Our StockSelection Methodology the Valuentum Buying Index Valuentum Securities Inc

Post on: 5 Июль, 2015 No Comment

Our Stock-Selection Methodology, the Valuentum Buying Index

Our Methodology for Selecting Stocks — the Valuentum Buying Index

At Valuentum, we think the best opportunities arise from a complete understanding of all investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. We think companies that are attractive from a number of investment perspectives—whether it be growth, value, income, momentum, etc.—have the greatest probability of capital appreciation and relative outperformance. The more deep-pocketed institutional investors that are interested in the stock for reasons based on their respective investment mandates, the more likely it will be bought and the more likely the price will move higher to converge to its true intrinsic value (buying a stock pushes its price higher). On the other hand, we think the worst stocks will be shunned by most investment disciplines and display expensive valuations, poor technicals and deteriorating momentum indicators.

Click to Sign Up! First 14-days FREE!

Stocks that meet our demanding criteria fall in the center of the Venn diagram below, displaying attractive characteristics from a discounted cash-flow basis. a relative value basis, and with respect to a technical and momentum assessment. The size of the circles reveals the relative emphasis we place on each investment consideration, while the arrows display the order of our process — value first then technicals and momentum last. We may like firms that are undervalued both on a DCF basis and relative value basis, but we won’t like firms just because they’re currently exhibiting attractive technical or momentum indicators. We’re not traders or speculators. We’re long-term investors and want to have complete confirmation and conviction in the best ideas we deliver to our subscribers.

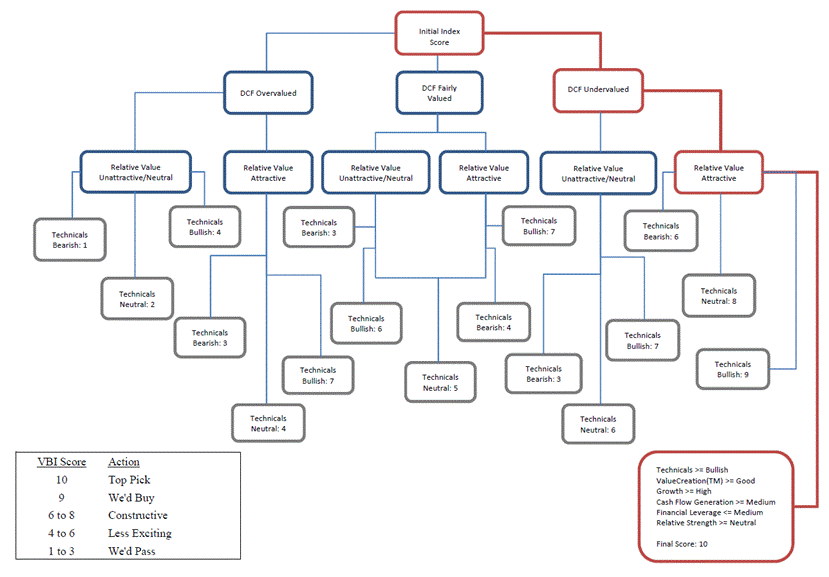

The center of the Venn diagram above, the Valuentum Buying Index (VBI) combines rigorous financial and valuation analysis with an evaluation of a firm’s technicals and momentum indicators to derive a score between 1 and 10 for each company (10=best). Because our process factors in a technical and momentum assessment after we evaluate a firm’s investment merits via our rigorous DCF and relative-value process, were better able to pinpoint the best entry and exit points on the most undervalued stocks.

Research firms that just focus on valuation may encourage investors to buy a stock all the way down (a falling knife), while those that just use technical and momentum indicators may expose portfolios to significantly overpriced stocks at their peaks. Only when both sides of the investment spectrum are combined can investors get the best stocks on the market today at the best prices, in our view.

