Paulson Book Behind the Scenes GE s Top Exec Confided Credit Woes

Post on: 30 Апрель, 2015 No Comment

Update Jan. 21, 2011: Today, President Obama announced that he was appointing General Electric CEO Jeffrey Immelt to lead an advisory board focused on jobs. Last year, ProPublicas Jeff Gerth reported on conflicting statements that Immelt made about GEs financial health in private versus in public. Gerth followed up with a report about the Securities and Exchange Commissions review of GEs public statements .

This story was co-published with The Washington Post.

As the financial crisis worsened toward the end of 2008, CEO Jeffrey Immelt and other leaders at General Electric repeatedly assured the public that there was no need to worry about the companys ability to access credit markets and refinance its massive debts as they came due.

But in private conversations that alarmed then-Treasury Secretary Henry Paulson, Immelt laid out a different picture of GEs credit situation, according to Paulsons new book about the crisis.

Instead, Paulson writes, Immelt on at least four occasions expressed worries about GEs short-term debt, known as commercial paper, and eventually lobbied for access to special government guarantees for such debt.

To take one example: On Sept. 15, 2008, the day Lehman Brothers declared bankruptcy, Paulson says he was startled when Immelt came to his office and told him GE was finding it very difficult to sell short-term debt for any term longer than overnight. A day earlier, GE sent investors a letter (PDF) saying its ability to sell commercial paper was robust.

Immelt, in a statement issued Friday by GE, said he does not believe the two discussed problems with GE commercial paper on Sept. 15, or in one previous talk. The company did not contest Paulson’s account of other conversations about the issue a few weeks later.

If correct, the portrayals in Paulsons book, On the Brink: Inside the Race to Stop the Collapse of the Global Financial System, could spell trouble for GE in court, where shareholders are accusing Immelt and other company executives in civil suits of violating securities laws by misleading investors in the fall of 2008 about GEs finances and withholding key information.

Immelt and other defendants have denied the claims, filed in federal court in New York City, and are seeking dismissal. But a leading securities expert said Paulsons book could complicate the litigation.

Assuming that what is in the book is accurate, said Donald C. Langevoort, the Thomas Aquinas Reynolds Professor of Law at Georgetown University Law Center, it offers new facts that any judge would have to take very seriously in considering whether to allow a suit alleging violations of the securities laws to go forward.

GE said in a statement that all the companys disclosures were accurate and that to suggest otherwise is misleading.

During the period in question, GE confirmed through its public statements the widely known fact that the CP [commercial paper] markets were under great stress. The company also disclosed that, despite this stress, it was able to meet its funding needs throughout the crisis, the statement said. In these circumstances, GE told the government that market intervention was important.

GE spokeswoman Anne Eisele said the companys commercial paper volume during the period in question was consistent with prior periods. She also disputed Langevoorts opinion that the book could affect the litigation.

The discussions with Immelt, like others in the book, are based on Paulsons call logs and his recollection of what transpired. There are no transcripts or documents to back up those conversations. Paulsons spokeswoman said he was not available for an interview.

Paulsons disclosures help flesh out one of the more perplexing mysteries of the 2008 bailout package: How, in a matter of a few weeks, GEs highly profitable finance arm, GE Capital, became eligible for a federal debt guarantee program that initially excluded firms like GE.

In his book, Paulson takes credit for helping to persuade Sheila C. Bair, the chair of the Federal Deposit Insurance Corp. which runs the program, to change the rules and allow in financial institutions like GE. By last June, the FDIC was guaranteeing more than $70 billion in GE debt, much of it the short-term commercial paper companies use for operating expenses.

As investors fret, reassuring words

At the center of the shareholder lawsuits is GEs sale of stock early that October. The company wound up raising $15 billion; $12 billion from investors who bought common stock and $3 billion from Warren Buffett, whose firm, Berkshire Hathaway, bought preferred stock.

