Protecting Yourself from Rising Interest Rates Traditions of America

Post on: 6 Июнь, 2015 No Comment

Jul 08, 2014 by Nathan Jameson, Partner

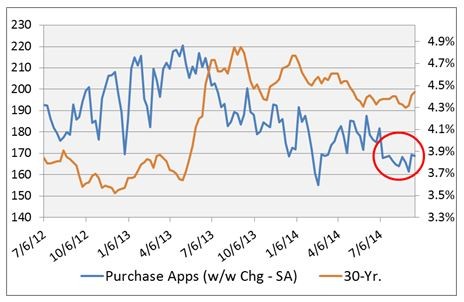

Stock markets hover at record highs. The economy is stronger. Credit availability is healing — in some areas even overabundant. Yet interest rates, somewhat illogically, remain near record lows. This will not continue. Improving economic factors combined with the Federal Reserve reducing its treasury purchases will lead to higher interest rates. Higher interest rates erode the value of money and could force you to compromise on features youre excited to enjoy in your new home.

For every half-point rise in interest rates, purchasing power decreases 6%. If your closing is nine to twelve months away, and rates rise from 4.5% to 6% during that time, it will cost you 18% more than if you had locked in current rates now. (Calculate it for yourself here)

I dont have a crystal ball, so I wont predict whether higher mortgage rates are weeks or months away. The good news is, you dont have to have a crystal ball to prepare for higher rates because Wells Fargo offers new home buyers protection against higher future rates.

For the last 15 years, Traditions of America has partnered with Wells Fargo to provide mortgage financing to our clients. And while the banking industry and mortgage regulations have changed almost as frequently as my 5-year old daughter changes dresses (every half hour), Wells Fargo is the only bank that is unchanged in its commitment to Americas homebuyers nationwide and Traditions of Americas homebuyers in Pennsylvania.

If youve purchased or are planning to purchase a new home using a mortgage, Wells Fargos Builder Best Program is for you. Builder Best participants lock in current low interest rates today even if your closing is twelve months away.

If youre planning on paying cash for your new home, this could be for you too! Wouldnt the ability to finance tomorrows new home at todays rates be attractive? After all, a mortgage loan at todays rates (between 4.0% and 4.5%) is basically free if inflation increases only slightly to 3% (assuming you benefit from the mortgage interest deduction on your taxes).

Whether your new home is already under construction or if it wont be started until next year, Wells Fargo offers no-to-low cost rate locks to suit your situation.

As the noted economics professor Herbert Stein once said, If something cannot go on forever, it will stop. Low rates cannot last forever. Will you be prepared when they rise?

Get prepared today by speaking directly with one of Wells Fargos Home Mortgage Consultants who work with Traditions of America. Click here for more information on how to get in touch with one of our trusted representatives.

Please enable JavaScript to view the comments powered by Disqus.