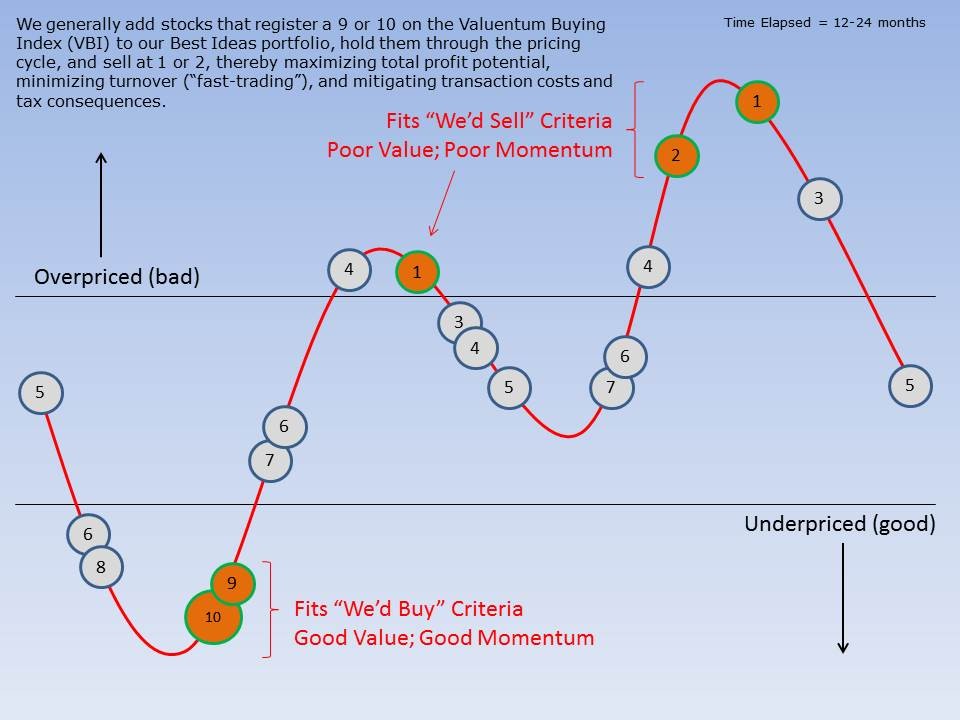

Let’s examine the chart below, which showcases how the Valuentum process has the greatest profit potential of any investing strategy. The Valuentum process targets adding stocks to actively-managed portfolios when both value and momentum characteristics are good and removing them when both value and momentum characteristics are bad (blue circles: Buy —> Sell). The Valuentum strategy captures the entire equity pricing cycle, while the value and momentum strategies individually truncate profits.

Furthermore, Valuentum subscribers are less likely to be involved in value traps because we demand material revenue and earnings growth for firms to earn a 10 on our Valuentum Buying Index. Value traps often occur as a result of secular declines in a firm’s products or services, resulting in deteriorating revenue and earnings trends (and a falling stock price). Valuentum subscribers are less likely to be exposed to these falling knives since our process requires firms to not only be undervalued but also be exhibiting bullish technical and momentum indicators before we would consider adding them to our actively-managed portfolios.

Since the stock market is a forward-looking mechanism, price usually leads fundamentals. Without a turnaround in price, the risk that the fundamentals of an undervalued stock have not turned for the positive is higher. Where value strategies may encourage the buying of a stock all the way down regardless of whether fundamentals ever turn (red circles: Buy —> Sell), the Valuentum strategy simply steers clear of these situations. We wait for technical improvement in the equity, which often precedes fundamental changes at the company.

Let’s walk through the three investment pillars of our stock-selection methodology.

I. We Use a Rigorous Discounted Cash Flow Valuation Process

Our methodology starts with in-depth financial statement analysis, where we derive our ValueCreation, ValueRisk, and ValueTrend ratings. which together provide a quantitative assessment of the strength of a firm’s competitive advantages. We compare a company’s return on invested capital (ROIC) to our estimate of its weighted average cost of capital (WACC) to assess whether it is creating economic profit for shareholders (ROIC less WACC equals economic profit). Firms that have improving economic profit spreads over their respective cost of capital score high on our ValueCreation and ValueTrend measures, while firms that have relatively stable returns score well with respect to our ValueRisk evaluation, which impacts our margin-of-safety assessment.

After evaluating historical trends, we then make full annual forecasts for each item on a company’s income statement and balance sheet to arrive at a firm’s future free cash flows. We derive a company-specific cost of equity (using a fundamental beta based on the expected uncertainty of key valuation drivers) and a cost of debt (considering the firm’s capital structure and synthetic credit spread over the risk-free rate), culminating in our estimate of a company’s weighted average cost of capital (WACC). We don’t use a market price-derived beta, as we embrace market volatility, which provides investors with opportunities to buy attractive stocks at bargain-basement levels.

We then assess each company within our complete three-stage free cash flow to the firm (enterprise cash flow) valuation model, which generates an estimate of a company’s equity value per share based on its discounted future free cash flows and the company’s net balance sheet impact, including other adjustments to equity value (namely pension and OPEB adjustments). Our ValueRisk rating. which considers the underlying uncertainty of the capacity of the firm to continue to generate value for shareholders, sets the margin of safety bands around this fair value estimate. For firms that are trading below the lower bound of our margin of safety band, we consider these companies undervalued based on our DCF process. For firms that are trading above the higher bound of our margin of safety band, we consider these companies overvalued based on our DCF process.

