Portfolio Management When To Sell Stocks

Post on: 16 Март, 2015 No Comment

You Only Make Money When You Sell

When To Sell Stocks

While the above statement is not quite true for dividend oriented investors, for most individuals who invest the only time you make money is when you sell your mutual fund or stock to lock in a capital gain.

The decision to sell is often one that plagues an investor early in their pursuit of success. Taking profits should be admired just as much as holding onto an investment for the long-term.

The truth is that knowing when to sell is not simple, straightforward and easy. Everyone has an opinion and an investor can struggle for a long period of time deciding when to sell and make a significant mistake in the management of their portfolio .

As investors we stick to specific prices far too passionately. If an investor sets a sell target at $30 and the price appreciates to $35 we are more likely to hold that investment (for further gains) than to sell it. The same goes for when a stock is falling; some investors will watch a stock go to almost zero before they sell it in the hopes of making gains on what they’ve lost.

The true answer of when to sell is simple. When you should sell your stock(s) is defined by your investing strategy and portfolio construction .

The difficulty is that an investing strategy is rarely developed in its entirety from the very beginning and portfolio construction may be an activity that takes an investor 1 to 5 years to complete at best.

How should an investor decide on their selling behaviour in the interim?

As a value investor I concentrate on buying low and selling high .

As a dividend growth investor I concentrate on selling high and buying low .

Confused?

Value is about making profit so I can build wealth.

Growth is about locking in returns to re-invest for more dividends.

While dividends can complicate the selling decision because of the inherent income returned in cash all investors need to have a plan of when to sell and know when is the right time to sell your stocks.

Reasons to Sell:

Fundamentals

An investor should sell their stocks when internal or external fundamentals of a company gradually or suddenly deteriorate. This decline could result directly or indirectly from corporate operations, sales, financial position, industry dynamics or significant economic challenges that you do not perceive the company being able to overcome.

Target Price

If your investment has met its set target price sell the investment to lock in gains and exit the position. Discipline is an art that many investors fail to harness early on and even though your initial target prices may be premature making the right decision to sell your stocks and getting that experience under your belt provides you with knowledge you can use in the future.

Price Appreciation

The stock market reacts to speculation and rumours on a regular basis. Suspicions of takeovers, mergers, product launches or anticipated earnings can drive a stock valuation up very quickly. An investor should never be afraid to lock in a sudden price appreciation of 30-50% during a short period of time to profit and examine re-entering the same position later on.

Risk Tolerance

Risk tolerance and how much volatility an investor can handle generally changes over time as an investor ages. Selling your investments and equities may be part of your asset allocation plan or when the investing landscape becomes too risky for your investment objectives.

Tax-Loss Selling

If your investments are in a taxable account (not in a RRSP or TFSA ) than selling stocks can make sense for your investment related taxes. Tax loss selling is a strategy used to minimize the capital gains you incur from selling investments for a gain. This is a strategy I use routinely during the year if an investment I have is clearly underwater and I can match that loss with a gain I’ve made on another investment. Remember that after a 30 day grace period (in Canada) you can purchase that investment back without penalty. This strategy should be effectively used by all investors in order to avoid excessive capital gains tax.

Personal Reasons

Even though investments in equities should be for the medium to long-term there are many situations where an investor may choose to sell for personal reasons. You may need the cash for an emergency, need to pay off a debt or you may have simply made a mistake by purchasing the wrong company or investment for the wrong reason. As part of your investment plan you may need to sell a percentage of your equities to meet a goal or objective (retirement).

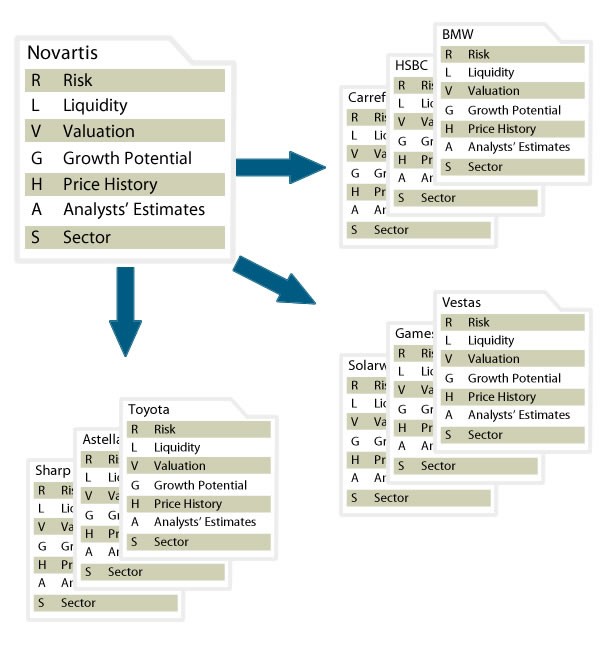

Portfolio Management

The best reason to sell, in the absence of a critical mistake, is for the purpose of rebalancing. When you invest on your own you are the manager of your portfolio which means there are times when you need to sell a stock and reallocate that capital to another segment of your portfolio. Warren Buffett is widely regarded as one of the most successful investors ever. In truth what Buffett is most successful at is allocating capital. Growing a portfolio over time means you need to sell some investments (or portions of) in order to redeploy equity into other areas of your portfolio.

Every investor should be able to find some helpful tips on how to design your own selling strategy. You may use only one of these strategies or combine more than one into your own. Regardless knowing when to sell and being successful at selling is just as important as knowing when to buy stocks. Developing a selling strategy should be a priority of any investor even before you buy your first investment . If you dont know when to sell make sure you tell yourself that, I dont yet know how Ill make money .

Saying that to yourself a few times will help you realize just how important knowing when to sell your investments really is!

Come back Next Week when I feature a follow up post titled: Portfolio Management When NOT To Sell Your Stocks