Preferred v Stocks A Primer on Preferred Stocks I

Post on: 8 Июль, 2015 No Comment

T his is a column from regular contributor Clark.

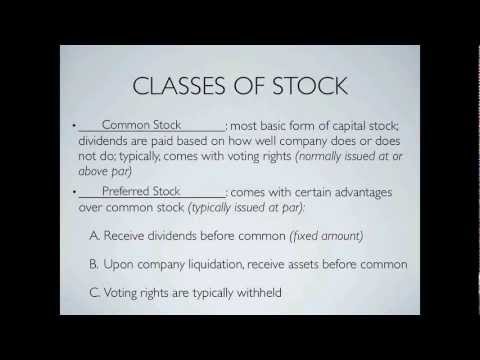

In addition to common stock, companies can also issue preferred shares. These shares pay dividends like common stocks but are senior to them and hence, the “preferred” tag. While preferred stocks are traded on the stock exchanges similar to common stocks, they have certain attributes that have gained them the label “hybrids falling between bonds and common stocks”. This post will compare preferred and common stocks and offer a few differences to consider before buying either one of them.

Advantages over Common Stocks

Preference Dividends. When a corporation decides to distribute some of its after-tax profits as a dividend. preferred stockholders get paid first. The dividend amount is set and paid at regular intervals to such owners. In addition, preferred share prices do not fluctuate as much as common shares. On the contrary, common stockholders are subject to the whims of the companys directors, who may decide to use the excess cash to develop the company and cut or stop dividend payments on common shares. This is not an inherently dire move but could be damaging to a portfolio of dividend stocks. more so for an investor who is living off the dividends. Nonetheless, it should be noted that preferential dividends are not guaranteed payments but that the company has a responsibility to pay preferred stockholders before distributing common share dividends.

Preference Bankruptcy. In case of insolvency. preferred share owners get preferential treatment over common stockholders. At such time, a company will have to sell assets and usually, pay creditors (banks or other lenders), bondholders, and preferred shareholders in that order before common shareholders get a look at the liquidation proceeds.

Convertibility. In addition, certain preferred shares may be issued with the option to be converted to common stock. This helps investors achieve a fixed return while partaking in possible common share price increases.

Disadvantages over Common Stocks

Interest Rate Risk. The dividend payout of preferred shares is set as a fixed percentage of the par value. You might be able to recall the similarity of this setup to bond yields. An increase in interest rates, say, from 3% to 4%, would mean that the market price of the preferred stock (having a fixed dividend percentage of 3% for a par value of $100) will have to decrease (from $100 to $75) to match the yield an investor would be able to achieve by buying another security quoting the higher interest rate of 4%. The reverse situation is true too. Yet, the change in preferred share prices is less striking when compared to bonds.

Price Appreciation. Common stock owners participate in the volatility of the share price. A mining company stock is bound to leapfrog competitors if it makes a new discovery, but it may also tank if the initial hype turned out to be bupkis. Common shares show the market response to both of the above in their price variations. Preferred shares have lesser volatility, which is a positive aspect in terms of stability, yet a debilitating factor for many investors.

Call Risk. Despite preferred shares being similar to common stocks in terms of having no date of maturity unlike bonds, they are eligible to be called by the company for a specified price after a stipulated date. The corporation may decide to call its preferred stock to take advantage of interest rate fluctuations. If the interest rate falls, then they may call shares that pay more than the market rate by paying a premium on the par value. The company may or may not reissue the preferred shares at a lower fixed percentage rate (the then existing interest rate). This may not qualify as a disadvantage but it shows the control that the company maintains over its preferred shares, unlike common shares that are the holder’s until he wants to dispose them or the company goes bankrupt, gets merged or acquired.

Voting Rights. Although a retail investor with a few hundred common shares is not going to change the direction of the company, several such like-minded ones could theoretically have a say in the direction of the company. Most preferred stock holders do not stand that chance since they are issued without any voting rights.

Liquidity. Preferred shares, though traded on exchanges, may be thinly traded when compared to common stock of the same company.

Can you think of any other difference(s) between the two types of stocks?

About the Author. Clark is a twenty-something Saskatchewan resident employed in the manufacturing sector. He repaid around $20,000 in student loans and has been working to build his investment portfolio as a DIY investor (not trader) while nurturing plans to retire early. He loves reading (and using the lessons learned) about personal finance, technology and minimalism.