Raising Money through Equity Investments Equity Financing Article

Post on: 10 Май, 2015 No Comment

Equity investors buy a piece of your business. They become co-owners and share in the fortunes andmisfortunes of your business. Like you, they can make or lose a bundle. Generally, if your business doesbadly or flops, you’re under no obligation to pay them back their money. However, some equity investorswould like to have their cake and eat it, too; they want you to guarantee some return on their investmenteven if the business does poorly. Unless you’re really desperate for the cash, avoid an investor who wantsa guarantee. It’s simply too risky a proposition for someone starting or running a small business.

Limiting Risk

Because equity investors are co-owners of the business, they may be exposed to personal liability for allbusiness debts unless your business is a corporation, limited partnership, or limited liability company. Ifyou recruit equity investors for what has been your sole proprietorship, your business will now be treatedas a general partnership. This means your equity investors will be considered to be general partners,whether or not they take part in running the business. And as far as people outside the business areconcerned — people who are owed money or who have a judgment against the business — general partnersare all personally liable for the debts of the partnership.

Equity investors often want to limit their losses to what they put into the business. An investor who puts$10,000 into a business may be prepared to lose the $10,000 but no more. In short, the investor doesn’twant to put the rest of his or her assets at risk. The investor will want to avoid being — or being treated as— a general partner.

Fortunately, there are three common ways toorganize your business so that you can offer an investor protection from losses beyond the money beinginvested.

- Corporation. Form a corporation and issue stock to the investor. A shareholder who doesn’t participate in corporate activities and decision making is virtually free from liability beyond his or her original investment. A shareholder who does help run the company is liable to outsiders for his or her own actions — for example, making slanderous statements or negligently operating a piece of equipment — but isn’t liable for corporate debts or the actions of corporate employees.

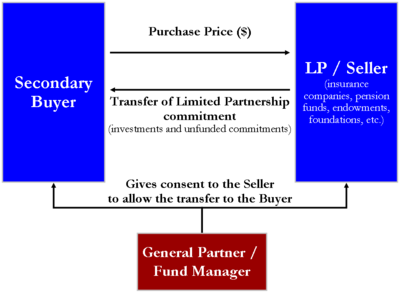

- Limited partnership. Form a limited partnership and make the investor a limited partner. A limited partner’s freedom from liability is similar to that of a shareholder, as long as the limited partner doesn’t become actively involved in running the business.

- Limited liability company. Form a limited liability company — now allowed in all but three states — and make the investor a member. The investor will be protected in much the same manner as a shareholder or limited partner.

Encourage investors to determine their own degree of risk. As mentioned, an investor in a businessorganized as a corporation, limited partnership, or limited liability company usually stands to lose no morethan his or her investment. However, state laws must be followed carefully to achieve this result. Toavoid having investors accuse you of giving misleading assurances, recommend that they check with theirown financial and legal advisers to evaluate if their investment exposes them to the possibility of incurringadditional losses.

Return on Investment

Someone who invests in your business may be willing to face the loss of the entire investment and notinsist that you guarantee repayment. But to offset the risk of losing the invested money, the investor maywant to receive substantial benefits if the business is successful. For example, an investor may insist on agenerous percentage of the business profits and, to help assure that there are such profits, may seek to put acap on your salary. The terms are always negotiable — there’s no formula for figuring out what’s fair toboth you and the investor.

Here are just a few possibilities:

- John, a former police detective, decides to start a business to offer security training seminars to midsize manufacturing companies. He forms STS Limited Liability Company and invests $10,000, which is only half of his $20,000 start-up budget. His aunt Paula, recently widowed, invests $10,000 of her inheritance in the company. The STS operating agreement states that John will be in full control of day-to-day operations. John and Paula agree in writing that John will receive a salary of no more than $4,000 a month from STS for the first four years, and that Paula will receive 60% of STS profits during that period. After that, John’s salary will be tied to gross receipts, and John and Paula will share profits equally.

- Stella wants to start a travel agency. She approaches Edgar, a friend from college, who has just sold a screenplay to a major studio and is looking for investment opportunities. They agree that Stella will form a limited partnership and act as the general partner. Edgar will invest $60,000 in the business and become a limited partner. Stella will work for $3,000 a month and use the first profits of the travel agency pay back Edgar’s $60,000 investment. After that, the profits will be split 50/50.

- Larry, an experienced carpenter, wants to become a general contractor so that he can build custom homes and do major remodeling jobs. He’s able to invest his savings of $30,000 in his new venture but needs another $20,000 to get started.Larry forms a corporation, Prestige Homes Inc. and invites his friend Brook, who owns a building supplybusiness, to invest $20,000 in return for a 40% interest in Prestige Homes. Brook agrees, on the conditionthat the new corporation will buy all its lumber and other building materials from Brook’s company — and,in addition, pay Brook $5,000 for each home that’s built by Prestige Homes. They sign a shareholders’agreement containing those terms.

Compliance with Securities Regulations

The law treats corporate shares and limited partnership interests as securities. Issuing these securities toinvestors is regulated by federal and state law. In some cases, an investor’s interest in a limited liabilitycompany may also come under these laws.

This means that before selling an investor an interest in your business, you’ll need to learn more about therequirements of the securities laws. Fortunately, there are generous exemptions that normally allow asmall business to provide a limited number of investors an interest in the business without complicatedpaperwork. Chances are good that your business will be able to qualify for these exemptions. In the rarecases in which the exemptions won’t work for your small business and you have to meet the complexrequirements of the securities laws — such as distributing an approved prospectus to potential investors —it’s probably too much trouble to do the deal unless a great deal of money is involved.