Paidin Capital and Retained Earnings

Post on: 10 Май, 2015 No Comment

Preferred Stock

Entries to the Retained Earnings Account, Book Value

Earnings Per Share, Other

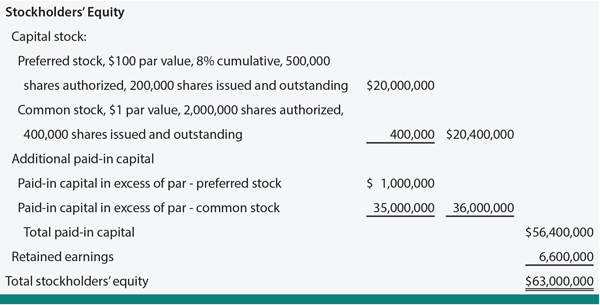

Paid-in Capital or Contributed Capital

Capital stock is a term that encompasses both common stock and preferred stock. Paid-in capital (or contributed capital) is that section of stockholders’ equity that reports the amount a corporation received when it issued its shares of stock.

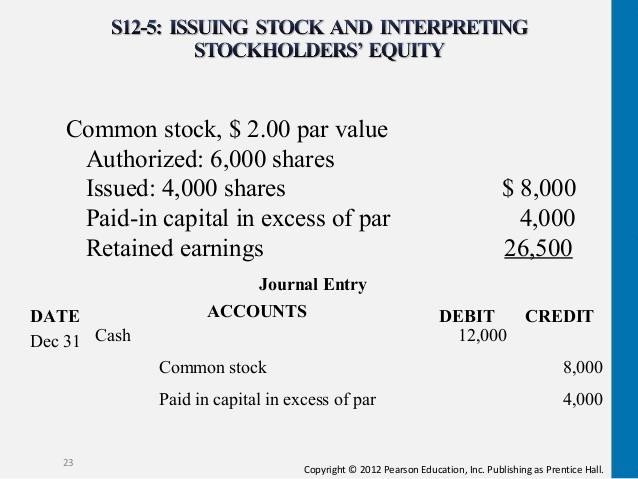

State laws often require that a corporation is to record and report separately the par amount of issued shares from the amount received that was greater than the par amount. The par amount is credited to Common Stock. The actual amount received for the stock minus the par value is credited to Paid-in Capital in Excess of Par Value.

To illustrate, let’s assume that a corporation’s common stock has a par value of $0.10 per share. On March 10, 2013, one share of stock is issued for $13.00. (The $13 amount is the fair market value based on supply and demand for the stock.) The accountant makes a journal entry to record the issuance of one share of stock along with the corporation’s receipt of the money (note that the Common Stock account reflects the par value of $0.10 per share):

While some states require a par value for common stock, other states do not. If there is no par value, some states require a stated value. If this is the case, the entry will be the same as the above except that the term stated will be used in place of the term par:

If a state does not require a par value or a stated value, the entire proceeds will be credited to the Common Stock account:

Generally speaking, the par value of common stock is minimal and has no economic significance. However, if a state law requires a par (or stated) value, the accountant is required to record the par (or stated) value of the common stock in the account Common Stock.

Retained Earnings

Over the life of a corporation it has two choices of what to do with its net income: (1) pay it out as dividends to its stockholders, or (2) keep it and use it for business activities. The amount it keeps is the balance in a stockholders’ equity account called Retained Earnings . This general ledger account is a real or permanent account with a normal credit balance.

The term retained earnings refers to a corporation’s cumulative net income (from the date of incorporation to the current balance sheet date) minus the cumulative amount of dividends declared. An established corporation that has been profitable for many years will often have a very large credit balance in its Retained Earnings account, frequently exceeding the paid-in capital from investors. If, on the other hand, a corporation has experienced significant net losses since it was formed, it could have negative retained earnings (reported as a debit balance instead of the normal credit balance in its Retained Earnings account). When this is the case, the account is described as Deficit or Accumulated Deficit on the corporation’s balance sheet.

It’s important to understand that a large credit balance in retained earnings does not necessarily mean a corporation has a large cash balance. To determine the amount of cash, one must look at the Cash account in the current asset section of the balance sheet. (For example, a public utility may have a huge retained earnings balance, but it has reinvested those earnings in a new, expensive power plant. Hence, it has relatively little cash in relationship to its retained earnings balance.)

Let’s look at the stockholders’ equity section of a balance sheet. We’ll assume that a corporation only issues common stock. The stock has a par value of $0.10 per share. There are 10,000 authorized shares, and of those, 2,000 shares have been issued for $50,000. At the balance sheet date, the corporation had cumulative net income after income taxes of $40,000 and had paid cumulative dividends of $12,000, resulting in retained earnings of $28,000.