Paulsen Look Deeper at Valuations

Post on: 25 Июнь, 2015 No Comment

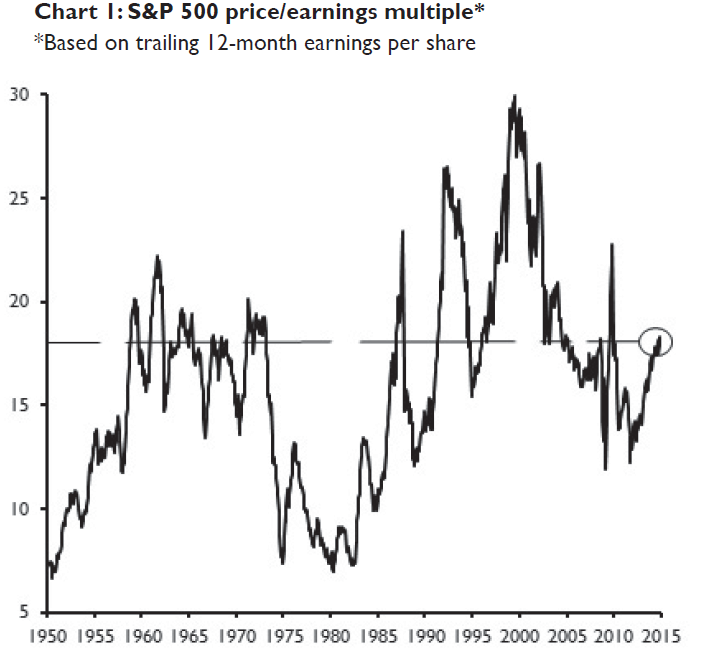

Nearly six years into the bull market, the S&P 500 is trading at somewhat elevated but far from euphoric valuations. But in a recent note, Wells Capitals James Paulsen says that doesnt tell the whole story of the overall markets valuation.

Most U.S. stocks, Paulsen says, are much more expensive than suggested by the S&P 500 Index. The median New York Stock Exchange (NYSE) stock is currently at a postwar record high P/E multiple, a record high relative to cash flow, and near a record high relative to book value! In the late 1990s, surging technology stock prices caused the overall S&P 500 P/E multiple to reach record highs even though the median stock’s P/E multiple never became excessive. Conversely, today, although the S&P 500 P/E multiple remains far below record highs, median valuations are at a pinnacle. Whereas most recognized the headline S&P 500 P/E multiple was at a record high in 2000, far fewer are aware of just how expensive the median stock is today.

Paulsen says that when NYSE median valuations have gotten as high as they are today, the overall stock market has usually either suffered an outright bear market (i.e. in 1962, 1969, 2000-2001, and 2007-2008) or a correction (i.e. in 1998). Only in 2005, from a similar median stock valuation, did the overall stock market avoid a correction or bear market until 2008. At a minimum, this historic record suggests investors should proceed with greater caution.

But, he adds all of this doesnt mean imminent disaster. Rather than suggest an imminent bear market, the widespread overvaluation of the U.S. stock market mostly indicates vulnerability, he says. Until the extreme valuation character of the median U.S. stock improves, the stock market may simply struggle to make consistent gains. This could, of course, be resolved by a correction or a bear market. Alternatively, simply a flattish stock market this year while earnings continue to rise may be enough to refresh median P/E valuations for 2016.

Paulsen says that one way to diversify valuation risk may be to increase allocation to international stocks, which in general have lower P/Es than US stocks right now. And he discusses whether the current broad-based elevated valuation climate is more dangerous than a concentrated valuation extreme like we saw in the late 1990s/early 2000s.