PreMBA Finance

Post on: 29 Июль, 2015 No Comment

How Do Companies Decide Which Projects to Undertake?

This discussion of net present value and internal rate of return examines how companies use NPV and IRR as decision tools to evaluate whether investments or projects are worth pursuing.

The perpetuities topic introduced the dividend discount model as a way to value a company’s stock. Aside from buying stock back from the public, cash dividends are the common way that a company returns cash payments to its equity investors.

Where does the company get the cash to pay the dividends? The company generates cash from the projects that it undertakes with the cash that it acquires from investors (both debt and equity investors) and any excess cash generated by its projects.

Investors base their required rate of return on the riskiness of the company’s projects. The more risk investors perceive in the cash flows from the projects, the higher the rate of return investors will require from the company. The combined return required by debt and equity capital is the weighted average cost of capital. or simply the cost of capital.

Investment versus financing

A key concept of business finance requires separating the investment decision from the financing decision. The liabilities and net worth comprise the source of fundswhere the company gets its money. The assets represent how those funds are investedthe investment decision. The key point is that it does not matter what the source of funds is when evaluating an investment.

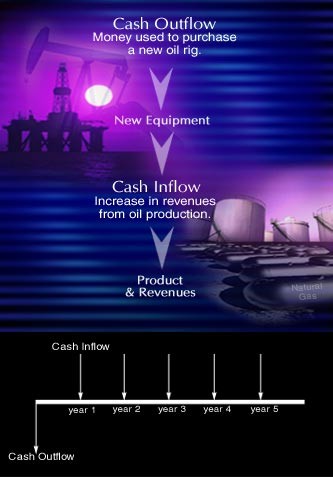

For example, suppose an airline wanted to acquire an airplane for a new route. The investment project is the new route. The airplane and crew, ground personnel, fuel, ticketing, airport fees, and so on represent the costs, or cash outflows, of this project. The revenues from ticket sales are the revenues or cash inflows of the project. These aspects of the project will remain the same regardless of how the airline finances the project. The cost of the airplane is considered a cash outflow. The firm could pay for the airplane with cash raised by selling other assets, by using available cash, by borrowing from a bank, issuing bonds, or issuing more stock. Even a lease represents a form of financing. It does not matter what the source of funds is when evaluating an investment.

So how does the firm take financing costs into account? Firms use the cost of capital.

Cost of capital

The cost of capital reflects the minimum amount that a firm must earn on its assets in order for those assets to add value to the firm. Expressed as a percent, the cost of capital is the rate at which assets must provide cash inflows to justify their cost. Therefore, if the rate of return of the net cash flows from a project, including the initial investment and all future net cash flows, exceeds the cost of capital, the project will add to the value of the firm. This was the case in Challenge B. There you found that the assets generated a return of 21.31 percent, while the cost of capital was assumed to be 15 percent.

Understanding the derivation of the cost of capital requires a review of how equity markets work, which goes beyond the scope of this course. For the purpose of this topic, assume that the company’s financial manager has derived a value for the cost of capital to use in evaluating projects.

Value additivity

Value additivity is the concept that the present value of a company equals the sum of the present value of independent projects. For projects to be evaluated independently, the cash flows from new projects must include the effects that new projects have on existing projects. This simple concept compels financial managers to go back and reevaluate existing projects and helps managers focus on all of the relevant cash flows attributable to the new project.

Relevant cash flows

Constructing the relevant cash flows for project evaluation is important and sometimes difficult. Some financial instruments. such as bonds and mortgages, present a fairly well-defined set of cash flows. Other financial instruments, such as options, futures, and derivatives, can have complex cash flows dependent on several factors. Most business projects require as much art as science in projecting the cash inflows and cash outflows of a project, including the effects of proposals on existing undertakings.

More advanced courses will deal with computing the cost of capital projects and relevant cash flows of the firm’s projects. The remainder of this section will consider two methods analysts use to evaluate the cash flows of different projects, regardless of when those cash flows occur. These two methods are the net present value (NPV) and the internal rate of return (IRR).

Does using returnable containers save a company money? Read about how to evaluate this option using net present value.

Can You Justify Returnables?

Projects with a Positive NPV Add Value to the Firm

The net present value, or NPV, is one of the most common methods used to evaluate investments. At its simplest, NPV is the present value computed by using the firm’s cost of capital as the discount rate of cash inflows, minus the present value of cash outflows, including the initial investment.