Penny Stocks Everything You Need to Know!

Post on: 14 Май, 2015 No Comment

Penny Stocks-a basic guide

Make money with penny stocks has always been a popular investment option for new investors, but actually what are Penny Stocks? Also known as cent stocks, penny stocks are common shares. In the UK, they are usually under £1 while in the US, penny stocks usually sell below $5. These stocks are usually sold on an over the counter exchange which trade on a dealer network instead of an exchange. Penny stocks can be a great way to enter the market as they are sold at such a low price, but they are also risky.

When buying penny stocks its extremely important to invest within your means-as this merchandise is very risky by definition you should always invest an amount you can afford to lose. Penny stocks are very easy to manipulate even by small traders and are very volatile, but often offer a very good risk-reward ratio that is hard to find elsewhere.

Basic rules for penny stocks investments:

Risk diversification: you should always look for several penny stocks to invest in simultaneously – as these stocks are very risky – you should diversify your portfolio by investing in several stocks thus minimizing the chance for losing all your money.

Before Investing in any stock – you should always look for a reason to buy the stock – you should learn the financial statements of the company you are about to invest in and look for a solid long term growth horizon. Companies with minimal leverage and good equity balance are often the better companies for the long run. If you are not familiar with basic accounting I would strongly suggest learning more before investing in the stock market.

Buy for the right reasons — never buy a stock that is considered hot or that is rumoured to go up – you should always make your own judgment and analysis and decide on your own whether the stock is worth buying.

Compare- the company to other similar companies in the same sector, your company should have some kind of competitive advantage whether in low production costs, strong branding or strong patent. You should know why your company is better than the others – otherwise there is no reason to buy the stock.

Volume- if the stock is not traded frequently enough you should know that you will have problems selling the stock in the future – thus taking an unnecessarily risk, that does not mean the stocks is not worth buying – sometimes this tradeoff is good enough.

When to buy Penny Stocks?

From a technical point of view-the best time or when to buy a penny stock is right before they start gain upward momentum in the stock market. This means you’ll have to do your research on the company and how their stocks have performed in the recent past. When it seems the stock price is going up, it may be a good idea to get in.

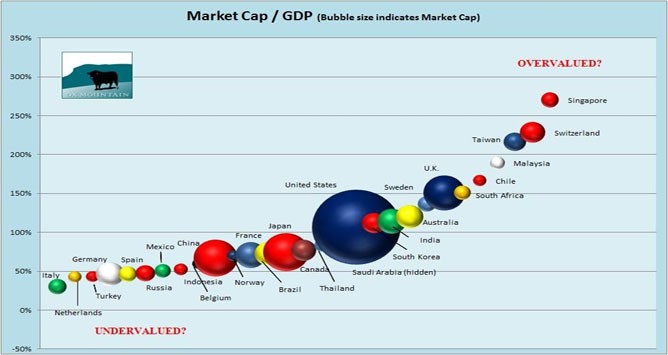

From a fundamental point of view- you should look for undervalued companies that have a big upside opportunity, you should always look for companies to buy for a reasonable price. Always compare the market capital against the equity and the predicted cash flow, a good indicator for an undervalued company is a low EPS multiplier (a basic method to determine stocks value – but certainly NOT the only parameter you should consider).

When to sell Penny Stocks?

From a technical P.O.V- When buying a penny stock it is a nifty idea to implement a strategy for when to sell a penny stock. Selling at a profit around 25% to 35% is a smart idea. However, some investors decide that a profit of 50% on penny stocks is better. It is also a good thing to have an exit strategy in place in case the stocks start falling. Picking a percentage that you are comfortable with is the best decision.

From a fundamental P.O.V-you should know the real estimated stock price and thus selling the stock around that price (you should know the right price BEFORE investing not DURING or AFTER buying the stock).

How to Make Money with Penny Stocks

Buying and selling stocks is a perfect way to make a profit, but not many people know how to work the market. Penny stocks are a great way to enter the market without much loss if the stocks lower than expected (if you are using a smart stop loss otherwise you can lose all your money). Penny stocks can have a large profit fast depending on the company they are purchased from. Doing your research before you purchase and watching the market is the best way to ensure you will make money with Penny Stocks. Be sure to also set strategies for exiting with a profit and a loss.

Remember – investing takes time, stock prices may not move at all for several months or even a year, be patient and confident about your investment and dont sell a stock simply because it hasnt moved for several days.

Risks Associated

Putting money in the stock market is a very risky investment. But what makes penny stocks riskier than others? Lack of information, because these companies are not as regulated as the larger companies, information for making a sound decision on when to buy a penny stock, or when to sell a penny stock is quite difficult to find. There are no minimum standards to remain on the exchange. When companies are listed as a penny stock they aren’t required to file documents as timely as higher profile companies. Sometimes there is also a lack of history because the company is so new or it is approaching bankruptcy. Liquidity is also a major problem because if stocks are lacking this, you may not be able to sell the stock as it will be hard to find a buyer, and traders can easily manipulate stock prices.