Private Equity Analyst Associate Salary Compensation Pay Salaries

Post on: 31 Май, 2015 No Comment

“ People used to think that private equity was basically just a compensation scheme, but it is much more about making companies more efficient.”

- David Rubenstein, co-founder of The Carlyle Group, a global private equity investment firm

Private Equity Analyst Salary

I’m sure that amongst other things, you are very keen in understanding more about the private equity analyst salary and compensation benefits that will come along.

But…before we start talking about private equity analyst salary, compensation. pay range, here’s just a small description of private equity firms and private equity analysts.

A private equity analyst is an investment manager that makes investments directly into the operating businesses, either by using their own capital or raising them from retail or institutional investors.

They use investment strategies like leveraged buyouts, management buyouts and private placements to strike deals.

As a private equity analyst, you need to perform analytical work like financial modeling and initial due diligence activities for the company in question.

For this, you rely on sophisticated financial modeling techniques and valuation techniques like Discounted Cash Flow (DCF) and Internal Rate of Return (IRR).

To start with, let us understand a little more about the hierarchy structure of private equity firms.

You may notice that private equity firms. just like investment banks tend to have somewhat flat hierarchy, but with fewer levels. Though private equity firm hierarchies vary from firm to firm, they have a rather rigid seniority structure.

This means that you will find large difference in experience as well as job responsibilities between various levels of hierarchy.

Thus, fresh graduates start with an associate or junior analyst position and are more involved in analytical work like financial modeling and initial due diligence activities.

With years of work experience, the analyst progresses to senior analyst level positions, where the professionals are accountable for decision making, deal sourcing, deal negotiations and relationship management.

In light of the hierarchy structure, let us talk about the private equity analyst salary and compensation.

The Private Equity Compensation Report 2012 based on research done by Private Equity Salaries, advises you that your compensation as a private equity analyst not only includes base pay, but also comprises of bonuses, perquisites like travel, healthcare insurance and retirement plans.

In fact as you rise in the hierarchy in a private equity firm, bonuses form the biggest chunk of your compensation.

Thus, you must keep in mind that the list of compensation items will comprise base salary, bonuses, carried interest, severance package, coverage of relocation expenses, training programs, investment in the companies which the firm has interests in, profit sharing plans, etc.

The compensation that you can attract in private equity is more than would be available in virtually any other area of finance and is directly related to the elite nature of the work.

The extent of your participation in the company’s profitability will determine your share of the “carried interest”.

For your understanding, ‘Carried Interest’ or carry is a share of the profits of an investment fund, which the fund manager receives upon exiting an investment.

This makes a significant component of your compensation over and above the management fees.

Standard ‘carry’ rates range from 20 percent to as high as 50 percent in case of private equity and hedge funds.

Private Equity Analyst Salary Range

In the private equity industry, the total compensation is only marginally 5 percent higher for MBAs, as compared to non-MBAs.

You will see that wherein, the base salaries average up to 13 percent higher for an MBA, there is no significant difference between bonuses earned by those with an MBA and those without.

This is because the bonus levels are usually directly related to the fund’s performance.

As per the WSO Company Database, based on approximation and rough range of user registration data on Wall Street Oasis, below is the estimated range of current private equity compensation.

A first year analyst / associate can earn from USD 50K USD 250K per annum.

In the second year the salary ranges from USD 150K – USD 300K, and it scales up to USD 170 K – USD 350K from the third year onwards.

The private equity compensation for Vice Presidents, Directors and Managing Directors depends a lot upon the company’s performance and comes with carried interest.

At such higher levels, the salary ranges from USD 300K – USD 800K+ for Vice Presidents, to USD 500K USD 10MM+ for Managing Directors or Partners.

