Profit From Mortgage Debt With MBS

Post on: 9 Июль, 2015 No Comment

In its May 2006 edition of Research Quarterly, the Bond Market Association estimated that mortgage debt represents $6.1 trillion of the $25.9 trillion bond market. As more people buy their first homes, move into bigger spaces, or purchase vacation homes, this borrowing is bound to expand. This situation creates an opportunity for astute investors, who can use mortgaged-backed securities (MBS) to own a piece of this debt. In this article, we’ll show you how you can use MBS to complement your other fixed-income assets.

Individuals invest in mortgage pools.

Types of MBS

Pass-Through

The pass-through or participation certificate represents direct ownership in a pool of mortgages. You will get a pro-rata share of all principal and interest payments made into the pool as the issuer receives monthly payments from borrowers.

The mortgage pool will usually have a five-to-30-year maturity. However, the cash flow can change from month to month depending on how many mortgages are paid off early — this is where the prepayment risk lies.

When current interest rates decline, borrowers might refinance and prepay their loans. Investors then must try to find yields similar to their original investments in a lower, current-interest rate environment.

Conversely, investors can face interest rate risks when current interest rates go up. Borrowers will stay with their loans, leaving investors stuck with the lower yields in a rising current-interest rate environment.

Collateralized Mortgage Obligations (CMO)

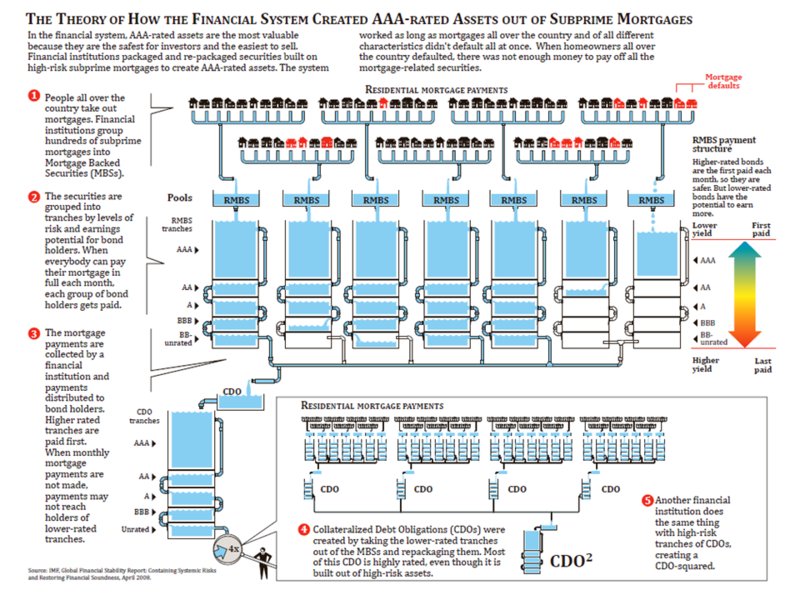

Collaterized mortgage obligations (CMOs) are pools of pass-through mortgages. The formation of a CMO is illustrated below:

Pass-Through Securities

There are several types of CMOs that are designed to reduce investors’ prepayment risk, but the three most common are:

1. Sequential Pay CMOs

When the mortgage payments come in, the CMO issuer will first pay the stated coupon interest rate to the bondholders in each tranche. Scheduled and unscheduled principal payments will go first to the investors in the first tranches. Once they are paid off, investors in later tranches will receive principal payments.

The concept is to transfer the prepayment risk from one tranche to another. Some CMOs may have 50 or more interdependent tranches. Therefore, you should understand the characteristics of the other tranches in the CMO before you invest. There are two types: Planned Amortization Class (PAC) Tranche

PAC tranches use the sinking fund concept to help investors reduce prepayment risk and receive a more stable cash flow. A companion bond is established to absorb excess principal as mortgages are paid off early. Then, with income from two sources (the PAC and the companion bond) investors have a better chance of receiving payments over the original maturity schedule.

Z-Tranche

Z-tranches are also known as accrual bonds or accretion bond tranches. During the accrual period, interest is not paid to investors. Instead, the principal increases at a compound rate. This eliminates investors’ risk of having to reinvest at lower yields if current market rates decline .

After prior tranches are paid off, Z-tranche holders will receive coupon payments based on the bond’s higher principal balance. Plus, they’ll get any principal prepayments from the underlying mortgages.

Because the interest credited during the accrual period is taxable — even though investors don’t actually receive it — Z-tranches may be better suited for tax-deferred accounts .

2. Stripped Mortgage Securities

Strips are MBS that pay investors principal only (PO) or interest only (IO). Strips are created from MBS, or they may be tranches in a CMO.

Principal Only (PO)

Investors pay a deeply-discounted price for the PO and receive principal payments from the underlying mortgages.

The market value of a PO can fluctuate widely based on current interest rates. As interest rates drop, prepayments can increase, and the PO’s value might rise. On the other hand, when current rates go up and prepayments decline, the PO could drop in value.

Interest Only (IO)

An IO strictly pays interest that is based on the amount of outstanding principal. As the mortgages amortize and prepayments reduce the principal balance, the IO’s cash flow declines.

The IO’s value fluctuates opposite a PO’s in that as current interest rates drop and prepayments increase, the income can go down. And when current interest rates rise, investors are more likely to receive interest payments over a longer period of time, thereby increasing the IO’s market value.

Safety Ratings

MBS Issuers

You can buy MBS from several different issuers:

Independent Firms

Investment banks, financial institutions and homebuilders issue private-label, mortgage-backed securities. Their creditworthiness and safety rating may be much lower than those of government agencies and government-sponsored enterprises.

Federal Home Loan Mortgage Corporation (Freddie Mac)

Freddie Mac is a federally-regulated, government-sponsored enterprise that purchases mortgages from lenders across the country. It then repackages them into securities that can be sold to investors in a wide variety of forms.

Freddie Macs are not backed by the U.S government, but the corporation has special authority to borrow from the U.S. Treasury .

Federal National Mortgage Association (Fannie Mae)

Fannie Mae is a shareholder-owned company that is actively traded (symbol FNM) on the New York Stock Exchange and is part of the S&P 500 Index. It receives no government funding or backing.

As far as safety goes, Fannie Maes are backed by the corporation’s financial health and not by the U.S. government.

Besides greater diversification of loans, mutual funds can reinvest all returns of principal in other MBS. This lets investors receive yields that change with current rates and will reduce prepayment and interest rate risks.

The Bottom Line