Private equity firm Wikipedia the free encyclopedia

Post on: 9 Май, 2015 No Comment

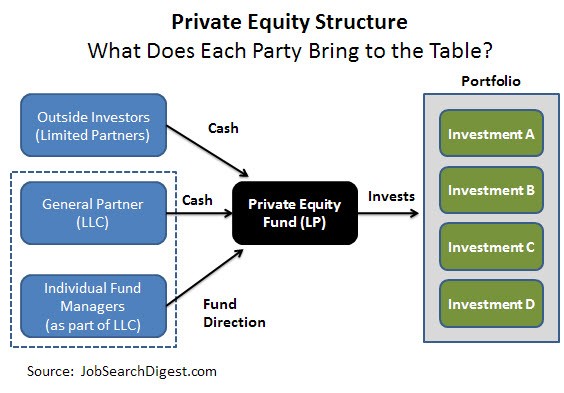

Diagram of the structure of a generic private equity fund

A private equity firm is an investment manager that makes investments in the private equity of operating companies through a variety of loosely affiliated investment strategies including leveraged buyout. venture capital. and growth capital. Often described as a financial sponsor. each firm will raise funds that will be invested in accordance with one or more specific investment strategies.

Typically, a private equity firm will raise pools of capital, or private equity funds that supply the equity contributions for these transactions. Private equity firms will receive a periodic management fee as well as a share in the profits earned (carried interest ) from each private equity fund managed.

Private equity firms, with their investors, will acquire a controlling or substantial minority position in a company and then look to maximize the value of that investment. Private equity firms generally receive a return on their investments through one of the following avenues:

- an initial public offering (IPO ) — shares of the company are offered to the public, typically providing a partial immediate realization to the financial sponsor as well as a public market into which it can later sell additional shares;

- a merger or acquisition — the company is sold for either cash or shares in another company;

- a Recapitalization — cash is distributed to the shareholders (in this case the financial sponsor) and its private equity funds either from cash flow generated by the company or through raising debt or other securities to fund the distribution.

Private equity firms characteristically make longer-hold investments in target industry sectors or specific investment areas where they have expertise. Private equity firms and investment funds should not be confused with hedge fund firms which typically make shorter-term investments in securities and other more liquid assets within an industry sector but with less direct influence or control over the operations of a specific company. Where private equity firms take on operational roles to manage risks and achieve growth through long term investments, hedge funds more frequently act as short term traders of securities betting on both the up and down sides of a business or industry sector’s financial health. [ 1 ]

Contents

§ Ranking private equity firms [ edit ]

According to an updated 2008 ranking created by industry magazine Private Equity International [ 2 ] (The PEI 50), the largest private equity firms include The Carlyle Group. Kohlberg Kravis Roberts. Goldman Sachs Principal Investment Group. The Blackstone Group. Bain Capital and TPG Capital. These firms are typically direct investors in companies rather than investors in the private equity asset class and for the most part the largest private equity investment firms focused primarily on leveraged buyouts rather than venture capital .