Principal ETF assets to top $ by 2020

Post on: 30 Июль, 2015 No Comment

Active exchange-traded funds are likely to proliferate and drive much of the growth of the ETF market.

Participant-directed defined contribution plans now account for $9.7 trillion of the approximately $16.5 trillion in total pension assets, new research shows.

Principal Financial unveils this finding in A 360-Degree Approach to Preparing for Retirement. Drafted in collaboration with CREATE-Research, the report examines the innovations, gaps and trends within the U.S. retirement system.

The research reveals that target-date funds mutual funds that automatically reset the asset mix (stocks, bonds, cash equivalents) in its portfolio according to a selected time frame appropriate for an investor held $500 billion of assets in 2012, a figure that is likely to grow at a compounded annual growth rate (CAGR) of 15 percent.

The report points to constraints that are preventing plan participants from preparing adequately for retirement. Among those identified by advisors are:

Participants not saving enough (74 percent)

Participants not starting to save early enough (70 percent)

Participants living beyond their means (69 percent)

Participants over-estimating their ability to plan ahead (66 percent)

Participants putting off creating a financial plan (62 percent).

More than two in five plan participants polled expect new or better features to be embodied in target-date/life-cycle funds during the accumulation phase of retirement. These include:

A clear income benchmark during the retirement phase (66 percent)

Dynamic asset allocation (64 percent)

Broad diversification (49 percent)

Embedded advice (48 percent)

The report adds that plan participants will increasingly adopt new investment approaches to retirement, while legacy assets are gradually wound down. The short- and medium-term approaches to asset allocation encompass:

Balanced funds (68 percent)

Traditional cap-weighted indexed funds (67 percent)

Target-date funds (63 percent)

Actively managed equities and bonds (55 percent)

Target-income funds (46 percent)

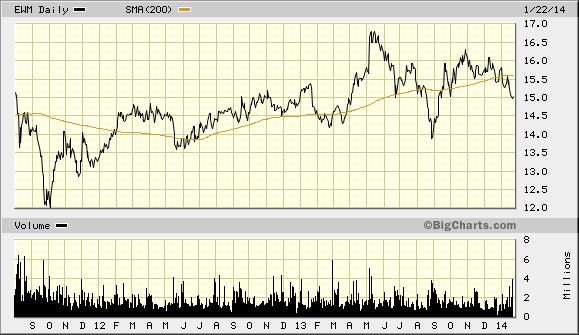

The survey also identifies asset allocation strategies chosen for opportunism, including ETFs (41 percent) and actively managed equities and bonds (40 percent).

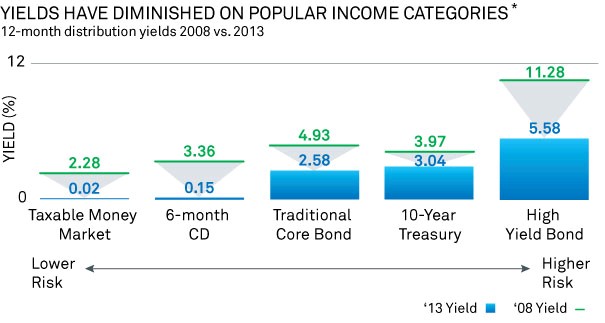

The use of ETFs is nascent, the report states. More and more financial advisors are likely to channel assets into them, such that the total ETF assets will top $9.5 trillion by 2020, up from the current level of $1.7 trillion.

As their registration process becomes less onerous, active ETFs in particular are likely to proliferate and drive this growth, the report adds. Indeed, plans are afoot to create ETFs based on lifecycle risk, with distinct tilts towards healthcare, life sciences, fuel and retirement communities backed by simple hedges.