Putcall parit Online Library

Post on: 11 Июль, 2015 No Comment

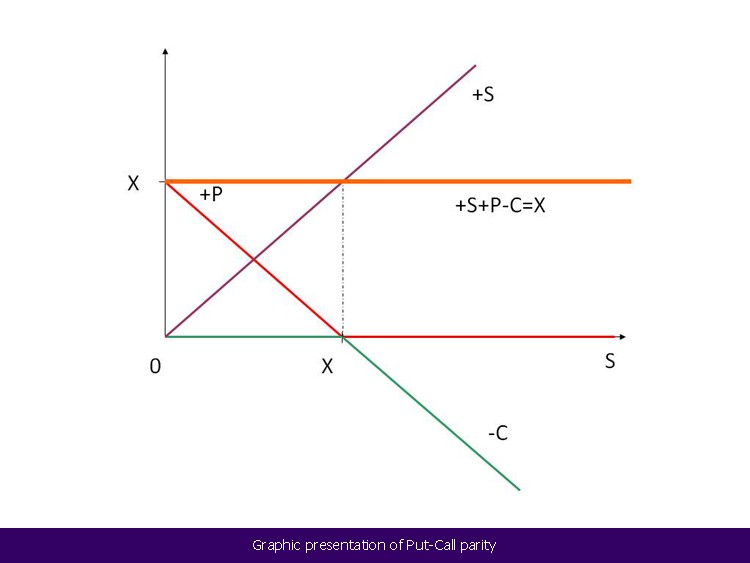

Occasionally a trader who intends to take a position in the futures market, either as part of a hedging or a speculative strategy, may find that he can construct an identical position in the options market, and at the same time do so at a more favorable price than the futures position. This is possible because of an important principle of option evaluation which specifies that there is a well defined relationship between the prices of an underlying contract, and a call and put with the same exercise price and expiration date. If any two of the three prices are known, then it is always possible to calculate the price of the remaining contract. This relationship is sometimes referred to as put-call parity.

For example, consider a coffee call and put which both have an exercise price of 85 and which both expire at the same time. Assuming that all options are carried to expiration (no early exercise), a trader who buys the call and sells the put can always expect to end up with a long position in the underlying futures contract at expiration. Moreover, the long position will be acquired at precisely the exercise price of 85. If the underlying futures contract is above 85 at expiration, the trader will choose to exercise his call, thereby going long at 85. If the underlying is below 85 at expiration, the trader will be assigned on his 85 put, likewise going long at 85. In other words, the trader will always go long at 85, either by choice (he chooses to exercise his 85 call), or by force (he is assigned on his 85 put).

The above position (long an 85 call, short an 85 put) is known as a synthetic long futures position, because it has almost all the characteristics of a true futures position, but will not become an actual long futures position until expiration. We can express this as:

synthetic long future = long call + short put

Using this equality as a basis, we can also express five other synthetic relationships.

synthetic short future = short call + long put

synthetic long call = long future + long put synthetic short call = short future + short put

synthetic long put = short future + long call synthetic short put = long future + short call

One common type of option arbitrage is to initiate a synthetic position and then to offset it with the underlying contract. For example, a trader might initiate a long synthetic futures position, as above, and offset this by selling the actual underlying futures contract. At expiration, when his synthetic long futures position becomes an actual long futures contract, it will exactly offset the short futures contract.

At what prices might the trader initiate such a position?

Suppose the trader initiates the synthetic long underlying position at the following prices:

long an 85 call at 3.00 short an 85 put at 1.00

The trader knows that he has paid 2.00 more for his call than he has received from the sale of his put and that therefore a break even futures price would be a sale at 87.00. If the trader wants to do no worse than break even, he would sell an underlying futures contract at exactly 87.

From the foregoing discussion, we can see that the following relationship must be maintained in the marketplace:

call price — put price = underlying price — exercise price

If this relationship is not maintained, a trader can take advantage of the mispricing by buying the cheaper side of the equation and selling the more expensive. This essentially locks in a profit equal to the amount of the mispricing. If, in our example, the underlying futures contract were trading at 86.75 while the call and put were still trading at 3.00 and 1.00 respectively, a trader could sell the call and buy the put for a credit of 2.00, and buy the underlying contract for a debit of only 1.75 (price of 86.75 less the exercise price of 85). His profit on the arbitrage would be the difference between the credit and debit, or .25. More importantly for a coffee futures trader this would present an opportunity to go long a synthetic futures contract at .25 cheaper than an actual futures position.

Depending on the settlement procedure, the put-call parity relationship may also be affected by interest rates. If the options require full and immediate cash payment, as they currently do on U.S. commodity exchanges, the synthetic side (call price — put price) must be reduced by the cost of carrying the options to expiration. In our example with the call at 3.00, the put at 1.00, and the futures contract at 87.00, even though the debit and credit of 2.00 will exactly offset each other, this will not happen until expiration when the synthetic position actually becomes a futures position. Therefore the debit of 2.00, resulting from the synthetic position, will have to be carried until expiration. If interest rates are nine percent annually and expiration is four months away, there will be a carrying cost of three percent, or .06(3% x 2.00). This amount must be deducted from the price of the synthetic position, so that if the call is trading at 3.00 and the future at 87, the put must be trading at 1.06. If this were not true, and the put were trading for say 1.03, a trader could sell the call at 3.00, buy the put at 1.03, and buy the futures contract at 87.00. His credit of 1.97 and debit of 2.00 would result in a loss of .03, but this would be more than offset by the .06 interest earnings on the credit resulting from the sale of the call and purchase of the put.

We can therefore express the full synthetic relationship as:

call price-put price = futures price-exercise price-carrying costs

where the carrying cost component is calculated on the difference between the futures price and exercise price.

Conclusion:

Put-call parity is important because it is the mechanism which keeps options prices in line with the underlying futures prices. If mispricing occurs, arbitrageurs will step into profit from the opportunity and bring prices back into line. Furthermore, it allows hedgers the opportunity to examine whether it is better to take an outright position in a particular options or futures contract or create that position synthetically using equivalent positions.