We think a focus on discounted cash-flow valuation prevents investors from exposing their portfolios to significantly overpriced stocks at their peaks. The chart below reveals how pure momentum investors may expose their portfolios to pricing extremes and dramatic falls (green circles: Buy —> Sell). We stay away from these situations.

II. We Perform a Forward-Looking Relative Value Assessment

Our discounted cash-flow process allows us to arrive at an absolute view of the firm’s intrinsic value. However, we also understand the critical importance of assessing firms on a relative value basis, versus both their industry and peers. Many institutional money-managers—those that drive stock prices—pay attention to a company’s price-to-earnings (PE) ratio and price-earning-to-growth (PEG) ratio in making buy/sell decisions. With this in mind, we have included a forward-looking relative value assessment in our process to further augment our rigorous discounted cash-flow process. If a company is undervalued on both a price-to-earnings ratio and a price-earnings-to-growth (PEG) ratio versus industry peers, we would consider the firm to be attractive from a relative value standpoint.

III. We Seek to Avoid Value Traps, Falling Knives and Opportunity Cost

Once we have estimated a firm’s intrinsic value on the basis of our discounted cash-flow process, determined if it is undervalued according to its firm-specific margin of safety bands, and assessed whether it has relative value versus industry peers, we then evaluate the company’s technical and momentum indicators to pin-point the best entry and exit points on the stock (but only after it meets our stringent valuation criteria). Rigorous valuation analysis and technical analysis are not mutually exclusive, and we believe both can be used together to bolster returns. An evaluation of a stock’s moving averages, relative strength, upside-downside volume, and money flow index are but a few considerations we look at with respect to our technical and momentum assessment of a company’s stock.

We embrace the idea that the future is inherently unpredictable and that not all fundamental factors can be included in a valuation model. By extension, we use technical and momentum analysis to help safeguard us against value traps, falling knives, and the opportunity cost of holding an undervalued equity for years before it converges to fair value. Other research firms do not consider opportunity cost as a legitimate expense for investors.

Putting It All Together — the Valuentum Buying Index

Though the time frame varies depending on each idea, we expect our best ideas to work out over a 12-24 month time horizon (on average) — any shorter than that is mostly luck, in our view. We tend to add firms to our Best Ideas portfolio when they register a 9 or 10 on our Valuentum Buying Index (VBI) and tend to remove firms from our Best Ideas portfolio when they register a 1 or 2 on our VBI.

We like to maximize profits on every idea, with the understanding that momentum does exist and that prices over and under shoot intrinsic value all of the time. A value strategy (10 —> 5) truncates potential profits, while a momentum strategy (4 —> 1) ignores profits generated via value assessments. We’re after the entire profit potential, as shown below.

Let’s follow the red line on the flow chart below to see how a firm can score a 10, the best mark on our index (a Top Pick). Please click here to view an enlarged pdf version. First, the company would need to be ‘UNDERVALUED’ on a DCF basis and ‘ATTRACTIVE’ on a relative value basis. The stock would also have to be exhibiting ‘BULLISH’ technicals. The firm would need a ValueCreation rating of ‘GOOD’ or ‘EXCELLENT’, exhibit ‘HIGH’ or ‘AGGRESSIVE’ growth prospects, and generate at least a ‘MEDIUM’ or ‘NEUTRAL’ assessment for cash flow generation, financial leverage, and relative price strength.

This is a tall order for any company, but we’re looking to deliver the very best of ideas to our clients and subscribers. Firms that don’t make the cut for a 10 are ranked accordingly, with the least attractive stocks garnering a score of 1 (We’d sell). Most of our coverage universe falls between 3 and 7, but at any given time there could be large number of companies garnering either high or low scores, especially at market lows or tops, respectively.

Please click here to enlarge the chart below for easier viewing.

How We Use the Valuentum Buying Index in the Best Ideas Newsletter Portfolio

First and foremost, firms in our Best Ideas portfolio should be considered our best ideas at any point in time. The Best Ideas portfolio can always be found on page 8 of our monthly Best Ideas Newsletter. Firms in our Dividend Growth portfolio should be considered our best dividend growth ideas at any point in time. The Dividend Growth portfolio can always be found on page 5 of our monthly Dividend Growth Newsletter.

