Quantum Long Term Equity Fund

Post on: 25 Июнь, 2015 No Comment

What is the Investment Objective of the Quantum Long Term Equity Fund?

The investment objective of the scheme is to achieve long-term capital appreciation by investing primarily in shares of companies that will typically be included in the S&P BSE 200 Index and are in a position to benefit from the anticipated growth and development of the Indian economy and its markets.

Tell me more about the Quantum Long Term Equity Fund or QLTEF.

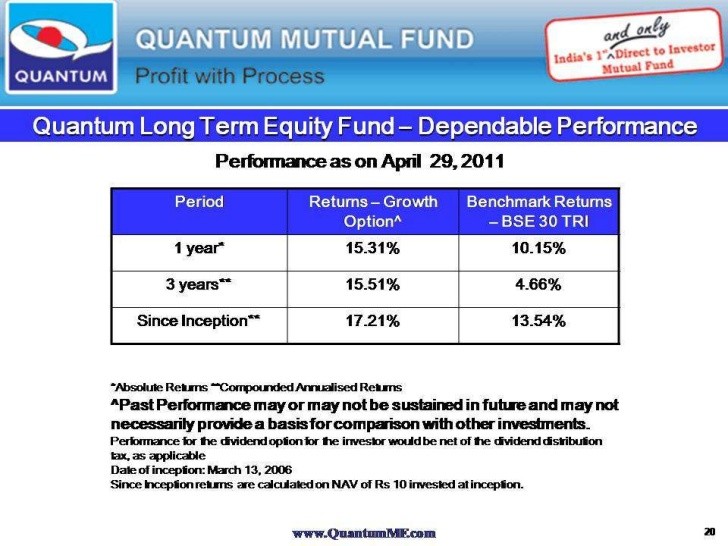

There is a saying in the world of investing, which is higher the risk, higher the gain. This is very significant when we speak of investing in the stock markets or Equities. Over the long term (5 years or more) Equities tends to give better returns to the investor, which also goes with the inherent risk of investing in Equities. For example over the last 10 years the BSE Sensex has given returns in the range on 18-20% (Source Bloomberg), which is probably higher than other vehicles of investment. However, we know how unpredictable the markets can be, hence sound investment strategies like a bottom-up stock selection process can be used to minimize risk. Click here to read more about Investment Philosophy .

Quantum Long Term Equity Fund -QLTEF is an open ended equity scheme which is a diversified equity fund . By this we mean that Quantum Long Term Equity Fund invests in shares of various companies across sectors and is not a sector — specific fund. Open Ended Scheme means it is open for purchase and redemption on all business days. Investors can conveniently buy and sell units at Net Asset Value (NAV”) based prices offering complete liquidity.

It is pertinent to note that Quantum Mutual Fund is India’s first and only Direct to Investor fund house and does not pay any commission whatsoever to distributors. Not paying commissions decreases the expense of most of our schemes and thereby adds to the returns of the schemes (subject to performance).

Investors with a long term time horizon and looking for diversification across shares of various sector companies can invest in Quantum Long Term Equity Fund. Some attributes of Quantum Long Term Equity Fund other than the complete transparency we offer and the convenience of Investing Online without any paperwork are;

• QLTEF follows disciplined research and investment process.

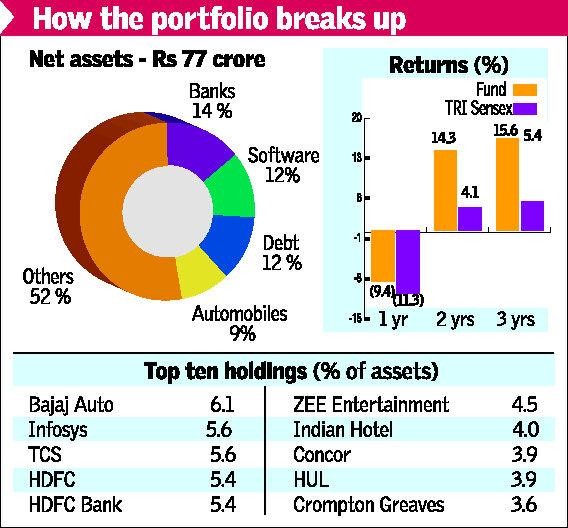

• QLTEF consists of a well balanced portfolio — typically 25 to 40 stocks, across sectors.

• QLTEF has a low portfolio turnover which helps in keeping the expense ratio low.

• QLTEF holds shares or cash when stock are overvalued — No derivatives and No hedging.

What are the different options/facilities available under the Quantum Long Term Equity Fund?

Quantum Long Term Equity Fund offers Growth Option and Dividend Option.

If you decide to opt for the dividend option, you would again have to choose one of the facilities: Dividend Payout or Dividend Reinvestment.

Dividend history of the scheme

We have not paid out dividends since our Inception, but, we do know how to manage your money, and manage it well – our NAV has nearly doubled, and our expense ratios have moved down – ensuring you of even better returns. Read our article on We invite you to declare your own Dividend .

What are the different features available under the Quantum Long Term Equity Fund?

The following features are available under the Quantum Long Term Equity Fund:

Systematic Investment Plan (SIP): This feature enables investors to save and invest periodically over a long period of time. Know more about Systematic Investment Plan (SIP) in detail.

Systematic Transfer Plan (STP): This feature enables an investor to transfer fixed amounts from their accounts in the Scheme to another scheme within a folio from time to time. Know more about Systematic Transfer Plan (STP) in detail.

Systematic Withdrawal Plan (SWP): This feature enables an investor to withdraw amount/units from their holdings in the Scheme at periodic intervals through a one-time request. Know more about Systematic Withdrawal Plan (SWP) in detail.

Triggers: A trigger is facility that allows you to specify an exit target (linked to value or time) or to receive an update when the desired levels are reached. The moment this target is achieved, the trigger gets activated. There can be Alert triggers or Action trigger.

Where will Quantum Long Term Equity Fund invest? What is the Current portfolio?