Prosper Review Investing with a Peer to Peer Lender

Post on: 5 Июль, 2015 No Comment

Investing With Prosper

A re you looking for higher rates of return than you can earn on certificates of deposit, online savings accounts, and bonds?

If you are willing to accept a bit more risk and want to mix up your portfolio to not rely solely on stocks then peer-to-peer lending can be a great option.

Prosper was the first successful company in the peer-to-peer space, and remains a great place for you to invest money in P2P lending.

What Problem Does Prosper Solve?

If you find yourself in a financial bind and in need of cash, you have several options. You can borrow from family or friends, use your credit card, a personal loan from your bank, or as a last resort use payday lending. These were your options up until about 4 or 5 years ago when peer-to-peer lending arrived on the scene.

With peer-to-peer lending you have a new option. Instead of having to go to a financing company to solve your money needs, you can turn to other individuals. These individual lenders pool their money together and lend it to borrowers they deem worthy of their funds. Investors get better rates of return than other investments, albeit at some risk, and borrowers get much more competitive rates than the other options available.

The first company to successfully establish itself in this market was Prosper. The company has grown to have over 1 million individuals involved in lending funds through the website. Those lenders have sent out over $272 million in loans. Millions in interest has been saved by borrowers, and healthy returns have been earned by investors.

How Does Prosper Work?

Prosper connects borrowers who want cheaper loans to individual investors seeking higher investment returns. Your states laws determine whether or not you can borrow or lend on Prosper. A borrower can borrow up to $25,000 over a 3 or 5 year loan at an interest rate that is determined by their credit worthiness.

How to Invest in Loans on Prosper

QuickInvest with Prosper

As an investor/lender there is no cap as to how much money you can put into the lending system. Getting set up for investing is simple. First you must sign up for an account and attach a bank account to your Prosper account so you can transfer money in and out of the system.

Setting up a bank account takes a few days because Prosper will make 1 deposit and 1 withdrawal of less than a dollar in that bank account. You must then go on and verify the amounts that were deposited and withdrawn. After your account is set up, you simply decide how much money you want to deposit into your Prosper account to invest in loans.

After you have money in your Prosper account you can invest in two different methods: by reviewing specific loans to put your money in or let an automated investing system pick loans for you based on criteria you set. Once you have invested money into either specific loans or a portfolio of loans the interest you earn will be deposited back into your account for either further investment or withdrawal.

Compare Prosper and Lending Club

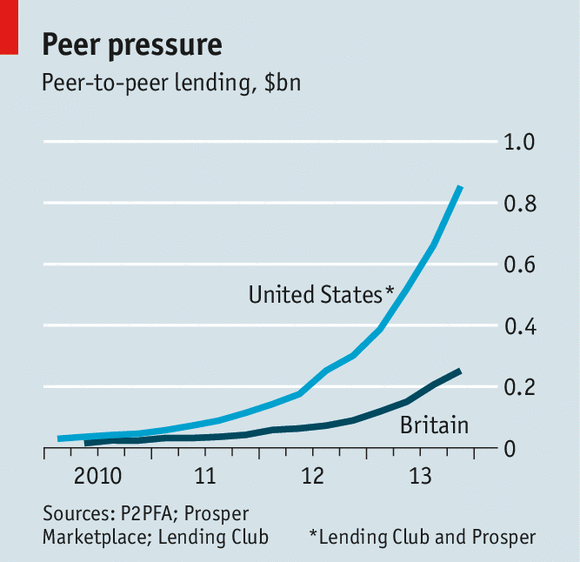

As Prosper continued to grow a new competitor emerged in the peer-to-peer lending market: Lending Club . The two companies are very similar and offer the same ability to borrow and lend between individuals.

Note: read our post where we discuss investing with Lending Club to learn more about them.

Know the Risk of Default

When you agree to lend money to a stranger over the internet, you have to ask yourself why they cant get access to funds elsewhere. They dont have family that could help? They dont have a bank or credit card company willing to give them money? Financing companies – banks, credit card companies, payday loan companies – make money by lending money to people who need it. If a person cant turn to them for help, why should you let them turn to you? Many times a peer-to-peer loan is the loan of last resort because it takes the longest to come through the origination process. If a borrower has made it to the point of needing a peer-to-peer loan they are many times getting funds at increased risk.

Prosper Loans

Peer-to-peer lending isnt “easy” like setting up a certificate of deposit. You cant set it and forget it while raking in interest payments. Knowing default rates for different types of loans is critical to having positive returns from your P2P lending. However, if you can accept greater risk and spend a little bit of time doing research on a loan, you can earn much higher returns than are possible on CDs and savings accounts.

How Much Can I Make with Peer-to-Peer Lending?

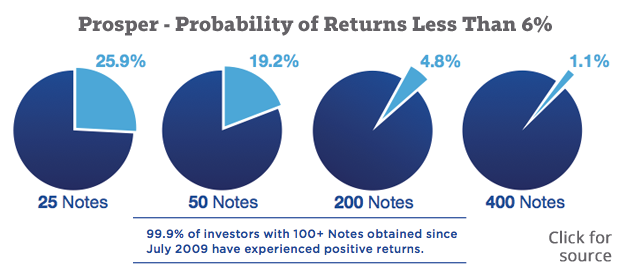

Exactly how high your rate of return will be with P2P lending is dependent upon many factors:

- how much you invest

- which loans you invest in

- what your portfolios rate of default in

The better your personal screening process is to invest in a specific loan, the better your returns will be. You can earn astronomical returns – at least in theory – by moving further down the credit quality ratings. However, just because you can lend money at 18% doesnt mean that loan will be kept current through the payoff date. You must balance risk and reward to avoid losses that take a chunk out of your returns.

Does My State Let Me Participate in P2P Lending?

Unfortunately not every state lets its citizens participate in P2P lending. Direct investment in Prosper loans is currently available in 26 states. Direct investment in Lending Club notes is available in 28 states. Both firms are actively trying to expand to all 50 states.