PPT Global Investment Performance Standards GIPS Brief history key concepts and status of GIPS

Post on: 5 Апрель, 2015 No Comment

Loading.

PPT Global Investment Performance Standards GIPS Brief history, key concepts and status of GIPS in Asia PowerPoint presentation | free to view

Global Investment Performance Standards GIPS Brief history, key concepts and status of GIPS in Asia

Brief history, key concepts and status of GIPS in Asia Pacific. Promulgate local compliance with GIPS standards. Maintain local integrity of the Standards. PowerPoint PPT presentation

Title: Global Investment Performance Standards GIPS Brief history, key concepts and status of GIPS in Asia

Global Investment Performance Standards (GIPS)

Brief history, key concepts and status of GIPS

Committee Chair, Asia Pacific RIPS, GIPS

Council Presentations in Seoul at AMAK and KSCFA

Conferences

Outline

- GIPS Standards

- brief history

- why have them?

- key GIPS objectives

- key GIPS provisions

- evolutionary approach

- Status of GIPS Adoption Worldwide

- Governance Framework

- framework to date (IPC)

- new framework (GIPS Council and EC)

- increasing importance of Country Sponsors

- Country Sponsors

- list of all Country Sponsors to date

- focus on Asia Pacific Region

1. GIPS Standards

Brief history

- AIMR Code of Ethics and Standards of Professional

Conduct (1962)

develop GIPS

standards

countries involved)

comment

published

further

for public comment

adopt revised GIPS standards

Committee formed

of all Country Sponsors)

Why are standards necessary?

- Perceived questionable practices

- Back testing

- Model portfolios

- Portable performance

- Survivorship bias

- Self selection or representative account/period

(cherry picking)

Perceived questionable practices Solved with GIPS

standards

- Model or back tested results not permitted

- Performance record is owned by the firm

- Terminated accounts history must stay with firm

- Remove account subjectivity (cherry picking)

firm must include all fee paying accounts in

compliant presentations

- Remove time subjectivity must report annual

returns

GIPS objectives

- To obtain worldwide acceptance of standards for

calculating presenting results

investment firms

basis

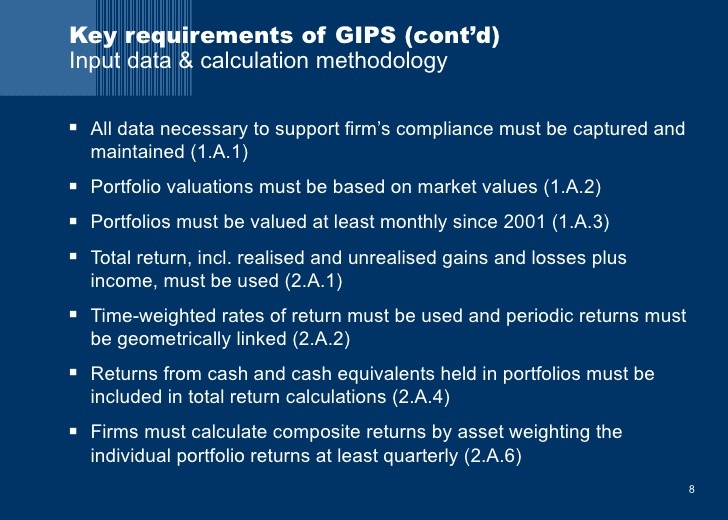

Key requirements of GIPSFundamentals of

compliance

- GIPS standards must be applied on a firm-wide

basis (0.A.1)

assigned to a sub-advisor in a composite provided

the firm has discretion over the selection of the

sub-advisor (0.A.4)

and procedures used in establishing and

maintaining compliance (0.A.6)

standards (0.A.8)

provide a compliant presentation to all

prospective clients (0.A.11)

description to any prospective client that makes

such a request (0.A.12)