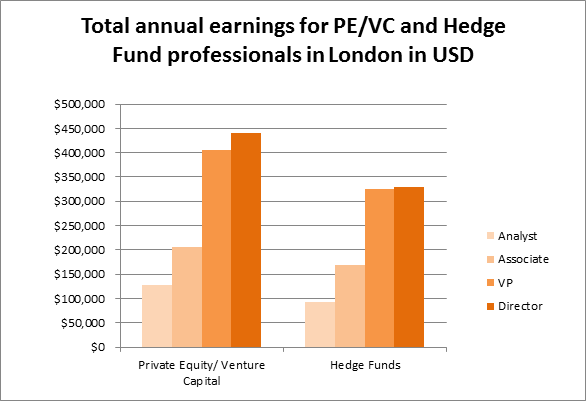

Let us get a better understanding of these determinants by looking at the pay structure across some of the largest financial districts in the world:

Private Equity Analyst Salary New York

Like you all know, that New York City is the biggest financial districts in USA. New York houses more than 150 private equity firms. You will find that average private equity analyst salaries for job postings in New York are 21 percent higher than average private equity analyst salaries for job postings elsewhere.

According to a May 2013 article published in The New York Times, the private equity recruiting season has begun with fierce competition and a rush to recruit young analysts.

The candidates are being taken up, less than a year after graduating from college. Such offers guarantee candidates, USD 50K to USD 150K a year, moving to more than USD 150K per annum for more desirable candidates.

Private Equity Analyst Salary Blackstone

The Blackstone Group L.P. is an American multinational private equity firm based in New York City. Its private equity business has been one of the largest investors in leveraged buyout transactions over the last decade.

Blackstone hires analysts for a 3-year program straight out of undergrads school or pre-MBA associates for 2 years with a 2 year experience in the Investment Banking division.

While an analyst at Blackstone can earn salary from USD 50K – USD 200K, an associates’ salary can range from USD 100K – USD 400K per annum.

Private Equity Analyst Salary London

London being the capital city of United Kingdom, and their financial capital, it is one of the most important providers of job opportunities.

A private equity analyst in London can gross a total pay ranging from GBP 20K – GBP 60K per annum, of which around GBP 1K – GBP 10K would comprise of bonus component, the rest being the base salary.

Private Equity Analyst Salary India

According to India Private Equity Report 2013 by Bain & Company, the private equity market in India is maturing.

Their research says that amongst investors there is a gradual change of attitude towards private equity, and coupled with the improving regulatory framework, Indias private equity industry shows positive future prospects.

The average salary for a private equity analyst in India can range from INR 4 to 10 lakhs per annum for entry level to as high as more than INR 50 lakhs per annum depending on growing years of experience.

I really hope this article has answered your questions about private equity analyst job profile and salary structure and you are able to fulfill your dream of working in this high profile sector!

Are You Ready To Rock?

There you have it: a complete guide of private equity analyst salary.

Don’t just click away. Check out some private equity analyst salaries right now .

If you have any questions — or have some personal experience to share — please leave a comment below.

Image credit: www dot illiniphcrecruitment dot com

Special Bonus on BIWS Programs from FinanceWalk

Heres an offer on Breaking Into Wall Street (BIWS) programs:

All FinanceWalk readers will get FREE $97 Bonus FinanceWalks Equity Research Program.

If you want to build a long-term career in Financial Modeling, Investment Banking, and Private Equity, I’m confident these are the only courses you’ll need. ( Because Brian (BIWS) has created world-class online financial modeling training programs that will be with you FOREVER).

If you purchase BIWS courses through FinanceWalk links, I’ll give you a FREE Bonus of FinanceWalks online Equity Research Program ($97 Value).

I see FinanceWalks Equity Research Program as a pretty perfect compliment to BIWS courses – BIWS helps you build financial modeling and investment banking skills and then I will help you build equity research and report writing skills.

To get the FREE $97 Bonus, please purchase from the following links.

IB Networking Toolkit + IB Interview Guide $144 ( Save $50)

BIWS Platinum – Save $632 ( Save 35%) + Free $97 Bonus. The most comprehensive IB package on the market today. Includes the NEW and Improved BIWS Premium Financial Modeling Course (RRP: $497) PLUS access to the above 6 complementary courses designed to make you into an even more well-rounded IB Professional: