Plan adds Medicare tax on high earners investment income

Post on: 27 Май, 2015 No Comment

By Matt Krantz, USA TODAY

Health care reform has a 3.8% solution that some worry could have unhealthy side effects on financial markets.

The legislation, separate from the bill President Obama signed Tuesday and still awaiting Senate approval, has a 3.8% Medicare tax levied against high-income taxpayers’ investment income. The fear is that the stock and bond markets could be disrupted as wealthy investors jockey portfolios to manage the tax. It’s a big hike, says Gregg Wind, of accounting firm Wind & Stern in Los Angeles. It’s really wild.

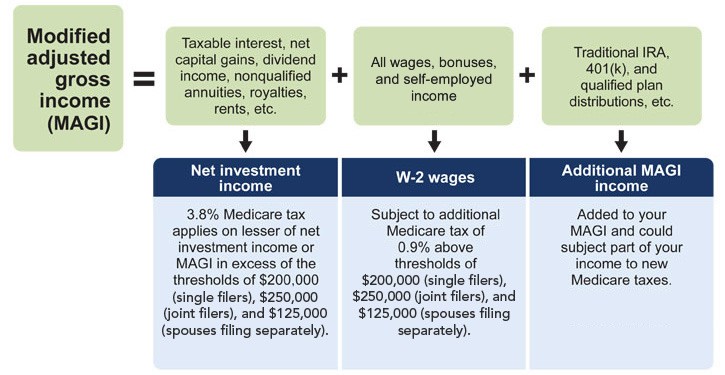

Single taxpayers who earn more than $200,000 and married taxpayers with combined income of more than $250,000 would face the new tax on their investment gains starting in 2013, says Mark Nash of PricewaterhouseCoopers .

The tax would be applied to investment income including interest, dividends, rents, royalties, annuities and capital gains, he says. It would not apply to distributions from retirement plans, he says.

Still, facing an extra 3.8% tax on investment gains is something that could affect the way high earners approach their investments, in that it’s a:

Boost to the total investment tax bill. The proposed 3.8% tax isn’t the only hit high earners with investments will take. The tax on long-term capital gains is expected to rise to 20% next year, taking the total tax tab to 23.8% from 15%, says Clint Stretch of Deloitte Tax.

It’s a big increase, he says, though the new rate is still below the 28% top earners paid during the Reagan administration. High-income taxpayers see this latest tax as a warning of the kinds of taxes that are coming to help shore up the government’s finances, says Bill Larkin of Cabot Money Management. High-income taxpayers are being targeted as a revenue source, he says.

Reason to take a look at tax-shielded investments. High earners may consider municipal bonds, as their tax-free nature will be even more attractive now, Stretch says.

Larkin, though, doesn’t expect a stampede from stocks to muni bonds, because wealthy investors would rather take a 3.8% hit than take a gamble lending money to cities and state agencies suffering through tough financial times.

Muni bond yields are attractive, and in some cases, twice those offered by Treasuries, but the uncertainly is still too large, relative to such a relatively small tax, Larkin says.

Strike against dividend-paying stocks. The tax hits dividends, which compete with stock buybacks as a way for companies to give excess cash to shareholders. Investors, though, likely won’t sell dividend-paying stocks over such a small tax, says Michael Farr of Farr Miller & Washington.

Wealthy investors have braced for higher taxes and here they are, Farr says. There’s not much they can do about this one, he says.