Put call parity with dividends

Post on: 11 Июль, 2015 No Comment

Put-Call Parity

Put-Call Parity the relationship between the prices of a European put option and a European call option when they have the same maturity date and strike price.

Put-Call Parity of European Options with Dividends

The Put-Call Parity also holds for the dividend-paying stock. Now we will examine the impact of the dividends on the European options. In most cases the value of the.

Putcall parity — Wikipedia, the free encyclopedia

Assumptions. Putcall parity is a static replication, and thus requires minimal assumptions, namely the existence of a forward contract. In the absence of traded.

Put-Call Parity Definition | Investopedia

The above illustration demonstrates a simple put-call parity relationship. Looking at the graph, we see that a long-stock/long-put position (red line) has the same.

Put-Call Parity Definition | Investopedia

The above illustration demonstrates a simple put-call parity relationship. Looking at the graph, we see that a long-stock/long-put position (red line) has the same.

Put/Call Parity — The Options Industry Council (OIC)

Put/call parity is a captivating, noticeable reality arising from the options markets. By gaining an understanding of put/call parity, one can begin to better.

Put Call Parity by OptionTradingpedia.com

Put Call Parity requires, mathematically, that option trading positions with similar payoff or risk profiles (i.e Synthetic Positions) must end up with the same.

Wilmott Forums — What is put-call parity?

well to get this started. Put-call parity is a strong arbitrage relation between Euro-style call prices C and put prices P with the same strike price K.

Options Pricing: Put/Call Parity | Investopedia

Options traders use put/call parity as a simple test for their European style options pricing models. If a pricing model results in put and call prices that do not.

Put-Call Parity; Conversion Arbitrage; Reverse Conversion.

Put-Call Parity Theorem; C + x/(1+i) t = S 0 + P: C = Call Premium x = Call Strike = Face Value of T-bill i = annual interest rate t = number of years S 0 = Initial.

Put-call parity | Put and call options | Khan Academy

Why would an investor purchase a stock and insure it with a put, rather than purchase a call, if the call will tie up much less money than the put and the stock together?

Put-call parity | Put and call options | Khan Academy

Why would an investor purchase a stock and insure it with a put, rather than purchase a call, if the call will tie up much less money than the put and the stock together?

A Primer on Put-Call Parity and How to Use It

This week, we review what are known as the put/call parity rules. If you know one rule — and you remember your high school algebra — you can quickly master all the rules.

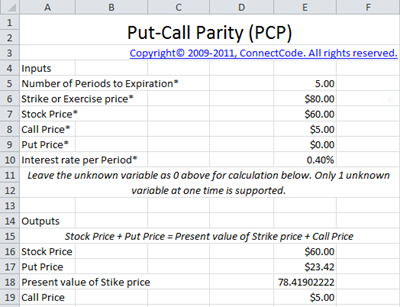

Free Options Valuation. Put Call Parity, Binomial Option.

Options Valuation Options An option is a contract that gives a person or institution the right to buy or sell an asset at a specified price. A call option is a.

Implied Dividend Calculator — Invest Excel

This article teaches you how to calculate the implied dividend of an option via put-call parity, illustrated with an Excel spreadsheet. Although option holders do not.

Spotfuture parity — Wikipedia, the free encyclopedia

Spotfuture parity (or spot-futures parity) is a parity condition that should theoretically hold, or opportunities for arbitrage exist. Spotfuture parity is an.

Effect of Dividends on Option Pricing | The Options.

Cash dividends issued by stocks have big impact on their option prices. This is because the underlying stock price is expected to drop by the dividend amount on.

Ford Poised to Raise Dividend by 20% Even as Profit.

Our plan for dividends is to continue to grow regular dividends up to the point that we dont believe this is sustainable, Chief Financial Officer Bob Shanks.