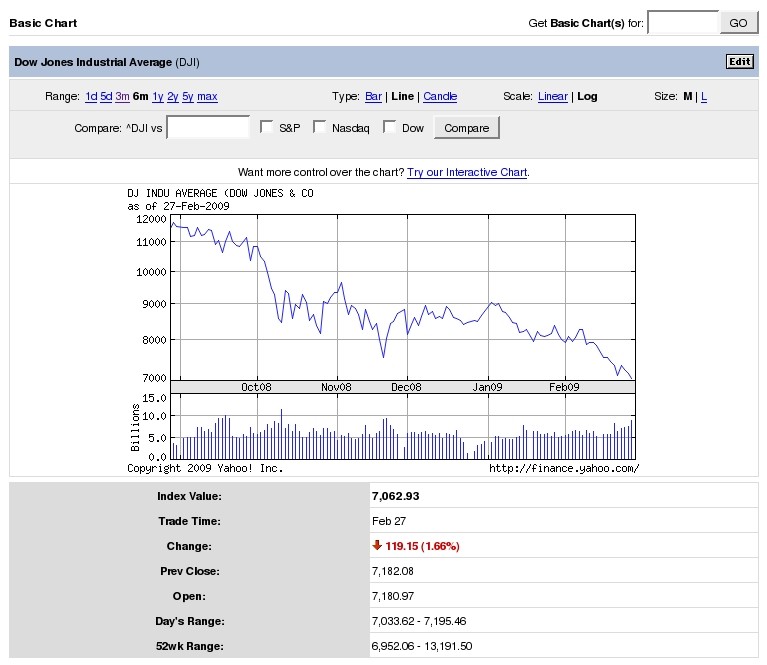

Despite the successful sale, investors worried about GE. The companys stock price, like that of many others, dropped. The price of insuring GEs debt as measured by credit default swap rates soared much higher than for other triple-A rated companies. At the time, GE was the biggest U.S. issuer of commercial paper.

GE began reassuring investors with a Sept. 14 letter (PDF). Ten days later, the companys chief financial officer told analysts the company was having no issues meeting its commercial paper funding needs. Immelt added that GEs overall funding situation looked very secure.

Yet according to the book, Immelt struck a different tone in conversations with Paulson. On Sept. 8, Paulson writes that Immelt phoned in late morning, to tell me that his company was having problems selling commercial paper and that the report alarmed me. When Immelt delivered a similar message on Sept. 15, Paulson describes being startled.

Immelt, according to GE, doesnt believe he and Paulson discussed problems with the companys commercial paper in those two calls. On the 15th, Lehman Brothers filed for bankruptcy, triggering large write-offs at one of the industrys oldest money market funds. The funds are major purchasers of short-term corporate debt, including GEs, and fears quickly rippled across the commercial paper market over the next day or two.

As part of its October stock sale, GE filed documents with the Securities and Exchange Commission, including one that quoted Immelt as saying: We continue to successfully meet our commercial paper needs.

Another filing contained a long litany of possible future risks, noting that although GE Capital has continued to issue commercial paper, there can be no assurance that such markets will continue to be a reliable source of short-term financing for GE Capital.

On Oct. 10, after the successful stock sale, Immelt was on a conference call with investors. Even with all this volatility, he said, we have never had issues refinancing debt in the commercial paper market. GEs top financial officer made similar statements to the analysts.

Lobbying to get loan guarantees

Two days later, early on a Sunday morning, Paulson called Immelt. Because GE Capital wasnt a traditional bank, GE wouldnt be eligible for the FDICs soon-to-be announced program to guarantee short- and medium-term debt, Immelt told Paulson.

I dont think we can do anything for GE, Paulson recalled telling him. Immelt told him to do what was best for the country, which impressed Paulson.

The next day, when Paulson met with the heads of Americas largest banks and cajoled them into accepting federal cash infusions, Immelt called to say his company was now at a disadvantage because it was left out of the program. Immelt said GE officials were nervous, according to Paulson. He quotes the GE executive as saying: Im worried about my company and our ability to roll over paper in the face of this.

Over the next few days the FDIC explained to bankers that the debt guarantee program applied only to banking institutions. Faced with probable exclusion, Immelt came to Paulsons office on Oct. 16 and, according to the book, complained again. We are the ones out there making the loans that the banks arent, Immelt is quoted as saying, and we need help.

Paulson writes that he knew Immelt was right and told him we would explore it with his finance team and the FDIC. So, Paulson explains, he and one of his aides worked hard to get Bair comfortable with making this decision.

The following week, the FDIC changed its rules, and by early November GE had been accepted into the program. Analysts said that the program was critical to GEs financial health and that it enabled the company to avoid paying exorbitant prices to sell debt in late 2008.

Whatever advantages GE gained from the guarantee program were not enough to stave off short-term woes. By February 2009, the company was forced to cut its quarterly dividend by two-thirds. And the next month, Standard & Poors lowered its credit rating to AA+ the first downgrade in decades.

Immelt and Paulson are longtime business associates. Goldman Sachs, which Paulson headed before coming to Treasury, has long been GE’s investment banker. Ive known Jeff for years, Paulson writes, and admired the cool, unflappable demeanor he had displayed as CEO of the biggest, most prestigious company in America.

Director of Research Lisa Schwartz contributed to this report.

Like this story? Sign up for our daily newsletter to get more of our best work.