Personal Capital Review Track Your Investments Online for Free

Post on: 26 Апрель, 2015 No Comment

T he internet has done wonders in the world of money management. With websites like Mint and now Power Wallet, tracking your finances for free online is a snap. But one thing that’s been missing is a robust tool to automatically track your investments.

Sites like Mint do allow you to link your investment accounts. But they don’t help you understand your asset allocation or investing expenses in any meaningful way. And that brings me to a site I’ve recently starting using called Personal Capital.

Personal Capital is the best investment tracking tool that I’ve ever used. It solves several problems for me:

- It automatically links to my investment accounts, keeping my holdings updated throughout the trading day;

- It tracks the fees I’m paying for each mutual fund and ETF I own;

- It provides detailed asset allocation data for my investments, much like the X-Ray feature of Morningstar; and

- It alerts me when my asset allocation is over or under-weighted as compared to a target asset allocation model determined based on my age and tolerance for risk.

I’ve enjoyed the tool so much, that I thought a detailed review was in order.

Getting Started

Personal Capital is a free tool. To get started, you simply create an account with your email address and password. Once you have access to the site, you can connect just about all of your bank and investment accounts into Personal Capital.

Visit Personal Capital to Get Started

I had no trouble connecting accounts from Citi, Capital One 360, Vanguard, Scottrade and Fidelity. And once all of your accounts are connected, the fun begins.

The Dashboard

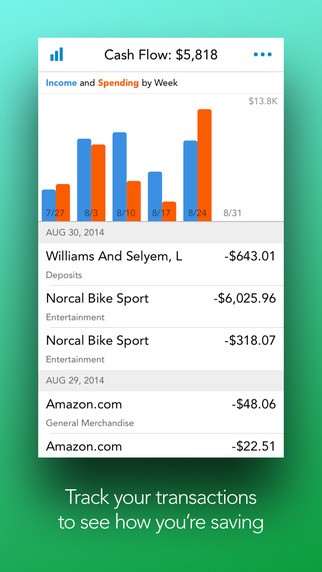

The Dashboard is the one place you’ll find high level information about all your finances. While I use Personal Capital primarily for my investments, you can also track your checking and savings accounts. In fact, they offer what is called a Cash Manager that let’s you see all of your spending in one place.

But as I said, Personal Capital really stands out because of its investment tools.

Investment Tracking

Personal Capital does a great job of tracking investments real-time. And just as importantly, the layout of the site and the way in which information about your investments is displayed is the best I’ve seen (note, the image is not of my personal investments):

What you can’t see from the above screen shot is what happen as you roll the cursor over parts of the screen. On the graph at the top left, you’ll see your investment balance by date. And as you roll the cursor over the colored ring top right, you’ll see details about each of your investment accounts.

And what’s really cool is when you click on an individual account in the list at the bottom. As you can see from the screenshot above, the graph highlights the portion of your total attributed to that account, and the colored ring breaks out the portion of the circle related to the selected account.

Now the truth is that while the above is really cool, it’s just information. It doesnt really give you any analysis that you can actually use. But the next few features do.

Mutual Fund and ETF Expenses

As I’ve said many times, keeping investment expenses low is one of the most important factors for successful investing. And Personal Capital gives you two tools to help you. The first is a breakdown of your investment costs by mutual fund or ETF:

In my case, total investment costs are a real eye-opener. Beyond the screenshot above, Personal Capital breaks down the cost by fund or ETF, so that you can focus your analysis and determine whether you need to make any changes. Through using the tool, it became clear to me that there are a couple of funds I need to dump for less expensive alternatives.

401(k) Fee Analyzer

The second tool to help fight the high cost of investing is revolutionary. It’s called the 401k Fee Analyzer.

The first time you run this tool, it will base its analysis on data not specific to your retirement funds. But you can get additional data on 401k expenses from your employer or broker to get more accurate results.

What’s so great about the analyzer is that it doesn’t stop with just the expense ratios of the funds and ETFs you own. That part’s easy. It also looks at the costs funds charge you for trading, which aren’t reflected in the expense ratio. And it looks at administrative costs charged to run the 401k, which are often passed down to employees.

If you have a 401k, this tool by itself makes it worth checking out Personal Capital. And it’s a good reminder as to why most folks should transfer their 401k to a rollover IRA when they leave their employer.

Asset Allocation Tools

The next handy tool is its asset allocation feature. The first thing it does is breaks down all of your investments by their asset class. And if a single fund or ETF contains investments that span more than one asset class, as most do, Personal Capital slices and dices the fund to apportion your account into each relevant asset class.

You can click on each investment in the box chart at the top or the list at the bottom to get details of your asset classes. This is extremely helpful when it comes to rebalancing your portfolio.

Investment Checkup

Finally, with the click of a button Personal Capital will analyze your investments. It compares your actual asset allocation with your target allocation, and flags asset classes in which you are over or under-weighted. It’s an easy way to see if you need to rebalance.

Note that in the above screenshot heading is a reference to my “target allocation.” You can set this by entering your name, how many years to retirement, and your investing style (e.g. aggressive, conservative). It takes all of 10 seconds, and Personal Capital then generates a target allocation for you.

So what’s not to like?

Frankly, not much. One thing I haven’t mentioned is that an advisor is available for a call or a live chat. When you log into your account, you’ll see a picture of your advisor, his or her name, and telephone number. And even better, they don’t hound you. I’ve not heard from my advisor, and that’s how I want it. If I need to speak to him, I’ll give him a call. But it’s good to know that’s an option.

Personal Capital also has mobile versions of its site for iPhone, iPad and Android. I use the iPad app and have had no issues. I’ve not had any issues with linking accounts. Occasionally I have to provide or confirm my login credentials for certain accounts. But that’s it.

But there are three things that could be improved:

- You cant enter your own target asset allocation model. Personal Capital creates one for you based on your age, time to retirement, and investing style. This is probably fine for the majority of investors, but a custom option would be nice.

- The daily updates on stock and bond prices is a bit slow. As compared to Wikinvest, another tool Ive used before, Personal Capital could be faster

- It does not include the cost basis of your investments, which would be nice.

So there you have it. It’s an excellent tool. If you want to give it a try, visit the Personal Capital website. And please leave a comment below to share your thoughts on the tool.