Quantity Theory of Money Fisher s Transactions and Cambridge Cash Balance Approach

Post on: 16 Март, 2015 No Comment

By Supriya Guru Money

Quantity Theory of Money: Fishers Transactions and Cambridge Cash Balance Approach!

1. Quantity Theory of Money: Fishers Transactions Approach :

The general level of prices is determined, that is, why at sometimes the general level of prices rises and sometimes it declines. Sometime back it was believed by the economists that the quantity of money in the economy is the prime cause of fluctuations in the price level.

The theory that increases in the quantity of money leads to the rise in the general price was effectively put forward by Irving Fisher. They believed that the greater the quantity of money, the higher the level of prices and vice versa.

Therefore, the theory which linked prices with the quantity of money came to be known as quantity theory of money. In the following analysis we shall first critically examine the quantity theory of money and then explain the modem view about the relationship between money and prices and also the determination of general level of prices.

The quantity theory of money seeks to explain the value of money in terms of changes in its quantity. Stated in its simplest form, the quantity theory of money says that the level of prices varies directly with quantity of money. Double the quantity of money, and other things being equal, prices will be twice as high as before, and the value of money one-half. Halve the quantity of money and, other things being equal, prices will be one-half of what they were before and the value of money double.

The theory can also be stated in these words: The price level rises proportionately with a given increase in the quantity of money. Conversely, the price level falls proportionately with a given decrease in the quantity of money, other things remaining the same.

There are several forces that determine the value of money and the general price level.

The general price level in a community is influenced by the following factors:

(a) The volume of trade or transactions;

(b) The quantity of money;

(c) Velocity of circulation of money.

The first factor, the volume of trade or transactions, depends upon the supply or amount of goods and services to be exchanged. The greater the amount or supply of goods in an economy, the larger the number of transactions and trade, and vice versa.

But the classical and neoclassical economists who believed in the quantity theory of money assumed that Jull employment of all resources (including labour) prevailed in the economy. Resources being fully employed, the total output or supply of goods (and therefore the total trade or transactions) cannot increase. Therefore, those who believed in the quantity theory of money assumed that the total volume of trade or transactions remained the same.

The second factor in the determination of general level of prices is the quantity of money. It should be noted that the quantity of money in the economy consists of not only the notes and currency issued by the Government but also the amount of credit or deposits created by the banks.

The third factor influencing the price level is the velocity of circulation. A unit of money is used for exchange and transactions purposes not once but several times in a year. During several exchanges of goods and services, a unit of money passes from one hand to another.

Thus, if a single rupee is used five times in a year for exchange of goods and services, the velocity of circulation is 5. Hence, the velocity of money is the number of times a unit of money changes hands during exchanges in a year. The work done by one rupee which is circulated five times in a year is equal to that done by the five rupees which change hands only once each.

Let us illustrate the quantity theory of money. Suppose in a country there is only one good, wheat, which is to be exchanged. The total output of wheat is 2,000 quintals in a year. Further suppose that the government has issued money equal to Rs. 25,000 and no credit is issued by the banks. We further assume that one rupee is used four times in a year for exchange of wheat.

That is, velocity of circulation of money is four. Under these circumstances, 2,000 quintals of wheat are to be exchanged for Rs. 1, 00,000 (25,000 x 4 = 1, 00,000). The price of wheat will be 1. 00,000/2,000 = Rs. 50 per quintal. Suppose the quantity of money is doubled to Rs. 50,000, while the output of wheat remains at 2,000 quintals. As a result of this increase in the quantity of money, the price of wheat will rise to 2, 00,000/2,000 = Rs. 100 per quintal.

Thus with doubling of the quantity of money, the price has doubled. If the quantity of money is further increased to Rs. 75,000, the amount of wheat remaining constant, the price level will rise to 3,00,000/2,000 = Rs. 150 per quintal. It is thus clear that if the volume of transactions, i.e. output to be exchanged remains constant, the price level rises with the increase in the quantity of money.

Fishers Equation of Exchange :

An American economist, Irving Fisher, expressed the relationship between the quantity of money and the price level in the form of an equation, which is called the equation of exchange.

This is:

PT = MV….(1)

Or P = MV/T

Where P stands for the average price level:

T stands for total amount of transactions (or total trade or amount of goods and services, raw materials, old goods etc.)

M stands for the quantity of money; and

V stands for the transactions velocity of circulation of money.

