Overview Of The New 3 8% Investment Income Tax Part 1

Post on: 16 Март, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

Alright, it’s Friday, so let’s get our tax geek on.

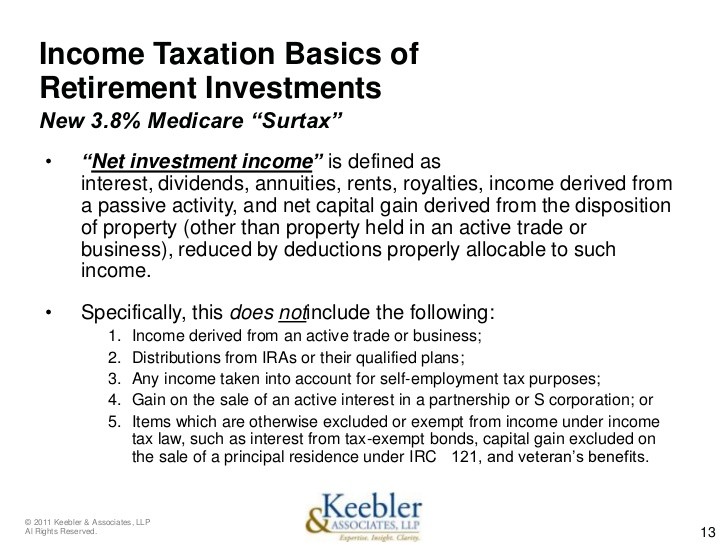

Beginning January 1, 2013, Obamacare – through the enactment of Section 1411 — will impose upon certain high earners a brand spankin’ new 3.8% tax on their “net investment income.” This additional tax has been the source of much confusion and misinformation for taxpayers and tax advisors alike.

Much of the uncertainty is to be anticipated; after all, Section 1411 is not an amendment, expansion, or alteration of preexisting law. Rather, this is brand new statute, which means there are no judicial precedents or administrative rulings available to help interpret the legal language.

But this new statute presents hurdles beyond what we typically see with recently enacted legislation; specifically, the vagaries of a term as critical to its implementation as “net investment income” is to Section 1411.

In my honest opinion (man, I wish there was a shorthand way to write that), the determination of what does and does not constitute “net investment income” for purposes of Section 1411 will vex tax advisors more than any other issue in 2013. So as a public service, I thought I’d take advantage of this post-April 15 th downtime to put together a handy, four-part overview of the new investment income tax, focusing primarily on answering the question, “What IS net investment income?”

Before we begin unraveling that mystery, however, let’s address the basic mechanics of Section 1411.

Beginning January 1, 2013, taxpayers will pay an additional 3.8% Medicare tax on the lesser of :

- The taxpayer’s “net investment income,” or

- The taxpayer’s “modified adjusted gross income” (if the taxpayer does not have foreign earned income excluded under Section 911, this will be identical to adjusted gross income)” less the “applicable threshold;” specifically:

•For married taxpayers filing jointly: $250,000.

•For married taxpayers filing separately: $125,000.

•For all other taxpayers: $200,000.

There are two very important distinctions to be made about the math behind this lesser of calculation that should serve to dispel two popular misconceptions about the new tax:

First, because this is a “lesser of” rather than “greater of” computation, the tax cannot apply unless an individual’s modified adjusted gross income exceeds the applicable threshold. If the taxpayer’s MAGI does not exceed the applicable threshold, the second component of the “lesser of” calculation will always be zero, and the last time I checked, zero will always be the lesser of two positive numbers. Thus, right from the start, we can eliminate from the reaches of Section 1411 all married filing jointly taxpayers with MAGI less than $250,000, married filing separately taxpayers with MAGI less than $125,000, and all other taxpayers with MAGI less than $200,000.

Secondly, just because an individual’s MAGI exceeds the applicable threshold does not necessarily sentence the taxpayer to paying the 3.8% tax on all of their net investment income. Again, this is due to the mechanics of the “lesser of” calculation.

Example: Hansel, a single taxpayer, earns $195,000 in compensation and $30,000 of dividend and interest income during 2013. These are his only items of income or loss.

Hansel is subject to the 3.8% Medicare tax on the lesser of:

1. Net investment income, or $30,000, or

2. MAGI ($225,000) less the applicable threshold ($200,000) or $25,000.

Thus, despite the fact that Hansel has both net investment income and MAGI in excess of his applicable threshold, he does not owe the 3.8% on all of his investment income. Rather, he owes the tax on the lesser of the two components, or $25,000.

But let’s not kid ourselves; it’s not the mechanics or mathematics behind Section 1411 that will be the bane of the tax advisor’s existence during 2013, it’s the understanding of what constitutes “net investment income.” And for clarity on that issue, we must look to our only source of guidance on the topic.

In late November, the IRS released long-awaited proposed regulations under Section 1411. While the proposed regulations are not effective until tax years beginning after December 31, 2013, they may be relied on until final regulations are issued, which is expected to happen sometime during 2013.

The definition of “net investment income” is first introduced in Prop. Reg. Section 1.1411-4(a)(1), which breaks those items constituting “net investment income” into three subparagraphs:

(i) Gross income from interest, dividends, annuities, royalties, rents, substitute interest payments, and substitute dividend payment. (one little i income)

(ii) Other gross derived from a trade or business described in Prop. Reg. Section 1.1411-5 (two little i income); and

(iii) Net gain attributable to the disposition of property (three little i income).