Personal Financial Statement

Post on: 8 Август, 2015 No Comment

Feb 13th, 2008

In the first part of personal financial freedom article I covered basics and important aspects of the quest. In this part I am going to talk about personal financial statement form and how to perform financial statement analysis.

As I said before, being literate in finances is just a skill, like any other and can be learned with more or less success. There is always a first thing you should do when you learn a new skill. Like basic skiing position in skiing, or how to float in the water if you want to learn swimming. In finances, the first step is to learn how to read, write and use financial statements.

I know a lot of you react repulsive on the mention of financial statements. You think of math, hard and boring work and complicated programs. But I am talking something entirely different here. Not only they are easy to understand, financial statements can become very fun part of you monthly routine. I am also going to give you an Excel template to run your own personal financial statement.

Why you need a personal financial statement form

In a quest for financial freedom, it is incredibly important to be able to read, write and use your financial statement. As you start realizing you are in charge of your business you will start to discover new frontiers. The progress you’ll be making on weekly or monthly basis will become something deeply addictive. Just like when you first time ski down a nice slope. Your mind will enter a new realm, and that will be a realm of finances used exclusively by rich guys until now. But not anymore.

Having the history of financial statements is the only way to measure your progress. Just like in skiing you know you are making progress by skiing on harder and harder slopes. Your financial statement will show you clearly in what direction and by how much you are moving. It will help you see more clearly what is slowing you down and what is helping your wealth grow faster. Not until you put these things to paper, you will be able to see clearly the way of the money around you.

Financial statement analysis

The basic financial statement consists of two parts:

- Income statement

- Balance sheet

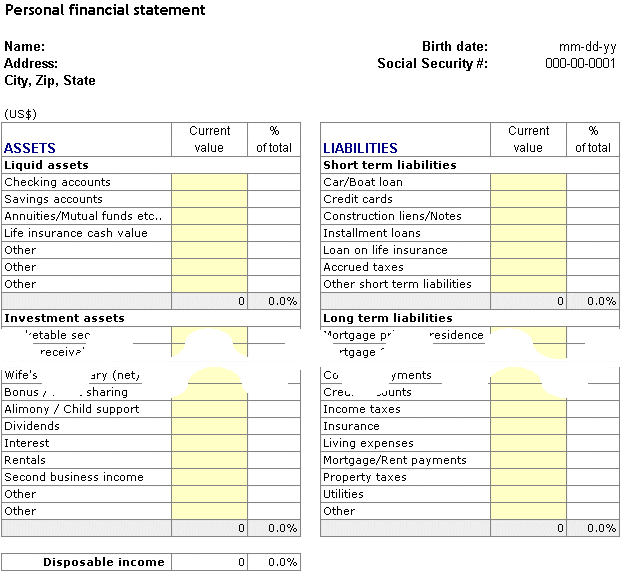

Income statement shows you the flow of the money which can be either positive (income ) or negative (expenses ). This will include your salary, passive streams of income like rent and your monthly expenses (groceries, education, fun. ) The difference between the two is called total cashflow which you want to be positive and of course the more the better.

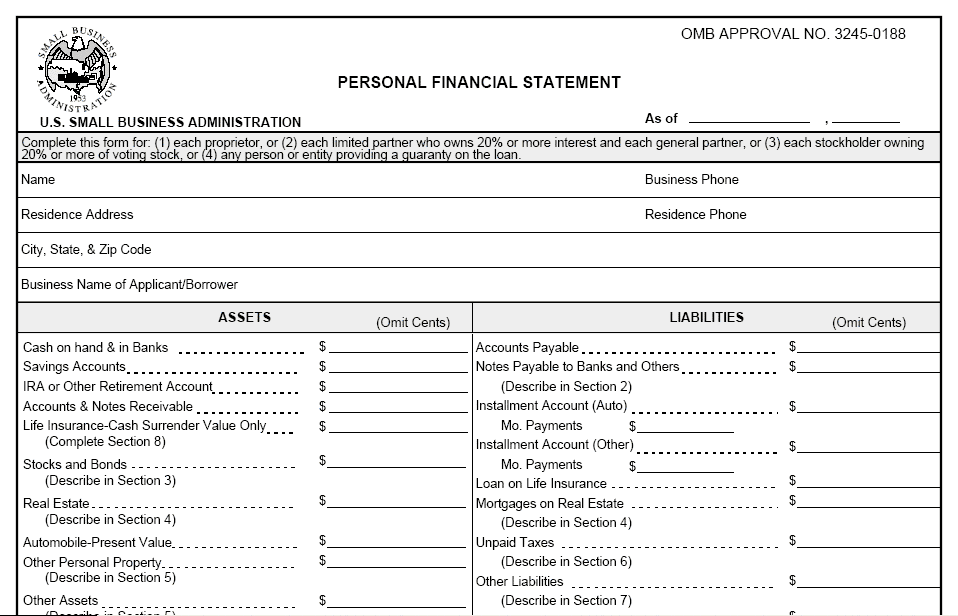

Balance sheet lists all your assets (things that make you money) and liabilities (things that make you lose money). Assets are your bank savings, real estate and other valuables. Mortgages, loans and other outstanding debt are examples of liabilities. The difference between assets liabilities worth is your total net worth.

You can see example income streams from salary and passive sources. Expenses are listed in detail to help pinpoint biggest spenders.

Assets include real estate, car, savings. even cash on hand. On the other side are liabilities like loans and mortgages.

This person has achieved financial freedom (meaning passive income of at least two times all their expenses as explained in the first part of the article ).

What do do next

This is only a example to get you going. You can easily expand and add new fields with minimum Excel knowledge.

Then start filling it up. Add all money, valuables and cash flow you can think off at this time. You will add more as you start tracking it. You can update your financial statement daily, weekly or monthly. Which means you can have a daily, weekly or monthly history of financial statements.

Track your progress. The come back and leave a comment on your experience. I am eager for you to share them.

If you did all that you made your first step to financial freedom. You just entered the realm of finances. Isn’t that great?