Pakistan’s best performing sectors in 2013 – Topline Research Investor Guide Pakistan

Post on: 15 Август, 2015 No Comment

Pakistan’s best performing sectors in 2013 – Topline Research

By: Vahaj Ahmed,

+9221-35303331 Ext: 125

Topline Securities (Private) Limited

Another eventful year is coming to an end for Pakistan market which posted a gain of 48% (US$ 38%) in 2013 to-date as total market cap increased by 47% to Rs6.0tn. Benchmark KSE Index has gained 8,617 points in 2013 with only 12 trading sessions left in this year. Out of 32 listed sectors as defined by Karachi Stock Exchange, we analyzed big and medium-sized sectors with market cap of Rs100bn+; below are our findings.

Outperformers: Telecom, Foods, Cements and Textiles

Expectations of 3G auction coupled with high international calls rates, telecom sector gained 75%, outperforming index by a big margin. This was followed by food producers which gained 69% in 2013YTD as consumerism grew. For our estimate, we have excluded Uni Lever’s (ULEVER) market cap from our 2012 year-end sample as the stock is no more listed now. Even with the inclusion of ULEVER, this sector’s performance stood at 64%.

Fuelled by rising sales prices and declining financial charges, cement sector continued its momentum and saw its market cap rising to Rs287bn in 2013; up 67%. Textiles gained 57% on the back of better regional demand, firm prices and declining interest rates. This sector gained further as EU approved trade package for Pakistan, allowing some of country’s textile products duty-waiver on exports to EU. Both cements and textiles remained one of the best performing sectors for two years in a row.

Underperformers: Chemicals and Electricity

Chemicals and electricity underperformed in 2013 with returns of 15% and 36%, respectively. Due to declining margins, chemicals showed lack-lustre performance. Keeping investor interest high with its dividend yield play, the electricity sector recorded above-average performance in 1H2013 as yield spread against government-backed securities grew. This was further fuelled by circular-debt resolution which saw many power producers stepping up cash payouts. However, cumulative 100bps discount rate hike in the last two monetary policy decisions saw investors turn away from this sector to seek risk-free investments. Just to clarify that due to high dividend payout sector’s market cap lagged behind the market.

Oil & Gas and Banks performed in line

While the oil & gas sector showed decent uptick for 1H2013, price performance was mainly marred as E&Ps recorded lower full-year profits as a result of one-time adjustment required by the tax authorities, resulting in the sector posting 41% return.

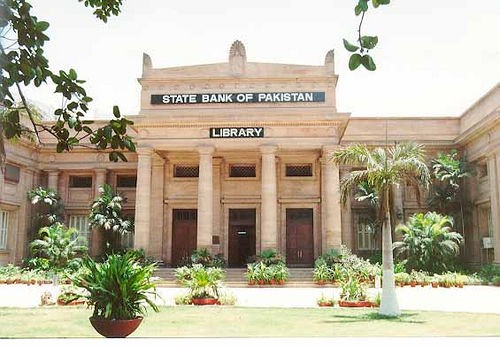

2013 remained a mixed bag for commercial banks as discount rate took both up and downswings. With the central bank linking minimum rate on savings to repo rate, rising interest rates towards the end of 2013 did not add much to the sector’s likeness as its market cap grew 44% to Rs1,219bn.