Quick Ratio

Post on: 12 Май, 2015 No Comment

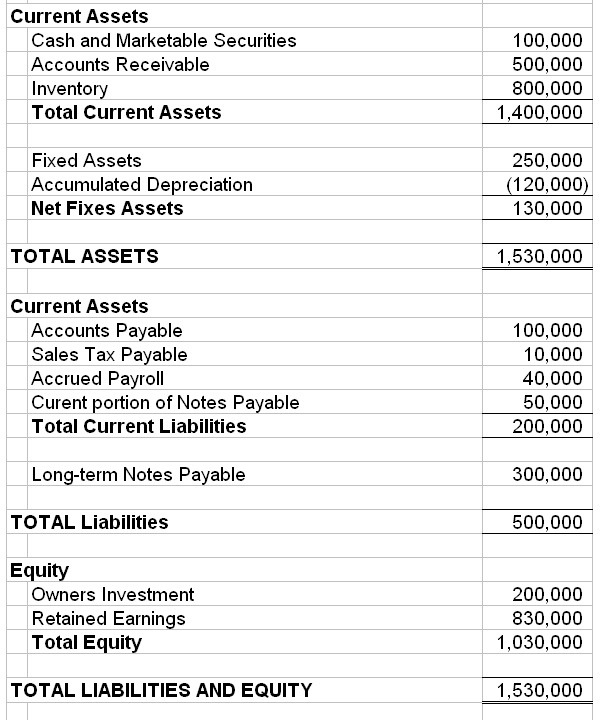

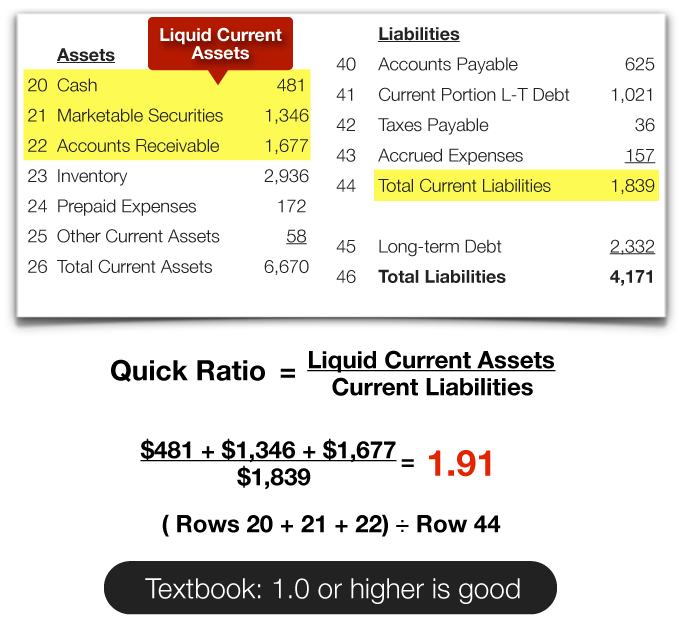

2. Formula

3. Explanation

Quick ratio shows the extent of cash and other current assets that are readily convertible into cash in comparison to the short term obligations of an organization. A quick ratio of 0.5 would suggest that a company is able to settle half of its current liabilities instantaneously.

Quick ratio differs from current ratio in that those current assets that are not readily convertible into cash are excluded from the calculation such as inventory and deferred tax credits since conversion of such assets into cash may take considerable time.

4. Example

5. Variations

In industries which typically have long receivables recovery duration such as in the construction sector, it may be appropriate to calculate the quick ratio by excluding receivables from the numerator to give a more suitable evaluation of the company’s liquidity.

6. Interpretation & Analysis

Quick ratio is an indicator of solvency of an entity and must be analyzed over a period of time and also in the context of the industry the company operates in.

Generally, companies should aim to maintain a quick ratio that provides sufficient leverage against liquidity risk given the level of predictability and volatility in a specific business sector among other considerations. The more uncertain the business environment, the more likely that companies would maintain higher quick ratios. Conversely, where cash flows are stable and predictable, companies would seek to keep quick ratio at relatively lower levels. In any case, companies must achieve the right balance between liquidity risk arising from a low quick ratio and the risk of loss resulting from a high quick ratio.

A quick ratio that is greater than industry average may suggest that the company is investing too many resources in the working capital of the business which may more profitably be used elsewhere. If a company has too much spare cash, it may consider investing the surplus funds in new ventures and in case company is out of investment options it may be prudent to return the excess funds to shareholders in the form of increased dividend payments.

Acid test ratio which is lower than the industry average may suggest that the company is taking too much risk by not maintaining an appropriate buffer of liquid resources. Alternatively, a company may have a lower quick ratio due to better credit terms with suppliers than the competitors.

When analyzing the quick ratio over several periods, it is important to take into account seasonal variations in some industries which may cause the ratio to be traditionally higher or lower at certain times of the year as seasonal businesses experience irregular bursts of activities leading to varying levels current assets and liabilities over time.

7. Industry standards

Acid test ratio must be assessed in the context of the specific industry of an organization.

Certain business sectors traditionally have a very low quick ratio such as the retail sector. Companies leading the retail sector are able to negotiate very favorable credit terms with suppliers due to their dominance in the market leading to relatively high current liabilities in comparison to their liquid assets. The business environment is also relatively stable in the retail sector and the expansion of operations is incremental which allow such companies to maintain lower acid test ratios without taking too much risk.

As per 2011 annual reports, quick ratios of Wal-Mart Stores, Inc and Tesco PLC were 0.2 and 0.29 respectively.

Conversely, industries which expand at a very fast pace require higher levels of liquid resources at their disposal to satisfy their investment needs. Examples of companies operating in such industries include the fast food giants such as McDonald’s and Burger King. Such companies require high levels of liquid assets to finance the growth in operations achieved through collaboration with franchisees.

As per 2011 annual reports, quick ratios of McDonald’s Corporation and Burger King Holdings, Inc. were 1.05 and 1.30 respectively.

8. Importance

Quick ratio is a measure of a company’s ability to settle its current liabilities on a very short notice. Current ratio may provide a misleading indication of a company’s liquidity position when a considerable portion of its current assets is illiquid. Quick ratio is therefore a more reliable measure of liquidity for manufacturing companies and construction firms that have relatively high levels of inventory, work in progress and receivables.