Our Strategy How to Buy and Hold

Post on: 26 Июль, 2015 No Comment

So, what’s the secret behind Buy and Hold investing, anyway? What magic makes it work? Actually, it’s not magic, but two well-known and very powerful financial concepts working in combination:

1. Compounding — Reinvesting a stock’s dividends buys you more shares which can grow your total investment value at a faster pace. (See chart below.)

Most of the companies offered through BUYandHOLD pay dividends (typically on a quarterly basis). You can elect to have your cash dividends automatically reinvested to buy more shares of the same stock at no additional cost to you. These new shares may earn future dividends, and the cycle will continue again and again. Before you know it, you will have more shares working for you.

The charts below demonstrate the benefits of compounding through dividend reinvestment:

Source: DRIP Investor Newsletter

Source: DRIP Investor Newsletter

top of page

2. Dollar-Cost Averaging and E-ZVest sm — One method to take advantage of dollar-cost averaging is through our E-ZVest sm service. This feature allows you to set up regularly scheduled purchases of your selected stocks. You can designate a specific dollar amount (as little as $20 or as much as you want) to be invested in each stock on a weekly, monthly or quarterly basis.

The money for each purchase can either come from your personal bank account or from your BUYandHOLD account. Since you determine the exact dollar amount to invest, you can budget accordingly throughout the years and can make changes at any time.

To activate this feature, simply go to the View Your Account section and click, E-ZVest.

Weekly purchases are made each Wednesday (or the next business day if Wednesday is a holiday). Monthly purchases are made on the 10th of each month (or the next business day if the 10th is holiday). Quarterly purchases are made on the 10th of each of the following months: January, April, July and October (or the next business day if the 10th is holiday).

Consider the impact of adding dollar-cost averaging to your BUYandHOLD investing plan as a means to decrease the risk of making a large investment when prices are at their peak (something every investor hopes to avoid). Such a plan does not assure a profit and does not protect against a loss in declining markets, and you should consider your financial ability to continue to invest during periods of low price levels.

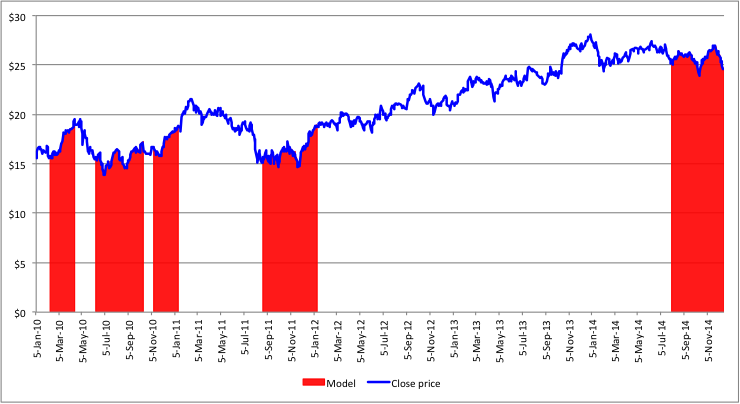

The charts below demonstrate the added value of making regular investments on a consistent basis:

Source: DRIP Investor Newsletter

Source: DRIP Investor Newsletter

top of page

Window Trades Executed Three Times a Day

BUYandHOLD executes orders three times a day so we can pass along our low commissions to you. There are three Windows each day when we place orders to buy or sell stock on your behalf:

Morning Session — from 10:00am to 11:00am EST

Mid-day Session from 12:30pm to 1:30pm EST

Afternoon Session — from 3:00pm to 4:00pm EST

Although we do not currently offer evening trading, we will accept your order throughout the night until our next Morning Session.

If the stock market closes before 2:30 pm EST, or in certain other instances, there will not be a 3:00 pm window.

We at BUYandHOLD wa nt to be part of your long-term investment strategy. Open an account and start investing for your future today!

top of page

Real-time Trades

In addition to our three trading windows, you can place real-time buy or sell orders for $15 per trade.

Dollar-based investing

All your investments are based on dollar amounts — not shares. That means you control the amount spent on each purchase, even when the stock price fluctuates. Your entire investment (minus the trade cost) goes towards the purchase of stock because we can buy fractions of shares, not just whole shares.

BUYandHOLD does not offer or provide any investment advice or opinion regarding the nature, potential, value, suitability or profitability of any particular security, portfolio of securities, transaction or investment strategy. Any investment decisions you make will be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance, and liquidity needs. The securities mentioned above are being used for illustrative purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy and past performance is no guarantee of future results.