Peter Lynch Fair Value

Post on: 16 Март, 2015 No Comment

I am always on the lookout for new stock valuation techniques. Rather than rely on any single method, its usually better to evaluate a potential purchase in multiple ways. With any value calculation there are always assumptions that need to be made, which prevents determination of the true value with absolute certainty, but I am more confident in my numbers if more than one method gives me close to the same result. Today Im going to cover a very simple rule of thumb check developed by Peter Lynch, aptly named Peter Lynch Fair Value.

I like this valuation method because it is extremely simple actually about as simple as they come. This is the equation:

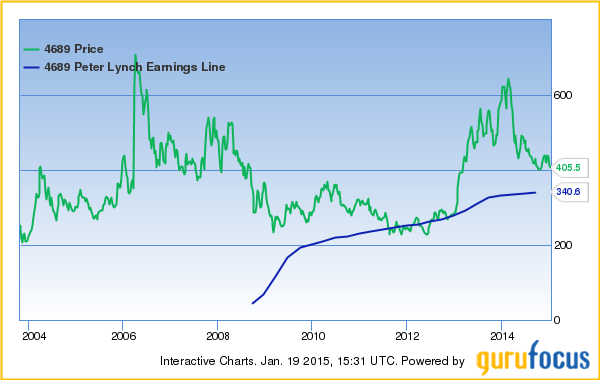

Peter Lynch FV = EPS Growth Rate x EPS (ttm)

Thats it. Its a 10 second check that can be used to see if youre way off the mark or not using a more complex valuation method such as DCF or EPS growth capitalization. Lets look at it a bit more closely and understand how it works.

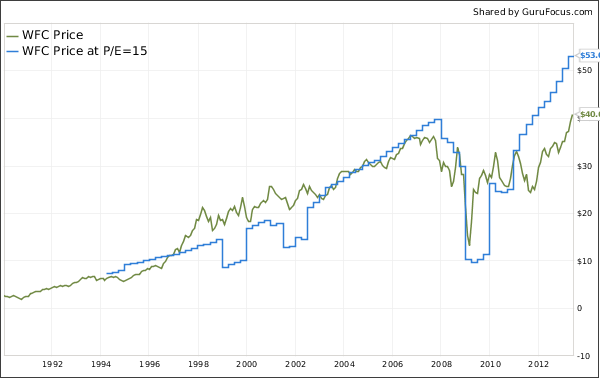

Peter Lynch is a big proponent of the belief that a company should be trading at a PE ratio equal to its growth rate. For example, a company growing its earnings at 12% per year should have a PE of 12. Intuitively this makes sense. Its common knowledge that companies with higher growth rates trade for a higher PE multiple this just puts a number to it.

Usually we determine a stock price by multiplying PE x EPS. In Peters equation however, hes saying that hes only willing to pay a multiple equal to the companys growth rate. We therefore substitute EPS growth into the equation instead of PE. Lets look at an example.

Company XYZ is trading for $20 / share, and has been growing at a rate of 16% per year. EPS over the past year have been $1.77. How much is this company worth? Using Peter Lynch Fair Value we simply multiply 16 x 1.77 to arrive at a valuation of $28.32. By this account, XYZ looks like a bargain at $20!

In the example above, XYZs PE ratio was 11.29 (20 divided by 1.77). Since the PE ratio of 11.29 is less than the EPS growth rate of 16, it makes sense that the company is a bargain. Actually, if we divide PE by the EPS growth rate we get another ratio called the PEG ratio. A PEG less than 1 is an indication that the stock is undervalued. (Its 0.7 in this case!)

Typically when I use this valuation method, I use the EPS 5-yr CAGR (compound annual growth rate), since it smooths out any fluctuations in earnings growth over time. I also limit EPS growth to 25% for purposes of this calculation. For example, Im not going to pay 100 times earnings for a company that is growing at 100% per year. This effectively limits the Peter Lynch Fair Value calculation to companies with growth rates in the 8% to 25% range.