Price to Earnings Ratio (P

Post on: 25 Апрель, 2015 No Comment

Definition

The price to earnings ratio (P/E ratio ) is the ratio of market price per share to earning per share. The P/E ratio is a valuation ratio of a company’s current price per share compared to its earnings per share. It is also sometimes known as earnings multiple or “price multiple”. Though Price-earning ratio has several imperfections but it is still the most acceptable method to evaluate prospective investments. It is calculated by dividing “Market Value per Share (P)” to “Earnings per Share (EPS)”. Market value of share can be taken from stock market or online and earning per share figure can be calculated by dividing net annual earnings to total number of shares (Net Annual Earnings/Total number of shares).

P/E ratio is a widely used ratio which helps the investors to decide whether to buy shares of a particular company. It is calculated to estimate the appreciation in the market value of equity shares.

Calculation (formula)

The formula used to calculate the price to earnings ratio is:

Price to Earnings Ratio = Market Price per Share / Earnings per Share

The price to earnings ratio can also be calculated with the help of following formula:

Price to Earnings Ratio = Market Capitalization / Earnings after Taxes and Preference Dividends

The P/E ratio tells how much the market is willing to pay for a companys earnings. A higher P/E ratio means that the market is more willing to pay for the earnings of the company. Higher price to earnings ratio indicates that the market has high hopes for the future of the share and therefore it has bid up the price. On the other hand, a lower price to earnings ratio indicates the market does not have much confidence in the future of the share.

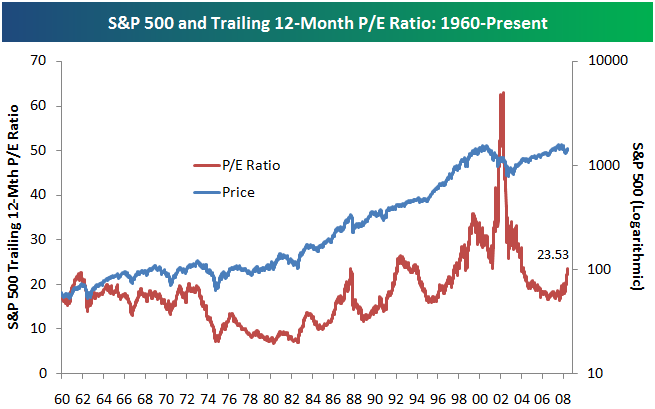

The average P/E ratio is normally from 12 to 15 however it depends on market and economic conditions. P/E ratio may also vary among different industries and companies. P/E ratio indicates what amount an investor is paying against every dollar of earnings. A higher P/E ratio indicates that an investor is paying more for each unit of net income. So P/E ratio between 12 to 15 is acceptable.

For example, if company A shares are trading at $50/share and most recent EPS is $2/share. The P/E ratio will be $50/2$ = $25. This indicates that the investors are paying $25 for every $1 of company’s earnings. Companies with no profit or negative earnings have no P/E ratio and usually written as “N/A”.

Norms and Limits

A higher P/E ratio may not always be a positive indicator because a higher P/E ratio may also result from overpricing of the shares. Similarly, a lower P/E ratio may not always be a negative indicator because it may mean that the share is a sleeper that has been overlooked by the market. Therefore, P/E ratio should be used cautiously. Investment decisions should not be based solely on the P/E ratio. It is better to use it in conjunction with other ratios and measures.

The most obvious and widely discussed problem in P/E ratio is that the denominator considers non cash items. Earnings figure can easily be manipulated by playing with non cash items, for example, depreciation or amortization. If it is not manipulated deliberately, earnings figure is still affected by non cash items. That is why a large number of investors are now using “Price/Cash Flow Ratio” which removes non cash items and considers cash items only.

It is normally assumed that a low P/E ratio indicates a company is undervalued. It is not always right as this may be due to the stock market assumes that the company is headed over several issues or the company itself has warned a low earnings than expected. Such things may lead to a low P/E ratio.