PPT COMPANY ANALYSIS AND STOCK VALUATION PowerPoint presentation

Post on: 14 Июль, 2015 No Comment

COMPANY ANALYSIS AND STOCK VALUATION

Applying the Valuation Models to Walgreens. Walgreens experienced a larger increase than its industry in all ratios, while. PowerPoint PPT presentation

Title: COMPANY ANALYSIS AND STOCK VALUATION

Chapter 15

- COMPANY ANALYSIS AND STOCK VALUATION

Chapter 15 Questions

- Why is it important to differentiate between

company analysis and stock analysis?

and a growth stock?

valuation of common stock?

valuation approach?

techniques?

Chapter 15 Questions

- How do we apply the relative valuation approach?

- What are the major relative valuation techniques

(ratios)?

links that should be considered in company

analysis?

from analyzing its competitive strategy and from

a SWOT analysis?

Chapter 15 Questions

- How do we apply the two valuation approaches and

several valuation techniques?

inputs to alternative valuation models?

earnings per share for a company?

Chapter 15 Questions

- What factors do we consider when estimating the

earnings multiplier for a firm?

firm use to cope with the competitive environment

in its industry?

Company Analysis and Stock Selection

- Good companies are not necessarily good

investments

value of a stock to its market value

one with management and opportunities that yield

rates of return greater than the firms required

Growth Companies and Growth Stocks

growth companies

other stocks with similar risk

because of market under-valuation compared to

other stocks

generally not been growth stocks

Defensive Companies and Stocks

- Defensive companies future earnings are more

likely to withstand an economic downturn

to changes in the market

Cyclical Companies and Stocks

- Sales and earnings heavily influenced by

aggregate business activity

markets, low returns in down markets

Speculative Companies and Stocks

- Speculative companies invest in sssets involving

great risk, but with the possibility of great

gain

surprises and above-average risk adjusted rates

of return because the stocks are undervalued

besides earnings growth potential

ratios of price to book value

The Search for True Growth Stocks

- To find undervalued stocks, we must understand

the theory of valuation itself

Theory of Valuation

- The value of a financial asset is the present

value of its expected future cash flows

flows

Stream of Expected Returns (Cash Flows)

- From of returns

- Depending on the investment, returns can be in

the form of

investment?

Required Rate of Return

- Determined by the risk of an investment and

available returns in the market

of returns

premiums, vary by the type of investment

Investment Decision Process

- Once expected (intrinsic) value is calculated,

the investment decision is rather straightforward

Economic and Industry Influences

- If trends are favorable for an industry, the

company analysis should focus on firms in that

industry that are positioned to benefit from the

economic trends

sensitive to macroeconomic variables should also

Structural Influences

regulatory influences can have significant

influence on firms

changes in technology which followers may imitate

and benefit from

opportunities even when economic influences are

weak

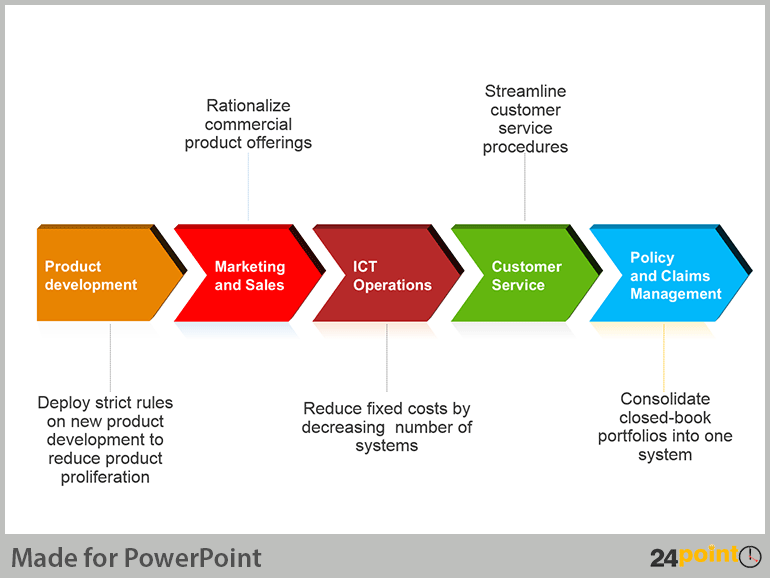

Company Analysis

- Competitive forces necessitate competitive

strategies.

