Principles of Investing CASH FLOW

Post on: 22 Апрель, 2015 No Comment

Principles of Investing: CASH FLOW

One of the vital components of successful real estate investing is understanding how cash flow is calculated and what cash on cash return means. These concepts are critical to evaluating a property prior to purchase. The Net Operating Income (NOI) minus the monthly principal and interest on the loan (debt service) is called “cash flow.”

Let’s break that down to determine how we arrive at this number. (This is something we cover in great detail in the Rich Dad Education Elite Creative Financing course.)

To understand Cash Flow. we first need to define the following terms:

Gross Income This is money received from the tenant(s) along with any other monthly income, such as money from vending machines, laundry fees, or parking fees.

Adjusted Gross Income Gross income minus vacancy. Vacancy rates are obtained from the property management firm.

Capital Improvements – The changes or additions that increase the value of the property. Exterior capital improvements could include replacing the roof, siding, and/or windows, exterior paint, paving, adding a pool, landscaping, etc. Interior capital improvements might include remodeling the kitchen or bath, interior paint, new appliances, new floor coverings, the HVAC, etc.

Cash Reserve Money set aside per month for capital improvements made over a specified period of time. (Ex. 6 years)

Operating Expenses Includes things such as property taxes; cash reserves; utilities (i.e. electric, water, gas, etc.); management, accounting and legal fees; repairs; HOA; landscaping; maintenance; snow removal; pool service; pest control; etc. (Management expenses should average 6-8% per month.)

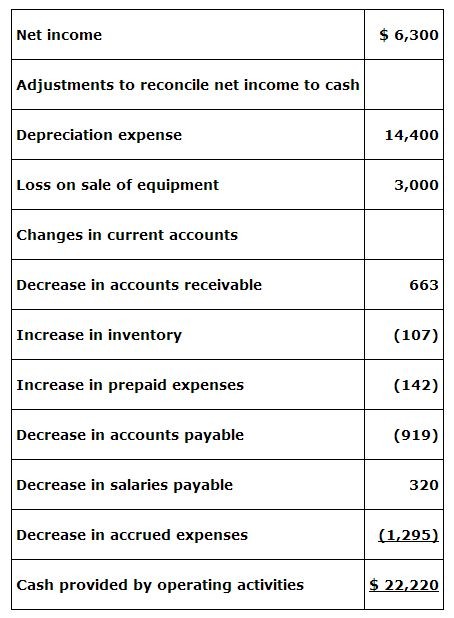

Net Operating Income Gross income minus the vacancy rate minus all operating expenses.

Total Cash Invested The combination of down payment, closing costs, carrying costs and repairs.

Cash Flow – Once again, it’s net operating income minus the monthly principal and interest on the loan (debt service). To determine the cash flow for the year, simply multiply the monthly cash flow by 12 The cash flow for the year divided by the total cash invested is called cash on cash return, which is a percentage for the year.

Cash on Cash Return will show the investor how much money he/she makes per year from cash flow only. Cash on cash return is an important calculation to help the investor determine whether the amount of cash received meets the investor’s criteria.

By Richard Maryanski and Erik Maryanski

Rich Dad® Education Elite Training Mentors

For more information on this topic or similar topics, check out the following blogs.