Private equity fund Wikipedia the free encyclopedia

Post on: 27 Март, 2015 No Comment

This article is about private equity investment funds. For private equity fund managers or financial sponsors and an overview of the industry, see private equity firm and private equity .

A private equity fund is a collective investment scheme used for making investments in various equity (and to a lesser extent debt) securities according to one of the investment strategies associated with private equity. Private equity funds are typically limited partnerships with a fixed term of 10 years (often with annual extensions). At inception, institutional investors make an unfunded commitment to the limited partnership, which is then drawn over the term of the fund. From the investors’ point of view, funds can be traditional (where all the investors invest with equal terms) or asymmetric (where different investors have different terms).

A private equity fund is raised and managed by investment professionals of a specific private equity firm (the general partner and investment advisor). Typically, a single private equity firm will manage a series of distinct private equity funds and will attempt to raise a new fund every 3 to 5 years as the previous fund is fully invested.

§ Legal structure and terms [ edit ]

Diagram of the structure of a generic private equity fund

Most private equity funds are structured as limited partnerships and are governed by the terms set forth in the limited partnership agreement or LPA. Such funds have a general partner (GP), which raises capital from cash-rich institutional investors, such as pension plans, universities, insurance companies, foundations, endowments, and high-net-worth individuals, which invest as limited partners (LPs) in the fund. Among the terms set forth in the limited partnership agreement are the following:

Term of the partnership The partnership is usually a fixed-life investment vehicle that is typically 10 years plus some number of extensions. Management fees An annual payment made by the investors in the fund to the fund’s manager to pay for the private equity firm’s investment operations (typically 1 to 2% of the committed capital of the fund. [ 1 ] Distribution Waterfall   The process by which the returned capital will be distributed to the investor, and allocated between Limited and General Partner. This waterfall includes the preferred return  : a minimum rate of return (e.g. 8%) which must be achieved before the General Partner can receive any carried interest, and the Carried interest. the share of the profits paid the General Partner above the preferred return (e.g. 20%). [ 1 ] Transfer of an interest in the fund Private equity funds are not intended to be transferred or traded; however, they can be transferred to another investor. Typically, such a transfer must receive the consent of and is at the discretion of the fund’s manager. Restrictions on the General Partner The fund’s manager has significant discretion to make investments and control the affairs of the fund. However, the LPA does have certain restrictions and controls and is often limited in the type, size, or geographic focus of investments permitted, and how long the manager is permitted to make new investments.

§ Private equity investments and financing [ edit ]

A private equity fund typically makes investments in companies (known as portfolio companies). These portfolio company investments are funded with the capital raised from LPs, and may be partially or substantially financed by debt. Some private equity investment transactions can be highly leveraged with debt financing —hence the acronym LBO for leveraged buy-out. The cash flow from the portfolio company usually provides the source for the repayment of such debt. While billion dollar private equity investments make the headlines, private equity funds also play a large role in middle market businesses. [ 2 ]

Such LBO financing most often comes from commercial banks, although other financial institutions, such as hedge funds and mezzanine funds. may also provide financing. Since mid-2007, debt financing has become much more difficult to obtain for private equity funds than in previous years.

LBO funds commonly acquire most of the equity interests or assets of the portfolio company through a newly created special purpose acquisition subsidiary controlled by the fund, and sometimes as a consortium of several like-minded funds.

§ Private equity multiples and prices [ edit ]

The acquisition price of a portfolio company is usually based on a multiple of the company’s historical income, most often based on the measure of earnings before interest, taxes, depreciation, and amortization (EBITDA ). Private equity multiples are highly dependent on the portfolio company’s industry, the size of the company, and the availability of LBO financing.

§ Portfolio company sales (or exits ) [ edit ]

A private equity fund’s ultimate goal is to sell or exit its investments in portfolio companies for a return, known as internal rate of return (IRR) in excess of the price paid. These exit scenarios historically have been an IPO of the portfolio company or a sale of the company to a strategic acquirer through a merger or acquisition (M&A), also known as a trade sale. A sale of the portfolio company to another private equity firm, also known as a secondary. has become common feature of developed private equity markets.

In prior years, another exit strategy has been a preferred dividend by the portfolio company to the private equity fund to repay the capital investment, sometimes financed with additional debt.

§ Private equity funds and private equity firms: an illustration [ edit ]

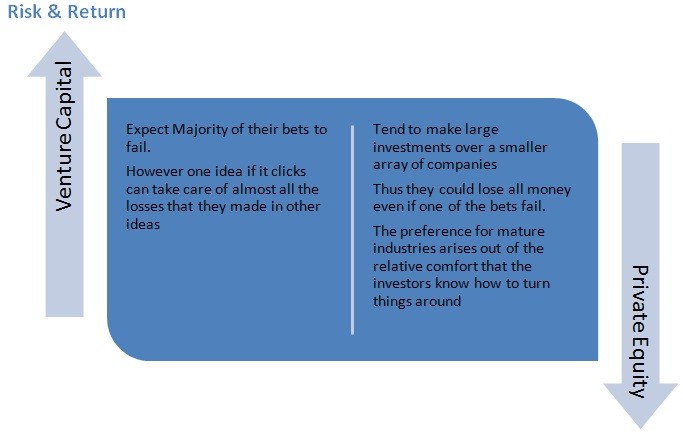

The following is an illustration of the difference between a private equity fund and a private equity firm :