Firm Competitive Strategies

- Defensive or offensive

- Defensive strategy deflects competitive forces in

the industry

competitive force in the industry to improve the

firms relative position

leadership and differentiation

Low-Cost Strategy

- Seeks to be the low cost leader in its industry

- Must still command prices near industry average,

so still must differentiate

return

Differentiation Strategy

- Seeks to be identified as unique in its industry

in an area that is important to buyers

price premium exceeds the extra cost of being

unique

Focusing a Strategy

- Firms with focused strategies

- Select segments in the industry

- Tailor the strategy to serve those specific

groups

its success

SWOT Analysis

- Examination of a firms

- Strengths

- Competitive advantages in the marketplace

- Weaknesses

- Competitors have exploitable advantages of some

kind

time

Favorable Attributes of Firms

- Peter Lynchs list of favorable attributes

- Firms product is not faddish

- Company has competitive advantage over rivals

- Industry or product has potential for market

stability

(insiders) are buying

Applying the Valuation Models (From Chapter 11)

- Discounted Cash Flow Techniques

- Based on the basic valuation model the value of

a financial asset is the present value of its

expected future cash flows

consider different cash flows and also different

appropriate discount rates

Applying the Valuation Models to Walgreens

- DDM Valuation with Temporary Supernormal Growth

- Value Estimate 27.05 (See page 491)

- Implied P/E of 21 times expected earnings

- Market Price 35.65 (mid 2004)

- Prevailing Market P/E of about 18 times current

earnings

Applying the Valuation Models to Walgreens

- Present Value of Free Cash Flow to Equity

- Value Estimate 35.99 (see page 493)

- Implied P/E of about 25 times expected earnings

- Market Price 35.65 (mid 2004)

- Prevailing Market P/E of about 17 times expected

earnings

lower beta

Applying the Valuation Models to Walgreens

- Present Value of Operating Free Cash Flows

- Value Estimate 33.13 (see page 496)

- Implied P/E of 26 times current earnings

- Market Price 35.65 (mid 2004)

- Prevailing Market P/E of about 18 times

Applying the Valuation Models (From Chapter 11)

- Relative Valuation Techniques

- These techniques assume that prices should have

stable and consistent relationships to various

firm variables across groups of firms

Applying the Valuation Models to Walgreens

- All four relative valuation ratios increasing

over time for Walgreens, its industry, and the

market

economic variables

industry in all ratios, while lagging the market

in terms of the P/E ratio in several years

Specific Valuation with the P/E Ratio

- Using the P/E approach to valuation

- Estimate earnings for next year

- Estimate the P/E ratio (Earnings Multiplier)

- Multiply expected earnings by the expected P/E

ratio to get expected price

Specific Valuation with the P/E Ratio

- Earnings per share estimates

- Time series use statistical analysis

- Sales — profit margin approach

- EPS (Sales Forecast x Profit Margin)/ Number of

Shares Outstanding

estimates

estimates and interpret announcements accordingly

Site Visits, Interviews, and Fair Disclosure

- Fair Disclosure (FD) requires that all disclosure

of material information be made public to all

interested parties at the same time

individuals, only provide information during

large public presentations

managers

Making the Investment Decision

- If the estimate of the stocks intrinsic value is

greater than or equal to the current market

price, buy the stock

value would yield a return greater than your

required rate of return (based on current

investment price), then buy the stock

its return would be less than your required rate

of return, do not buy the stock

Ranking Undervalued Stocks

- How do we rank if we have a budget constraint?

- Best to rank on the basis of the excess return

ratio

Influences on Analysts

- Several factors make it difficult for analysts to

outperform the market

opportunities are rare