The equation (1) or (2) is an accounting identity and true by definition. This is, because MV which represents money spent on transactions must be equal to Pr which represents money received from transactions.

However, the equation of exchange as given in equations (1) and (2) has been converted into a theory of determination of general level of prices by the classical economists by making some assumptions. First, it has been assumed that the physical volume of transactions is constant because it is determined by a given amount of real resources, the given level of technology and the efficiency with which the given available resources are used.

These real factors determine a level of aggregate output which necessitates various types of transactions. Another crucial assumption is that transactions velocity of circulation (V) is also constant. The quantity theorists accordingly believed that velocity of circulation (V) depends on the methods and practices of factor payments such as frequency of wage payments to the workers, and habits of the people regarding spending their money incomes after they receive them.

Further, velocity of circulation of money also depends on the development of banking and credit system, that is, the ways and speed with which cheques are cleared, loans are granted and repaid. According to them, these practices do not change in the short run.

This assumption is very crucial for the quantity theory of money because when the quantity of money is increased this may cause a decline in velocity of circulation of money, then MV may not change if the decline in V offsets the increase in M. As a result, increase in M will not affect PY.

The quantity theorists believed that the volume of transactions (T) and the changes in it were largely independent of the quantity of money. Further, according to them, changes in velocity of circulation (VO and price level (P) do not cause any change in volume of transactions except temporarily.

Thus classical economists who put forward the quantity theory of money believed that the number of transactions (which ultimately depends on aggregate real output) does not depend on other variables (M, V and P) in the equation of exchange. Thus we see that the assumption of constant V and T converts the equation of exchange (MV = PT), which is an accounting identity, into a theory of the determination of general price level.

The quantity of money is fixed by the Government and the Central Bank of a country. Further, it is assumed that quantity of money in the economy depends upon the monetary system and policy of the central bank and the Government and is assumed to be autonomous of the real forces which determine the volume of transactions or national output.

Now, with the assumptions that M and V remain constant, the price level P depends upon the quantity of money M; the greater the quantity of M, the higher the level of prices. Let us give a numerical example.

Suppose the quantity of money is Rs. 5, 00,000 in an economy, the velocity of circulation of money (V) is 5; and the total output to be transacted (T) is 2, 50,000 units, the average price level (P) will be:

P = MV/T

= 5, 00,000 × 5/ 2, 50,000 = 2,500,000/ 2, 50,000

= Rs. 10 per unit.

If now, other things remaining the same, the quantity of money is doubled, i.e. increased to Rs. 10, 00,000 then:

P = 10, 00,000 × 5/ 2, 50,000 = Rs. 20 per unit

We thus see that according to the quantity theory of money, price level varies in direct proportion to the quantity of money. A doubling of the quantity of money (M) will lead to the doubling of the price level. Further, since changes in the quantity of money are assumed to be independent or autonomous of the price level, the changes in the quantity of money become the cause of the changes in the price level.

Quantity Theory of Money: Income Version :

Fishers transactions approach to quantity theory of money described in equation (1) and (2) above considers such variables as total volume of transaction (T) and average price level of these transactions are conceptually vague and difficult to measure.

Therefore, in later years quantity theory was formulated in income from which considers real income or national output (i.e. transactions of final goods only) rather than all transactions. As the data regarding national income or output is readily available, the income version of the quantity theory is being increasingly used. Moreover, the average price level of output is a more meaningful and useful concept.

Indeed, in actual practice, the general price level in a country is measured taking into account only the prices of final goods and services which constitute national product. It may be noted that even in this income version of the quantity theory of money, the function of money is considered to be a means of exchange as in the transactions approach of Fisher.

In this approach, the concept of income velocity of money has been used instead of transactions velocity of circulation. By income velocity we mean the average number of times per period a unit of money is used in making payments involving final goods and services, that is, national product or national income. In fact, income velocity of money is measured by Y/M where Y stands for real national income and M for the quantity of money.

In view of the above, the income version of quantity theory of money is written as under:

MV = PY(3)

P = MV/PY (4)

Where

M = Quantity of money

V = Income velocity of money

P = Average price level of final goods and services

Y = Real national income (or aggregate output) Like that in the transactions approach, in this new income version of the quantity theory also the different variables are assumed to be independent of each other. Further, income velocity of money (V) and real income or aggregate output (Y) is assumed to be given and constant during a short period.

