Peak Energy

Post on: 3 Июль, 2015 No Comment

James Hamilton at Econbrowser started one of the year’s more interesting peak oil debates back in July with a post on developments in the oil markets — The Changing Face of World Oil Markets. This year the oil industry celebrated its 155th birthday, continuing a rich history of booms, busts and dramatic technological changes. Many old hands in the oil patch may view recent developments as a continuation of the same old story, wondering if the high prices of the last decade will prove to be another transient cycle with which technological advances will again eventually catch up. But there have been some dramatic changes over the last decade that could mark a major turning point in the history of the worlds use of this key energy source. In this article I review five of the ways in which the world of energy may have changed forever.

1. World oil demand is now driven by the emerging economies.

2. Growth in production since 2005 has come from lower-quality hydrocarbons.

Although the oil industry has a long history of temporary booms followed by busts, I do not expect the current episode to end as one more chapter in that familiar story. The run-up of oil prices over the last decade resulted from strong growth of demand from emerging economies confronting limited physical potential to increase production from conventional sources. Certainly a change in those fundamentals could shift the equation dramatically. If China were to face a financial crisis, or if peace and stability were suddenly to break out in the Middle East and North Africa, a sharp drop in oil prices would be expected. But even if such events were to occur, the emerging economies would surely subsequently resume their growth, in which case any gains in production from Libya or Iraq would only buy a few more years. If the oil industry does experience another price cycle arising from such developments, any collapse in oil prices would be short-lived.

My conclusion is that hundred-dollar oil is here to stay.

Reuters’ John Kemp was moved to respond in disagreement — Kemp: Forecasts For Higher Oil Prices Misjudge The Shale Boom. The shale revolution will turn out to be only a pause in the upward trend in prices, Hamilton argues, as growing demand from emerging economies and stagnant supplies from conventional oil fields push prices higher in the long term. Rather than a force pushing oil prices back to historical lows, it seems more accurate to view the emerging tight oil plays as a factor that can mitigate for a while what would otherwise be the tendency for prices to continue to rise.

The problem with Hamilton’s analysis is that it largely ignores the impact of the shale revolution on the economics of oil production and understates the tremendous variability in real oil prices in response to changes in technology. The professor devotes just 400 words out of almost 4,000 to discussing the production of crude oil and gas from shale formations.

Most of that discussion focuses on the high cost of drilling and fracturing shale wells; the rapid decline in production; the alleged unprofitability of shale wells; and question of whether the conditions that produced the shale revolution in North American can be replicated in other parts of the world. But this part of the paper is also the weakest, and it highlights the fundamental limitations with Hamilton’s entire argument about the increasing difficulty and costs of producing crude oil.

Since 2008, the dramatic increase in oil and gas production from shale formations in North America, and the abundance of shale resources around the world, has discredited theories about peaking oil production. The simple theory that supplies will run out has been reframed as a more sophisticated one about rising prices.

Peak oil supporters now point to the increasing cost of oil production, diminishing energy return on investment and the diminishing energy return on energy invested to claim that it is becoming harder and more expensive to sustain, let alone increase, crude output. Prices must continue to rise in real terms, they say, to reflect the increasing cost of producing crude and to restrain demand. Price increases will prove to be just as disruptive as physically running out of the stuff.

Hamilton’s paper lends influential support to this view. He notes that oil demand is now being driven by rising incomes in emerging markets, even as high prices restrain consumption in the advanced economies.

Platts then had a follow up post from Steve Kopits — Guest blog: Hamilton has it right on oil. Kemp seems to be arguing that shale oil is a game-changer which will materially change the supply outlook and catalyze a fall in oil prices.

To test this assertion, it is worth asking if shale production has actually led to the predicted fall in oil prices. As is well known, the shale surge caused a divergence of the West Texas Intermediate (WTI) oil price, the US domestic standard, from Brent, the international standard. Historically, these two prices rarely diverged by more than a dollar or two. Notwithstanding, from late 2011, surging shale production depressed the WTI price as US supply outran domestic infrastructure capabilities, and government regulations prevented the export of US crude.

Have prices fallen since? Growth of field production in the lower 48 states has been impressive, increasing by 400,000 b/d in the 12 months ending in mid-2011, and rising to a gain of 1 million b/d by mid-2012, a pace it has held ever since.

How did prices react? In the three months ending July 2011, WTI averaged $98, falling to $88/b a year later. On the other hand, by July 2013, WTI was back to $98, and will close this July around $104. Has surging shale production caused the US oil price to collapse? Not all at. It has been accompanied by increasing oil prices, even in the US.

Nor has Brent collapsed. True, Brent averaged $115/b in the three months to July 2011, and fell to $103 just a year later. But it will close this July at about $111/b, not much different from three years ago, and higher than it was at the beginning of the shale gale. Shale oil has not led, as a statistical matter, to lower oil prices in the USor globallyin the last two years.

How can this be, if the oil supply is in such fine fettle? Has peak oil really been debunked? Is Kemp right when he says: Since 2008, the dramatic increase in oil and gas production from shale formations in North America, and the abundance of shale resources around the world, has discredited theories about peaking oil production.

