Q and A Estimating LongTerm Market Returns

Post on: 22 Август, 2015 No Comment

- May 22, 2014

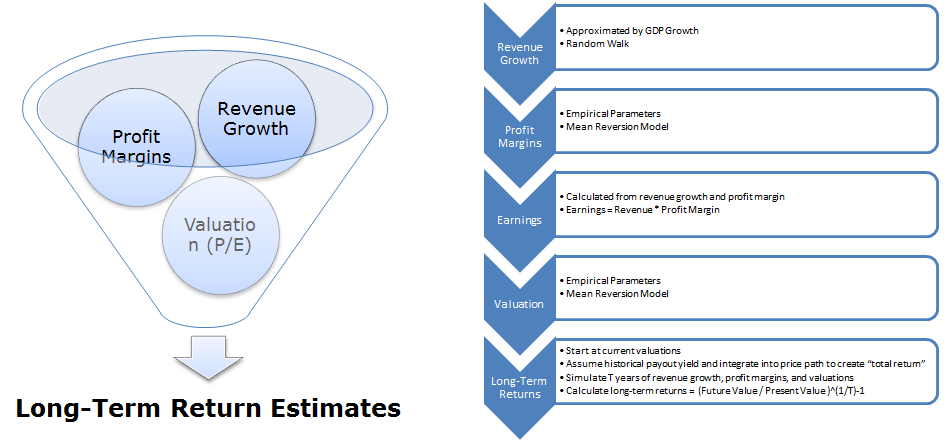

Each year, Charles Schwab Investment Advisory, Inc. (CSIA) calculates long-term return estimates for stock, bond and cash investments. Here, we’ll answer common client questions concerning this research, including an explanation of the methodology behind our estimates.

Why are long-term return estimates important?

Timing market returns from year to year is difficult, but over a long period of time, research shows that risky asset classes such as U.S. equities can offer a positive risk premium for a patient investor. Having a sound financial plan serves as a road map to help investors reach long-term financial goals, but to get there, you need reasonable estimates of what long-term stock- and bond-market returns might be.

For example, if your return estimates are too optimistic, you run the risk of not being able to retire on time or pay for a child’s education. If they’re too pessimistic, you may needlessly sacrifice some of your current lifestyle by over-saving for retirement.

Similar to the axiom garbage in, garbage out, you can’t use unrealistic assumptions to determine realistic outcomes, and this is especially true when developing your long-term financial plan.

How do you define long term?

When it comes to return forecasts, there’s no specific definition of long term, though a widely accepted rule of thumb is a time period of more than 10 years. A balance is struck when you consider both shorter-term market fluctuations (think 2008) and extremely long periods of time when your confidence in making predictions greatly diminishes. Accordingly, CSIA used a 20-year time horizon for the estimates provided here, though calculations using a time horizon between 10 and 30 years should produce similar results.

How do short- and long-term forecasts differ? Is one better than the other?

For some investors, the strategic asset allocation can serve as a starting point to make shorter-term tactical changes to their asset allocation. For example, an investor may target a long-term, strategic allocation of 50% stocks and 50% bonds. Depending on the market environment, the investor may want to temporarily favor stocks over bonds, or vice versa.

Continuing with the example, suppose the investor thinks that the stock market is currently undervalued. The investor may choose to act on this belief by temporarily adjusting her current allocation, possibly to 60% stocks and 40% bonds.

The process of making these shorter-term changes is called tactical asset allocation. These temporary shifts generally occur when estimates of short-term returns deviate from long-term estimates. Short-term return estimates are typically based on current economic and market conditions, whereas current conditions are not as relevant for estimating long-term returns.

When it comes to meeting your long-term goals, however, choosing an appropriate long-term, strategic asset allocation is more important than making short-term, tactical bets.

Some people argue that investors should focus exclusively on short-term returns and tactical asset allocation because it’s difficult to accurately estimate long-term returns. The problem is that it’s even more difficult to accurately estimate short-term returns!

And because most investors have at least one long-term goal—retirement—they need reasonable long-term return estimates to help determine how much money they’ll need to fund their retirement lifestyle, and in turn, how much they’ll need to save to get there.

For this reason, the focus of this study is on long-term returns.