Rates vs credit trading

Post on: 6 Август, 2015 No Comment

The market in credit trading, manifested most clearly in credit derivatives, has grown. banks and other financial institutions to price credit risk more effectively;. It will also enable participants, for the first time, to trade government versus .

www.yieldcurve.com/Mktresearch/files/CreditNOTE_figs.pdf

Confirm your identity

Morgan Stanley is a global dealer in interest rate and currency products across. Trades all cash and derivative products for securities with embedded credit in .

trading strategies made possible by the credit derivatives market. Credit versus equity trading. Recovery rate and curve shape impact on CDS valuation .

www.einstitutional.com/geodesicweb/papers/JPMorgan_CDS.pdf

Car rebate vs. low-interest calculator. The price of the vehicle, the amount of the car rebate and the interest rate available for. In some states a trade-in can also reduce the amount of sales tax you will owe. Traditional financing: The interest rate you may be able to receive from a bank, credit union or other lender. This is .

www.bankrate.com/calculators/auto/car-rebates-calculator.aspx

Online ID: [redacted]

Sign in using a different Online ID SiteKey Challenge Question:

Nov 28, 2010. Difference between credit trading and rates trading. on Wall Street Oasis, the largest. Like I said, very different focus in rates vs credit.

On 5/24/06 Thomas F. asked, “How do you determine if you will do a credit. Often I use the strike price that Im short and if the stock trades at that price, I buy in the. It will be ATM and it will pick up premium very quickly vs. its $5 counterpart.

Outlays the key benefits and cleared OTC (Credit Default Swaps) and resources that CME Group offers. Open access clearing solution for dealer-to-customer and interdealer Credit Default Swaps trades. Builds on the. Prices are % of par.

www.cmegroup.com/trading/cds/

These unusual investment vehicles can reignite your interest in trading. If there is no credit event, the seller of protection receives the periodic fee from the .

www.investopedia.com/articles/optioninvestor/08/cds.asp

Jun 22, 2012. The slight weakness when measured against last years first quarter was almost entirely due to weaker credit trading results, as interest rate .

https://mninews.deutsche-boerse.com/content/textus-occ-trading-revenue-70-bln-q1-178-vs-q4-2011

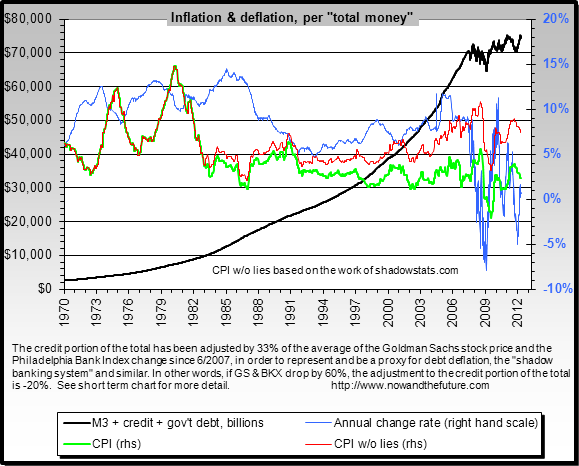

This section looks at the relationship between inflation and interest rates and how. These unusual investment vehicles can reignite your interest in trading. the credit market (loans) because higher interest rates make borrowing more costly.

www.investopedia.com/university/inflation/inflation3.asp

May 16, 2012. In February 2009, Deutsche Bank announced that its Credit Trading desk. prices and basis widening versus the Credit Default Swaps (CDS) .

blogs.reuters.com/felix-salmon/2012/05/16/how-bruno-iksil-lost-2-billion/