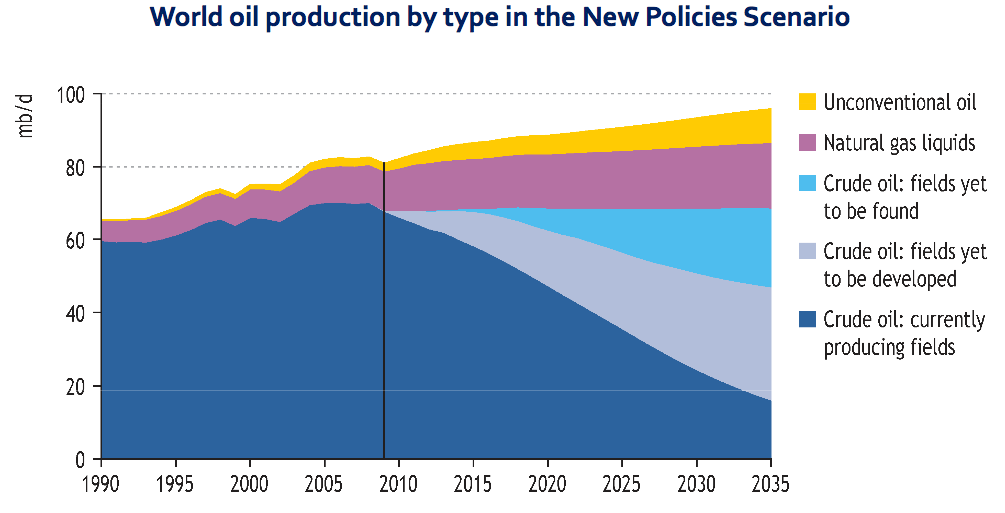

As the chart shows, just as many analysts have contended, the oil supply hit an inflection point in 2005. That year signals the high water mark of conventional crude and condensate production, which is 2.1 mbpd less than it was then.

Even if we include refinery processing gain, biofuels and NGLs (these latter two adjusted for energy content equaling about 70% of that of a barrel of crude), we find the oil supply is up only 0.4%, 300,000 b/d, compared to 2005.

Virtually all of the growth92%, on an energy-adjusted basishas come from unconventionals, specifically, Canadian oil sands and US shale (tight) oil. Indeed, 70% of the net growth of the global oil supply from 2005 through 2013 came from US shales alone. Shales are not the icing on the cake; they are the cake itself.

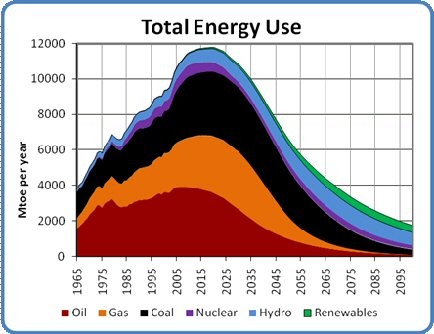

This matters, because shale production in turn depends overwhelmingly on only two plays, the Eagle Ford and the Bakken, where production is expected to peak in 2016 or 2017 or see much slower growth in production as the sweet spots there are exhausted. The Permian Basin may pick up the slack, but to date has not done so in needle-moving quantities.

Meanwhile, lagging oil prices are calling into question a number of oil sands projects, particularly those slated to begin production after 2020. Unconventional growth may well be approaching its high water mark. If 1 million b/d growth has led to higher oil prices, what will happen when unconventional growth slows to 300,000 b/d in two or three years?

And theres more. Kemp states: North American shale is currently the marginal source of supply in the world oil market, and most producers claim they can break even at $70 or even $60 per barrel.

It is not clear that the US independents are profitable. An industry can see a boom irrespective of profits or free cash flow if banks and investors are willing to underwrite the promises of future profits. The internet bubble showed us that.

We do not yet know if shale oil and gas will be consistently profitable. We do know, however, that US independents have been massively free cash flow negative in recent years.

D Ray Long has a postscript to the debate — Geology Is Crushing Technology. In July, I highlighted James Hamilton’s paper The Changing Face of World Oil Markets, as well as the critical response from Reuters writer John Kemp. But I didn’t circle back to also highlight Steven Kopits reply to Kemp that appeared in Platts: Hamilton has it right on oil.

You should definitely read the entire thing, but here’s a short quote below on Capex. Kopits discussed the capex issue in great detail in his Columbia University presentation earlier this year (and if you haven’t seen that, then go watch it immediately). But the short and simple version: Oil companies are spending more money, while gaining less production. Here’s Kopits:

. productivity of capital has deteriorated by a factor of four, from $5,300 capex b/d of oil production in 2004 to $21,400 in 2013. This deterioration is net of technology improvements. Geology is not only winning, it is crushing technology.

Hamiltons graph testifies to the grizzly unraveling of the economics underpinning oil production since 2005. For the oil business as a whole, productivity has imploded, not improved.