More specifically, they do not vary in response to the changes in M. In fact, real income or output (Y) is assumed to be determined by the real sector forces such as capital stock, the amount and skills of labour, technology etc. But as these factors are taken to be given and constant in the short ran, and further full employment of the given resources is assumed to be prevailing due to the operation of Says law and wage-price flexibility supply of output is taken to be inelastic and constant for purposes of determination of price level.

It follows from equations (3) and (4) above that with income velocity (V) and national output (F) remaining constant, price level (P) is determined by the quantity of money (M).

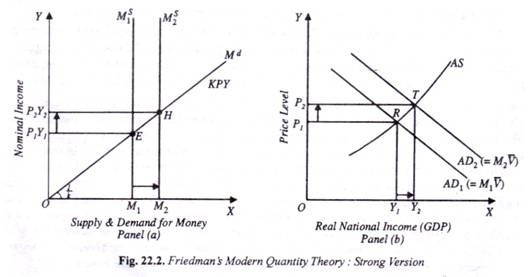

Classical quantity theory of money is illustrated in Fig. 20.1 through aggregate demand and aggregate supply model. It is worth noting that the quantity of money (A/) multiplied by the income velocity of circulation (V), that is, MV gives us aggregate expenditure in the quantity theory of money. Now with a given quantity of money, say M1 and constant velocity of money V, we have a given amount of monetary expenditure (M1 V).

Given this aggregate expenditure, at a lower price level more quantities of goods can be purchased and at a higher price level, less quantities of goods can be purchased. Therefore, in accordance with classical quantity theory of money aggregate demand representing M1 slopes downward as shown by the aggregate demand curve AD1 in Fig. 20.1. If now the quantity of money is increased, say to M2. aggregate demand curve representing new aggregate monetary expenditure M2 V will shift upward.

As regards, aggregate supply curve, due to the assumption of wage-price flexibility, it is perfectly inelastic at full-employment level of output as is shown by the vertical aggregate supply curve AS in Fig. 20.1. Now, with a given quantity of money equal to M1. aggregate demand curve AD1 cuts the aggregate supply curve AS at point E and determines price level OP1 .

Now, if the quantity of money is increased to M2. the aggregate demand curve shifts upward to AD2. It will be seen from Fig. 20.1 that with the increase in aggregate demand to AD2 consequent to the expansion in money supply to M2. excess demand equal to EB emerges at the current price level OP1. This excess demand for goods and services will lead to the rise in price level to OP2 at which again aggregate quantity demanded equals the aggregate supply which remains unchanged at OY due to the existence of full employment in the economy.

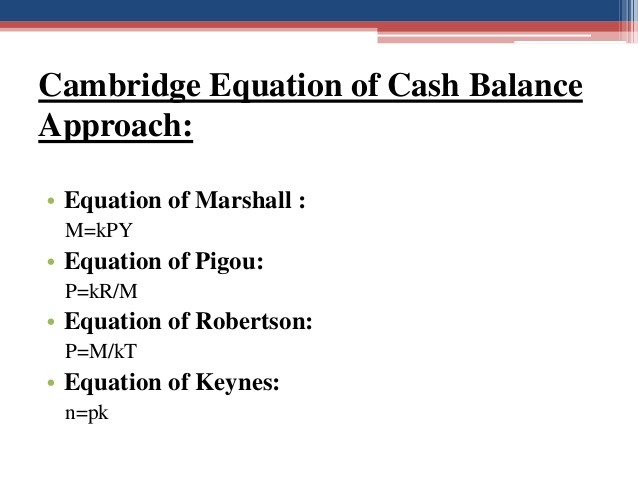

2. Quantity Theory of Money: The Cambridge Cash Balance Approach :

The equation of exchange has been stated by Cambridge economists, Marshall and Pigou, in a form different from Irving Fisher. Cambridge economists explained the determination of value of money in line with the determination of value in general.

Value of a commodity is determined by demand for and supply of it and likewise, according to them, the value of money (i.e. its purchasing power) is determined by the demand for and supply of money. As studied in cash-balance approach to demand for money Cambridge economists laid stress on the store of value function of money in sharp contrast to the medium of exchange function of money emphasised by in Fishers transactions approach to demand for money.

According to cash balance approach, the public likes to hold a proportion of nominal income in the form of money (i.e. cash balances). Let us call this proportion of nominal income that people want to hold in money as k.

Then cash balance approach can be written as:

M d =kPY ….(1)

Y = real national income (i.e. aggregate output)

P = the price level PY = nominal national income

k = the proportion of nominal income that people want to hold in money

M d = the amount of money which public want to hold

Now, for the achievement of money-market equilibrium, demand for money must equal worth the supply of money which we denote by M. It is important to note that the supply of money M is exogenously given and is determined by the monetary policies of the central bank of a country. Thus, for equilibrium in the money market.