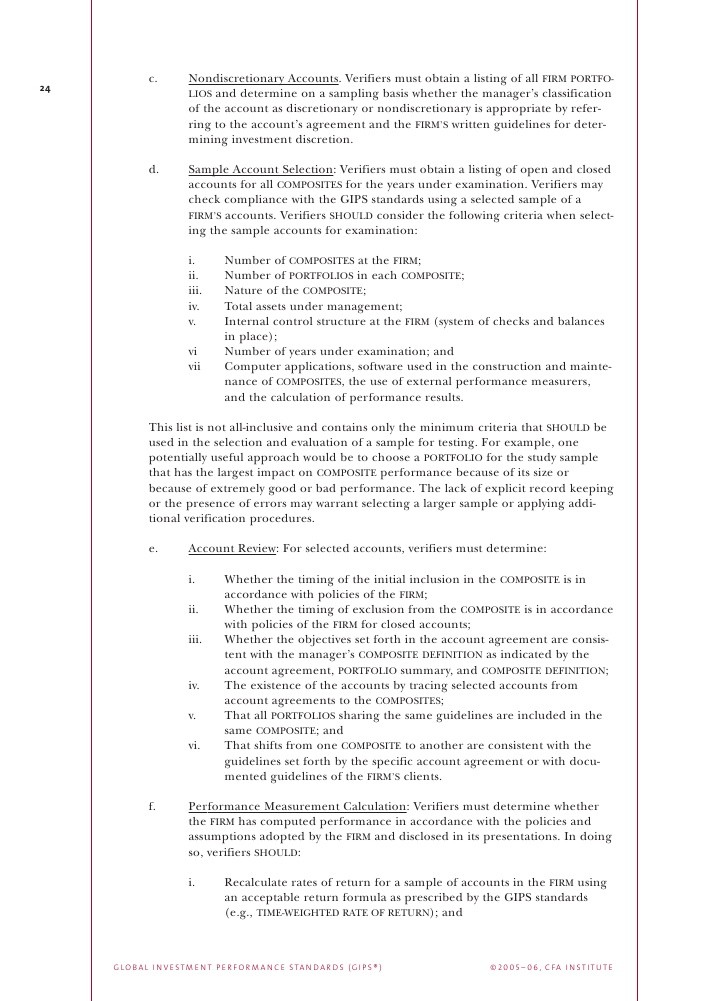

Key requirements of GIPS (contd)Input data

calculation methodology

- All data necessary to support firms compliance

must be captured and maintained (1.A.1)

values (1.A.2)

2001 (1.A.3)

and losses plus income, must be used (2.A.1)

periodic returns must be geometrically linked

(2.A.2)

portfolios must be included in total return

calculations (2.A.4)

weighting the individual portfolio returns at

least quarterly (2.A.6)

Key requirements of GIPS (contd)Composite

construction and maintenance

- COMPOSITE central/key concept of GIPS

- aggregation of individual portfolios representing

a similar investment mandate, objective, or

strategy

must be included in at least one composite

(3.A.1)

timely and consistent basis after the portfolio

comes under management (3.A.3)

history of the composites up to the last full

measurement period under management (3.A.4)

one composite to another unless documented

changes in client guidelines or the redefinition

of the composite make it appropriate (3.A.5)

Key requirements of GIPS (contd)Disclosures

- There are 26 disclosure requirements

- Firms must disclose the definition of Firm used

to determine the total firm assets and firm-wide

compliance (4.A.1)

complete list and description of all of the

firms composites (4.A.2)

of leverage or derivatives (if material),

including a sufficient description of the use,

frequency, and characteristics of the instruments

to identify risks (4.A.5)

or net-of-fees (4.A.6)

(4.A.12)

(4.A.24)

Key requirements of GIPS (contd) Presentations

- The following must be reported for each composite

presented (5.A.1)

composite inception) performance that is GIPS

compliant

the composite

returns for each annual period

their compliant history so long as the Firms meet

the disclosure requirements for noncompliant

performance and only compliant returns are

presented for periods after 1 January 2000

(5.A.2)

interpretation (incl. a glossary)

their interpretation (incl. a glossary)

revised GIPS standards as Sections 6 and 7,

respectively, and are effective from 1 January

2006

Evolutionary approach 3-pronged process used to

date

- 1. Extending the scope of the Standards to

adequately address

hedge funds)

Global endorsementCountries that have already

adopted GIPS principles

TGs GIPS (Austria) GIPS (Denmark) GIPS

(France) GIPS (Hungary) VBA-PPS (Netherlands)

GIPS (Norway) GIPS (Poland) GIPS (Spain)

GIPS (In English) New Zealand Portugal Belgium Lux

embourg Sweden Germany Hong Kong Singapore

CVGs AIPS (Australia) GIPS (Egypt) GIPS

(Ireland) IPPS (Italy) SAAJ-IPS (Japan) SA-IPS

(South Africa) SPPS (Switzerland) UKIPS

(UK) AIMR-PPS (US Canada)

Global convergence One brand GIPS

- Global convergence

- expected to be achieved in 2006

- GIPS will then become a truly global Standard

- 18 countries either have already replaced or are

in the process of replacing their existing CVG

(or TG) with the GIPS standards

replaced by the GIPS standards

necessary (e.g. France) and hopefully new ones

will emerge in other countries (e.g. China, etc)

The Goal

- To have all countries adopt GIPS as the standard

for investment firms to present historical

investment performance