Let’s talk about how the Valuentum Buying Index (VBI) informs which ideas we include in our actively-managed portfolios. We’ve noticed via our statistical backtesting that the momentum factor behind our process tends to be much more pronounced (powerful) over longer periods of time. This was one of the interesting findings of our academic white paper study. We try to replicate this dynamic with the update cycle of our reports (and the time horizon for our ideas to work out). That’s why our reports are updated regularly (at least quarterly) or after material events and not daily or weekly. We don’t want to whipsaw our membership, nor do we think churn is the way to generate outperformance.

Though the time frame varies depending on each idea, we expect our best ideas to work out over a 12-24 month time horizon (on average) — any shorter than that is mostly luck, in our view. We tend to add firms to our Best Ideas portfolio when they register a 9 or 10 on our Valuentum Buying Index (VBI) and tend to remove firms from our Best Ideas portfolio when they register a 1 or 2 on our VBI. You’ll notice that we have a qualitative overlay in the portfolio, which is necessary and similar in thinking as if you were to imagine a value investor not adding every undervalued stock to his/her portfolio. There are always tactical and sector weighting considerations in any portfolio construction.

As for the time horizon for ideas, we like to maximize profits on every idea, with the understanding that momentum does exist and that prices over and under shoot intrinsic value all of the time. A value strategy (10 —> 5) truncates potential profits, while a momentum strategy (4 —> 1) ignores profits generated via value assessments. We’re after the entire profit potential. So, for example, if a firm is added to the Best Ideas portfolio as a 10 and is removed as a 5, we would have tuncated profit potential. Most of our highly-rated Valuentum Buying Index rated stocks have generated the vast outperformance of the Best Ideas portfolio. Please view the pricing cycle below.

Importantly, regarding our process, we don’t blindly and immediately add firms to our portfolio once they score a 9 or 10 (and we do not add all firms that score a 9 or 10 to our portfolio). For example, Google (GOOG), a current Best Ideas portfolio holding, registered a 10 on our scale, but we remained patient and didn’t add the company to our portfolio until after it reported earnings in late 2012, which provided us with an even better entry point (as new information came to light). We engage in a qualitative portfolio management overlay to maximize returns and minimize risk. The number informs our process, but the team makes the allocation decisions of the portfolio.

After adding firms to our Best Ideas portfolio, we may tactically trade around these positions when they have VBI ratings between 3 and 8 depending on the size of their weighting in our portfolio or their attractiveness relative to other opportunities (a score of 3 through 8 is typically equivalent to a ‘we’d hold’). We tend to remove firms from our Best Ideas portfolio when they register a 1 or 2 on our process. Importantly, however, firms in our Best Ideas portfolio, which have generally registered a 9 or 10 on our scale when we added them, should be considered our best ideas at any point in time.

Take eBay (EBAY) as another example of our process in action. The firm initially flashed a rating of 10 in late September 2011 (at $32 per share), and we added it to our Best Ideas portfolio. The VBI rating changed to a 6 in December 2011 and then back to a 10 in May 2012. Because the rating never breached a 1 or 2, we did not remove the position from our portfolio. In fact, we tactically added to it. eBay is probably one of the better examples to use for illustrating the prolonged outperformance driven by undervalued stocks that are beginning to generate good momentum. We like to capture the entire pricing cycle and not truncate it as most value investors do.

Though eBay may register a lower VBI rating in a subsequent update, we would still view it as one of our best ideas, as it is a holding in our Best Ideas portfolio (it has never flashed a ‘We’d Sell’ signal, 1 or 2). Obviously, there have been more straight-forward opportunities in our Best Ideas portfolio, especially in the case of EDAC Tech (EDAC), which had tripled since we added it to the portfolio (never registering below a 9 along the way). The VBI ratings on our most recent 16-page reports, downloadable directly from our website, reflect our current opinion on the company.

The Valuentum Buying Index, like all methodologies, informs the investment decision process, but in constructing a portfolio, a qualitative overlay is not only necessary but has been shown to optimize performance in the white paper study.

About Our Name

But how, you will ask, does one decide what [stocks are] attractive? Most analysts feel they must choose between two approaches customarily thought to be in opposition: value and growth,. We view that as fuzzy thinking. Growth is always a component of value [and] the very term value investing is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1993

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from a complete understanding of all investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value to momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

Valuentum has developed a user-friendly, discounted cash-flow model that you can use to value any operating company that you wish. Click here to buy this individual-investor-friendly model now! It could be the best investment you make.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice. For more information about Valuentum and the products and services it offers, please contact us at info@valuentum.com.