Pay by Fee and Commissions Financial Advisor Pay by Fee and Commissions

Post on: 5 Июль, 2015 No Comment

For Financial Advisors

You can opt-out at any time.

Overview of Pay by Fee and Commissions: Some financial advisors offer a hybrid payment plan that straddles the space between the supposedly independent, fee-only advisors and those who are paid on a transactional, commission basis. In general, this payment scheme combines set fees for activities such as developing a financial plans. or asset based fees. with commissions paid when specific securities or investment vehicles are purchased. Presumably, if asset based fees are involved, they will be considerably lower than for a relationship in which they cover securities transactions in addition to general investment advice.

While recently adopted by securities brokerage firms as a title for investment broker s operating according to the suitability standard. the term financial advisor has a longer history of usage among registered investment advisors operating under the fiduciary standard. Fee based client relationships are relatively new innovation among the former, but have been standard with the latter.

Financial advisers who offer such a payment option typically are those known as hybrid or dually registered advisors, those who are securities brokers in addition to being pure investment advisors.

Advantages to the Client: Such a setup offers the convenience of allowing the client to use the same financial advisor or financial firm for general investment advice as well as for the execution of specific securities trades and investment purchases. In particular, this pricing model can make sense if the types of assets which trigger commission payments when trades are made are also asset types which are not covered by any asset based fee assessed by the financial advisor.

Advantages to the Financial Advisor: For financial advisors in firms where the norm is to offer fee-only service relationships, this is a way to earn extra revenue from the client, internalizing securities trades and investment purchases that otherwise might be executed by the client through third parties, such as unaffiliated discount brokerage firms.

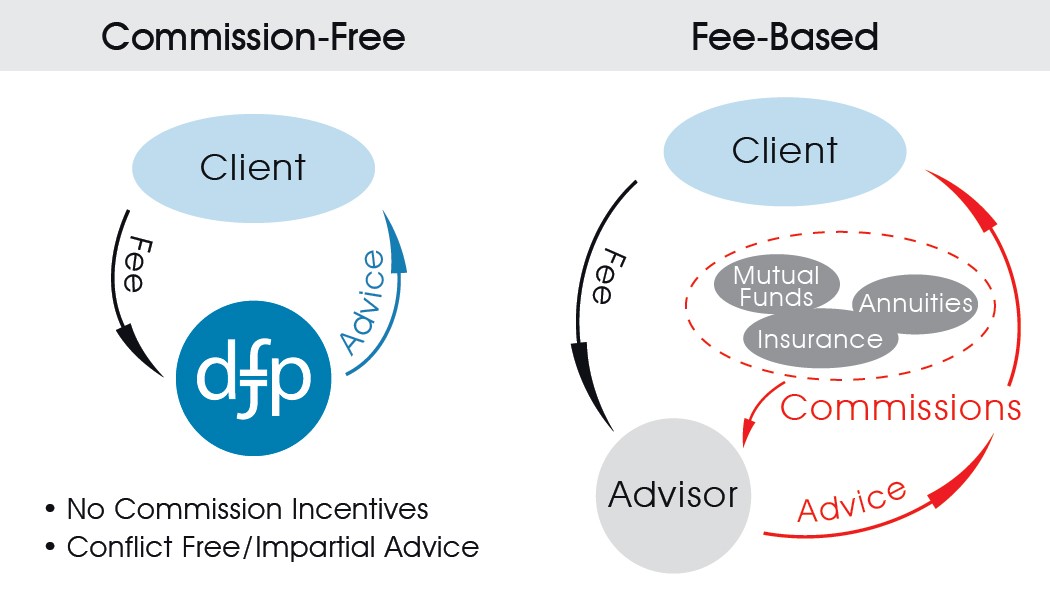

Conflicts of Interest: Financial regulators are concerned that combining a fee-based financial advisor relationship with some payment of commissions may introduce an especially potential set of conflicts of interest. In particular, financial advisors under this payment scheme have incentives to recommend securities and investment products that trigger the highest commissions, as well as to suggest excessive trading (that is, churning the account).

Wearing his or her registered investment advisor hat, the financial advisor is required to adhere to the fiduciary standard, acting in the client’s best interest. However, when acting as an investment or securities broker who earns commissions, the financial advisor instead is bound by the less stringent suitability principle, according to which the financial advisor can place his or her own interests first. This dichotomy introduces a conflict and complication into the relationship between the financial advisor and the client that may not be entirely clear to the latter. For example, a fiduciary must be concerned that the fees and commissions paid by the client are reasonable and justified, while an advisor operating under the suitability principle has much more leeway to charge as much as the client is willing to pay.

Prevalence: Among registered investment advisors operating on a fiduciary basis who serve individual clients and have a book of business that includes a total of at least $25 million in client assets. the percentage of those who get paid by miscellaneous fees (other than flat fees or hourly fees. and including those clients who pay their fees, in whole or in part, through barter than with cash):

- 23% in 2010

- 23% in 2009

- 18% in 2008

Keep in mind that some of the investment advisors counted here accept multiple payment plans, which can differ by client or client account. Accordingly, the percentages in this study add to more than 100% across all payment types.

These figures were developed by Dr. Lukas Dean, Assistant Professor and Financial Planning Program Director at the Cotsakos College of Business at William Paterson University in New Jersey. This study was cited in How to Pay Your Financial Adviser, The Wall Street Journal. December 12, 2011.