Put Option Explained

Post on: 6 Июнь, 2015 No Comment

The put option may be used to protect a stock portfolio from losses, to profit from falling prices with limited trading risk, or to buy stock at below market prices.

The buyer of a put option has the right, but not the obligation, to sell their stock at the pre-defined strike price prior to the option’s expiration. This characteristic of the put option provides an opportunity to protect equity positions against capital loss and also allows us to take bearish positions in the market without taking on the trading risk of selling stock short.

Using Put Options To Protect Stock

Because put options vest the buyer with the right to sell stock at a pre-determined price, these option contracts are frequently used to protected stock holdings from losses in the event of a market decline. Much like insurance, a stock investor can pay a premium and purchase a put option to protect his holdings. In the event of a market downturn, he may sell the put option at an increased value to offset any losses or the option may be exercised, and the stock sold, at what would then be above market prices.

Consider an investor who holds XYZ Company stock, but is concerned that the stock price may fall from its current level of $30 per share. He might simply sell his stock, but for various reasons this may not be desirable. Instead, let us assume the investor pays $3.00 for a put option that allows him to sell his stock at the current price of $30 per share.

If the stock falls in price to $25 per share, the put option will be worth at least $5.00, the difference between the current market price and the strike price of the option. The put option can be exercised and the stock sold at the $30 strike price or, alternatively, the put option may be sold to capture that the profit while still maintaining a position in the stock.

Put Options As Speculative Trading Instruments

It is not necessary to own stock before purchasing a put option. Because put options tend to increase in value when the underlying security falls in value, a put option is an excellent trading tool to utilize when you want to act on a bearish market outlook.

Expecting a drop in the current stock price of XYZ Company, we might consider selling the stock short. This can involve significant risk because if we are wrong about the direction of XYZ stock, we are exposed to unlimited risk to the upside. Even if we believe that the price increase is a momentary retracement, our short position exposes our account to a potential margin call that would require us to close our position, sell other securities t adequately cover the risk of further upside price moves, or add cash to the account.

Of course, none of these alternatives may be attractive. A put option allows us to avoid this dilemma entirely. Rather than selling stock short, we can simply buy a put option. Our risk is limited to the premium that we pay for the option contract no matter how high or low the stock price goes.

Assume you could buy the $30 strike put option for $3.00 and then sell it for $5.00 after the stock fell in price to $25 per share. This $2.00 profit represents ($2.00 / $3.00) a 66% return on risk. Conversely, if you sold the stock short at $30 per share and re-purchased it at $25.00 per share your return on risk would be substantially less because your broker’s margin requirements will tie up significantly more capital.

Risk Profile For A Long Put Option

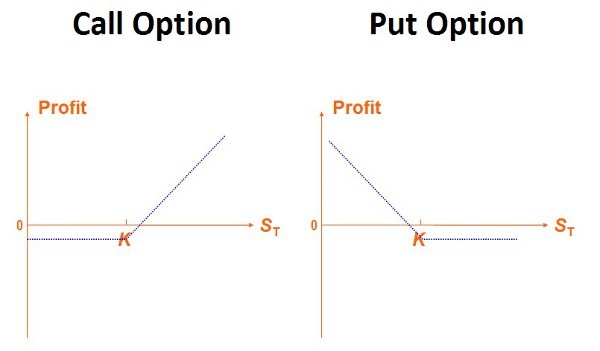

As with a call option, buying a put option is a limited risk option strategy. The most you will ever lose on a put option purchase is the price you paid to buy the option.

In the above graphic, your downside risk is limited to the $3.00 purchase price. If the stock continues to appreciate in price, the loss on the position never drops below that $3.00 maximum risk. On the other hand, your profits are not limited and will increase with a continued decline in the stock price.

If you are following along with our option trading tutorial, we have now covered two primary option strategies. Buying a call option allows you to take a bullish position in the market and vests you with the right, but not the obligation, to buy the underlying stock at a predefined price. The purchase of a put option allows you to take a bearish position in the market and can be used to protect stock holdings against a market sell off.

If you have questions, be sure to avail yourself of the very knowledgeable people who frequent our stock option trading discussion board.