Pricetocashflow is a good thing to look at; here s how

Post on: 12 Апрель, 2015 No Comment

Q: Are you aware of any free sites for screening stocks based on price-to-cash-flow?

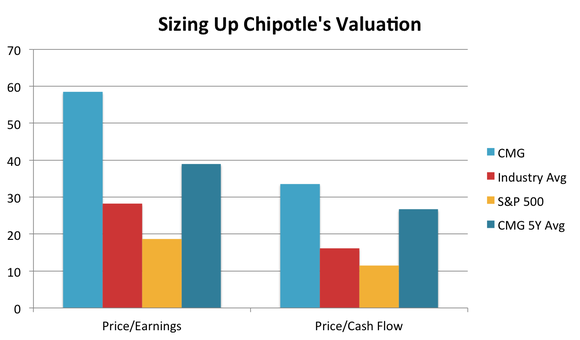

A: Most investors pay close attention to price-to-earnings ratios (P-Es). But it’s not a bad idea to consider price-to-cash flow, too.

A stock’s price-to-earnings ratio gives you a general idea of how much investors are paying to claim each dollar a company generates in earnings. If a stock has a P-E of 15, that means investors are paying $15 for every dollar of the company’s profit. The higher the P-E, the more investors are paying and the higher its so-called valuation. You can learn more about calculating P-E ratios here .

A stock’s price-to-cash-flow ratio is similar. But rather than comparing a stock’s price with earnings, you’re comparing it with cash flow, which is net income plus depreciation, amortization and other non-cash charges. Cash flow is a popular way to see how well a company is performing excluding distortions caused by accounting.

Want to find stocks with a certain price-to-cash-flow? MSN Money has a screening tool that does this. Go to moneycentral.msn.com and click on the Stock Research link in the left-hand column in the Investing section. Scroll down again, and click on the Stock Screener option in the left-hand column in the Find Stocks section.

If you’ve never used the screening tool, there’s a one-time setup needed. Don’t worry, it’s painless. Scroll down and click on the Deluxe Stock Screener link under where it says Supercharge your Search. Next, click the Download MSN Money Investment Toolbox on the left-hand side. When the installation is finished, click I see the chart.

The advanced screening tool then appears. Under the field name column, choose Price Ratios, then Price/Cash Flow Ratio. Set the operator, such as greater than or less than, and then the value. For instance, if you want to find all the stocks with price-to-cashflow ratios of less than 15, change the operator to a < and the

In this case, you’ll have to select again, and choose Price/Cash Flow Ratio > (greater than) 1 to get meaningful results. And at the top of the box, you can ask the tool to Return Top 100 or more matches if you want that many.

Matt Krantz is a financial markets reporter at USA TODAY and author of Investing Online for Dummies. He answers a different reader question every weekday in his Ask Matt column at money.usatoday.com. To submit a question, e-mail Matt at mkrantz@usatoday.com. Click here to see previous Ask Matt columns.