Real Estate Investment Trusts (REITs)

Post on: 9 Сентябрь, 2015 No Comment

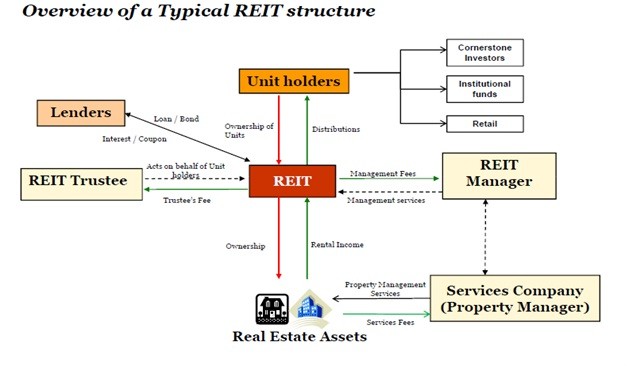

A Real Estate Investment Trust (REIT) is a company dedicated to owning physical real estate or loaning funds to others for real estate purchases.

Importantly, a real estate investment trust is required to pay vitually all of its taxable income (90%) to its shareholders every year. A REIT may deduct the dividends paid to its shareholders from its corporate tax bill so long as as the company’s assets are primarily real estate held for the long term, the companys income is mainly derived from real estate and the company pays out at least 90% of its taxable income to its shareholders.

The main benefit of a REIT is one level of taxation is removed (the REIT pays no taxes as long as they follow the rules). The main limitation of being a REIT is the restriction of earnings retained by the REIT. In order to grow there may not be enough free cash to expand so the REIT will be in a constant process of raising capital (either debt or equity) in order to expand.

Historically REITs have been good dividend payers and depending on the overall economy may make profits from reselling assets which they can then pay to shareholders as well.

The key metric for REITs is FFO (Funds from Operations). While net income is the normal metric for most common stocks, REITs key off of FFO which essentially is net income with depreciation added back in. Thus many REITs show net losses while still paying a sizable distribution—this cash is available because depreciation is a non cash expense which may cause net income to be negative while their is free cash because of the non cash charge against income.

Of course there are opportunities for gains and losses on the shares of the REIT, this adds a level of risk to holding REITs so one must analyze the business model just as you would any other investment.

FOR A QUICK SCAN ON ISSUES FALLING MORE THAN 3% JUST LOOK FOR RED IN THE ‘% CHANGE’ COLUMN

FOR A QUICK SCAN ON ISSUES RISING MORE THAN 3% JUST LOOK FOR GREEN IN THE ‘% CHANGE’ COLUMN

Clicking on the ticker symbol below will take you to the company website where you can do some further due diligence

Distributions Updated 2/28/2015

Spreadsheet link for sharing OR if you can’t see the sheet below click here