M = M d

As M d =kPY

Therefore, in equilibrium M = kPY (2)

Monetary equilibrium Cambridge cash balance approach is shown in Fig. 20.2 where demand for money is shown by a rising straight line kPY which indicates that with k and Y being held constant demand for money increases proportionately to the rise in price level. As price level rises people demand more money for transaction purposes. Now, if supply of money fixed by the Government (or the Central Bank) is equal to M0. the demand for money APK equals the supply of money, M0 at price level P0. Thus, with supply of money equal to M0 equilibrium price level P0 is determined. If money supply is increased, how the monetary equilibrium will change? Suppose money supply is increased to M1 at the initial price level P0 the people will be holding more money than they demand at it.

Therefore, they would want to reduce their money holding. In order to reduce their money holding they would increase their spending on goods and services. In response to the increase in money spending by the households the firms will increase prices of their goods and services.

As prices rise, the households will need and demand more money to hold for transaction purposes (i.e. for buying goods and services). It will be seen from Fig. 20.2 that with the increase in money supply to M1 new equilibrium between demand for money and supply of money is attained at point E1 on the demand for money curve kPY and price level has risen to P1 .

It is worth mentioning that k in the equations (1) and (2) is related to velocity of circulation of money V in Fishers transactions approach. Thus, when a greater proportion of nominal income is held in the form of money (i.e. when k is higher), V falls. On the other hand, when less proportion of nominal income is held in money, K rises. In the words of Crowther, The higher the proportion of their real incomes that people decide to keep in money, the lower will be the velocity of circulation, and vice versa.

It follows from above that k = 1/V. Now, rearranging equation (2) we have cash balance approach in which P appears as dependent variable. Thus, on rearranging equation (2) we have

P = 1/k.M/Y…………(3)

Like Fishers equation, cash balance equation is also an accounting identity because k is defined as:

Quantity of Money Supply/National Income, that is, M/PY

Now, Cambridge economists also assumed that k remains constant. Further, due to their belief that wage-price flexibility ensures full employment of resources, the level of real national income was also fixed corresponding to the level of aggregate output produced by full employment of resources.

Thus, from equation (3) it follows that with k and Y remaining constant price level (P) is determined by the quantity of money (M); changes in the quantity of money will cause proportionate changes in the price level.

Some economists have pointed out similarity between Cambridge cash-balance approach and

Fishers transactions approach. According to them, k is reciprocal of V (k = 1/V or V = 1/k). Thus in equation (2) if we replace k by. we have

M = 1/PY

Or MV=PY

Which is income version of Fisher’s quantity theory of money? However, in spite of the formal similarity between the cash balance and transactions approaches, there are important conceptual differences between the two which makes cash balance approach superior to the transactions approach. First, as mentioned above.

Fishers transactions approach lays stress on the medium of exchange function of money, that is, according to its people want money to use it as a means of payment for buying goods and services. On the other hand, cash balance approach emphasizes the store-of-value function of money. They hold money so that some value is stored for spending on goods and services after some lapse of time.

Further, in explaining the factors which determine velocity of circulation, transactions approach points to the mechanical aspects of payment methods and practices such as frequency of wages and other factor payments, the speed with which funds can be sent from one place to another, the extent to which bank deposits and cheques are used in dealing with others and so on.

On the other hand, k in the cash balance approach is behavioural in nature. Thus, according to Prof S.B. Gupta, Cash- balance approach is behavioural in nature: it is build around the demand for money, however simple. Unlike Fisher s V, k is a behavioural ratio. As such it can easily lead to stress being placed on the relative usefulness of money as an asset.

Thirdly, cash balance approach explains determination of value of money in a framework of general demand-supply analysis of value. Thus, according to this approach value of money (that is, its purchasing power is determined by the demand for and supply of money).

To sum up cash balance approach has made some improvements over Fishers transactions approach in explaining the relation between money and prices. However it is essentially the same as the Fishers transactions approach. Like Fishers approach if considers substitution between money and commodities.

That is, if they decide to hold less money, they spend more on commodities rather than on other assets such as bonds, shares real property, and durable consumer goods. Further, like Fishers transactions approach it visualises changes in the quantity of money causes proportional changes in the price level.

