Participants Need To Watch The Forex Market

Post on: 16 Август, 2015 No Comment

Posted by: : Paul Ebeling Posted on: January 30, 2015

Participants Need To Watch The Forex Market

The largest traded market in the world is not the US, Asian or European stock markets, it is the FOREX (foreign cash currency exchange market) Fx for short. Speculators and hedgers worldwide can and do trade this gian market, in which well over US$3-T and other currencies change hands every trading day.

It is very import to follow the FOREX market if you hold physical assets that are fungible worldwide, such as the precious metals, stocks and commodities.

If you have traveled between countries and needed to exchange your nations currency for another countrys currency, you know why foreign exchange is a necessity. Americans are somewhat spoiled when they travel to other countries because many retail merchants in other countries will accept USDs for payment.

The exchange rate for currencies is usually posted at the place at which you exchange your currency for another currency, like a bank branch at an international airport.

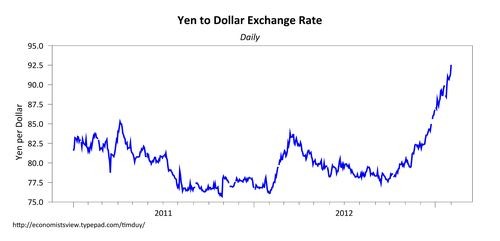

Currency exchange rates fluctuate daily.

Factors that impact an individual countrys currency exchange rate are the health of its economy, political events, natural disasters and events around the world that could impact that countrys economic or political well-being.

Exchange rate fluctuations can be significant for those traveling in other countries and exchanging currency, or for those investors holding fungible assets like precious metals, stocks and/or commodities.

FOREX trading is done in Currency Pairs.

In other words, when you trade Spot currencies you are trading in pairs. When you go to the airport to change out USDs for Euros (EUs single currency), you are actually making a transaction in the EUR/USD currency pair. The 1st currency listed in every pair is known as the base currency. The exchange rate refers to the amount of the 2nd currency that can be exchanged for 1 unit of the base currency.

Below are some major currency pairs that are traded by hedgers and speculators worldwide, as follows;

Note that the US Dollar is the base currency for most major currency pairs. There are many other currency pairs that are traded worldwide, but those I list above are the most popular and liquid pairs.

There are also currency futures and options that trade at the Chicago Merc, part of the CME Group in Chicago, Il.

You can trade the British Pound, Swiss Franc, Australian Dollar, Canadian Dollar, and others. But even though the CME currencies are not labeled as pairs, that is in fact what the futures are based upon.

For example, Japanese Yen futures prices are based upon the Dollar-Yen (USD /JPY) pair.

A Key advantage to trading in the FOREX market is that it is a very liquid market. The FOREX market trades from about 7:00 p ET time on Sunday night, straight through until about 3:00 p. ET. time on Friday afternoon in the USA.

There are nuances in FOREX trading that futures traders do not encounter.

One is the fact that since FOREX trading occurs continuously for 24 hrs per day, 5 days per week, there is a daily settlement period designated. FOREX traders must settle or square their positions at the end of each day. There is usually a small fee charged for this daily settlement process.

The margin required for trading the FOREX market varies depending upon the broker used.

It is important for holders of fungible physical assets, such as precious metals or other major raw commodities, which are priced in a specific currency, most are priced in USDs, to know the exchange rate for the currency in which their commodity is priced, and also the currency for which might be exchanged to buy a commodity priced in another currency.

Savvy and veteran market watchers know that precious metals prices tend to move in an inverse relationship with the value of the US Dollar (.DXY) on a daily basis.

On days when the .DXY is higher, precious metals prices can see buying interest limited, or be trading lower based upon the stronger Buck. And on trading days when the .DXY is lower, precious metals will at least see underlying support from the weaker US Dollar. So, precious metals and other commodity traders need to pay close attention to what the .DXY is doing, or what it could be about to do, in the near term, and in the future.

Given the importance of foreign exchange rates on raw commodity pricing, on daily movements in the prices of precious metals and other commodities, and in determining the actual value of an investor’s own physical assets being held, HeffX -LTN is setting up to produce daily FOREX technical /analytical charts and discussions on the major currency pairs traded worldwide.

These charts will be easy to understand and help better guide you for understanding, and better trading/investing decisions.

It is noteworthy that HEFFX was a big winner during the SNB triggered volatility, the Private Fund and managed accounts saw spectacular returns, those following the HEFFX alerts and participating in our open dialogue at Trading Street were spared the disaster of keeping high exposure in several Key currencies.

The National Futures Association and Commodity Futures Trading Commission rules cap leverage at 50 to 1 on major currencies like the Swiss Franc, meaning an investor putting up $1,000 could borrow as much as $50,000. It is still not clear if the CFTC, which oversees the futures association, would revisit its leverage caps. The agencies have 2 separate sets of leverage rules that mirror each other.

A spokesman for the CFTC did not respond to a request for comment.

Those interested in our funds or our trading platforms should contact us or call 312-219-1354 or visit us Monday morning at Trading Street.