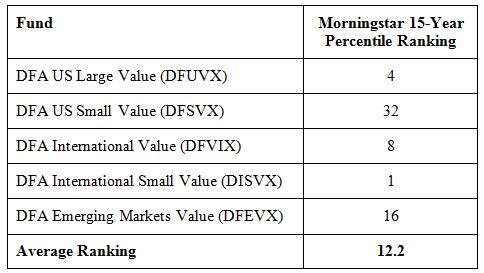

- Underperformance. The vast majority of mutual funds trail their respective indices over the long-term. A study in the US found that 78% of actively managed funds lagged the returns of the Vanguard 500 Index fund by an average of 2.6% per annum.

- Fees, fees and more fees. The average Canadian equity mutual fund charges a MER of over 2%. Some funds also charge a front-end load or a back-end load. The MER does not include brokerage commissions, which depends on the turnover of the fund (the number of positions that are changed every year) and further drags down results.

- Taxes: The returns advertised in mutual fund brochures and advertisements do not include the effect of taxes. A mutual fund with a high turnover will generate a high level of capital gains distributions that are taxed at the hands of the investor. Losing 20% of annual gains to taxes does not allow compounding to work its magic.

- Style and Asset Class Creep: With a lot of mutual funds you are never sure exactly what you own. For instance, during a bear market a mutual fund could hold a significant percentage in cash and still be called an equity fund. Many Canadian equity funds hold US and even international equities.

- Conflict of Interest: David Swenson writes in Unconventional Success that the competition between generating management company profits and serving investor interests resulted in a clear victory for the bottom line. As noted yesterday, it is often better to own the mutual fund company than one of its funds.