Like Fishers approach, cash balance approach also assumes that full- employment of resources will prevail due to the wage-price flexibility. Hence, it also believes the aggregate supply curve as perfectly inelastic at full-employment level of output.

An important limitation of cash balance approach is that it also assumes that the proportion to income that people want to hold in money, that is, k, remains constant. Note that. In practice it has been found that proportionality factor k or- velocity of circulation has not remained constant but has been fluctuating, especially in the short run.

Besides, cash-balance approach falls short of considering demand for money as an asset. If demand for money as an asset were considered, it would have a determining influence on the rate of interest on which amount of investment in the economy depends. Investment plays an important role in the determination of/level of real income in the economy.

It was left to J.M. Keynes who later emphasised the role of demand for money as an asset which was one of the alternative assets in which individuals can keep their income or wealth. Finally, it may be mentioned that other criticisms of Fishers transactions approach to quantity theory of money discussed above equally apply to the Cambridge cash balance approach.

Keyness Critique of the Quantity Theory of Money :

The quantity theory of money has been widely criticised.

The following criticisms have been levelled against the quantity theory of money lay by Keynes and his followers:

1. Useless truism:

With the qualification that velocity of money (V) and the total output (T) remain the same, the equation of exchange (MV= PT) is a useless truism. The real trouble is that these things seldom remain the same. They change not only in the long run but also in a short period. Fishers equation of exchange simply tells us that expenditure made on goods (MV) is equal to the value of output of goods and services sold (PT).

2. Velocity of money is not stable:

Keynesian economists have challenged the assumption that velocity of money remains stable. According to them, velocity of money changes inversely with the change in money supply. They argue that increase in money supply, demand for money remaining constant, leads to the fall in the rate of interest.

At a lower rate of interest, people will be induced to hold more money as idle cash balances (under speculative motive). This means velocity of circulation of money will be reduced. Thus, if a decline in interest rate reduces velocity, then increase in the money supply will be offset by reduction in velocity, with the result that price level, need not rise when money supply is increased.

3. Increase in quantity of money may not always lead to the increase in aggregate spending or demand:

Further, according to Keynes the quantity theory of money is based upon two more wrong assumptions.

Basically, for, the quantity theory to be true, the following two assumptions must hold:

(i) An increase is money supply must lead to an increase in spending, that is, aggregate demand i.e. no part of additional money created should be kept in idle hoards.

(ii) The resulting increase in spending or aggregate demand must face a totally inelastic output.

Both the assumptions according to Keynes, lack generality and, therefore, it either of them does not hold, the quantity theory cannot be accepted as a valid explanation of the changes in price level.

Let us take the first assumption. Under this assumption, the entire increase in the quantity of money must express itself in the form of increased spending. If spending does not increase, there is no question of a change in prices or output. But, is it valid to make such an assumption?

Obviously, there is no such direct link between the increase in the quantity of money and the increase in the volume of total spending or aggregate demand. No one is going to increase his expenditure simply because the government is printing more notes or the banks are more liberal in their lending policies. Thus, if the demand for money is highly interest-elastic, the increase in money supply will not lead to any appreciable fall in the rate of interest.

With no significant fall in rate of interest, the investment expenditure and expenditure on durable consumer goods will not increase much. As a result, increase in money supply may not lead to increase in expenditure or aggregate demand and therefore price level may remain unaffected.

This is not to say, however, that changes in the quantity of money have no influence whatsoever on the volume of aggregate spending. As we shall show below, changes in the quantity of money are often capable of inducing changes in the volume of aggregate spending. What Keynes and his followers deny is the assertion that there exists a direct, simple, and more or less a proportional relation between variation in money supply and variation in the level of total spending.

4. Assumption of constant volume of transactions or constant level of aggregate output is not valid:

Keys asserted that the assumption of constant aggregate output valid only under conditions of full employment. It is only then that we can assume a totally inelastic supply of output, for all the available resources are being already fully utilised. In conditions of less than full employment, the supply curve of output will be elastic.

Now, if we assume that aggregate spending or demand increases with an increase in the quantity of money, it does not follow that prices must necessarily rise. If the supply curve of output is fairly elastic, it is more likely that effect of an increase in spending will be more to raise production rather than prices.

Of course, at full-employment level every further increase in spending or aggregate demand must lead to the rise in the price level as output is inelastic in supply at full-employment level. Since full-employment cannot be assumed to be a normal affair, we cannot accept the quantity theory of money as a valid explanation of changes in the price level in the short run.