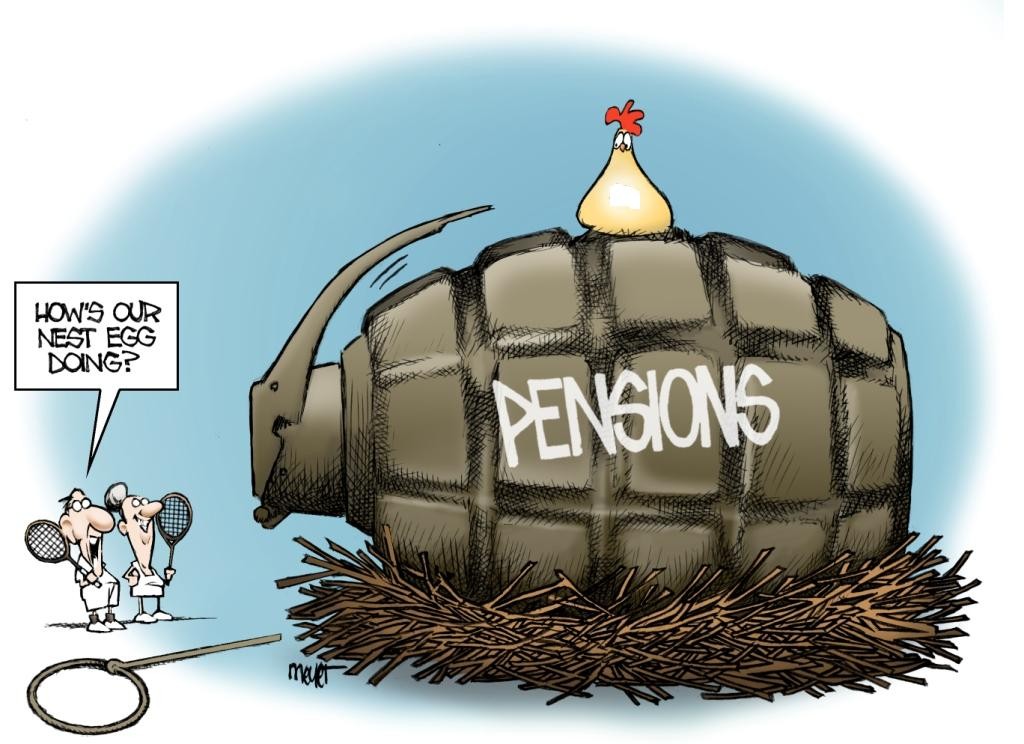

Pensions and investing Playing hedge funds with public money

Post on: 4 Июнь, 2015 No Comment

Playing hedge funds with public money

Add this article to your reading list by clicking this button

LISTEN here, voters, I’ve got a great deal for you. I’m sure you are all aware of the legendary financial acumen of public officials. So here is the deal. We are going to go into the business of hedge funds. My team and I are going to borrow money and invest it in the markets. The profits will roll in.

It seems unlikely that this pitch would appeal to much of the electorate. But in effect that is what they have agreed to in those states and cities that have issed pension obligation bonds (POBs). When I first heard of POBs, I could not quite believe they were allowed; this is not something that would be done in Britain. But as a new report from the Center for Retirement Research at Boston College explains, POBs have been around for nearly 30 years.

The early versions were designed as a tax arbitrage; the state or the city would issue tax-exempt (and thus low-yielding) debt and invest the proceeds in higher-yielding Treasury bonds. That loophole was closed but POBs were revived in the 1990s with a more explicitly hedge fund-like rationale. Over time, equity returns are higher than those for bonds. Therefore borrowing money to buy equities must be a good strategy; or at least that’s the reasoning (has anyone looked at Japan’s experience over the last 25 years?).

The more practical rationale for POBs was that pension funds were in deficit. States or cities could contribute more to the fund, but that would mean cutting services, or raising taxes, and that would be unpopular with voters. Workers could contribute more, but that would amount to an immediate pay cut and might cause strikes. Or benefits could be cut, but that was not always legally possible (although attempts are now being made ). So the contribution was simply borrowed from the market.

In a sense this was smoke and mirrors. As the CRR writes

While the issuance of a POB does not change the total indebtedness of the sponsor, it does change the nature of the indebtedness. Requirements to amortize unfunded pension liabilities may be relatively flexible obligations that can be smoothed over time, while the POB is an inflexible debt with required annual payments.

And of course, regular readers will know that financial economists regard pensions as bond-like obligations. Thus any strategy that does not exactly match the liabilities with a portfoilio of bonds is essentially playing hedge funds with public money. One could argue that POBs simply make this reasoning explicit.

The CRR considers the key question of how well the POBs have actually done, by calculating an internal rate of return. As of right now, the gamble has paid off; the internal rate of return has been 1.5%. But that is because the US stockmarket is at an all-time high. Go back to 2009, in the middle of the crisis, and the average POB had lost 2.6% a year. Given that US stockmarket valuations are well above average, that should not give taxpayers much comfort. Markets can fall again.

Perhaps the key point about POBs is that, if the reasoning for their use were sound, all cities and states would issue them. In fact, the CRR makes clear that activity has centered in 10 states, with Illinois and California in the lead, two states with well-known pension problems. And of course, Detroit issued POBs in 2005 and 2006 just before the market crash.

The CRR concludes that

governments are more likely to issue POBs if the plan represents a substantial obligation to the government, they have substantial debt outstanding, and they are short of cash

In other words, politicians that have made a mess of their state’s finances, are the most likely to issue POBs to exploit their alleged financial wizardry. Go figure.

Previous