OptionsXpress Review 2015 Rating Cost Fees IRA ROTH Stocks Mutual Funds

Post on: 4 Июль, 2015 No Comment

OptionsXpress Pricing

- Stocks and ETFs: $8.95

- Options: $14.95 for up to 10 contracts, $1.50 per contract for over 10 contracts

- Options Active Traders: $12.95 for up to 10 contracts, $1.25/contract for over 10 contracts

- Mutual funds: $9.95

- Bonds: $5 per bond, $9.95 minimum

- Spreads, Straddles & Combos: $14.95 for up to 10 contracts, $1.50 per contract for over 10 contracts

OptionsXpress Important Fees and Surcharges

- Extended hours surcharge: $0

- Large order surcharge: $0

- Penny stocks surcharge: $0

- Options exercises or assignments: $9.95

- IRA setup fee: $0

- Annual IRA fee: $0

- Maintenance fee: $0

- Inactivity fee: $0

- Hidden fees: $0

OptionsXpress Advantages

- Many easy-to-use and well-designed trading tools

- Top rated customer service

- No setup and annual fee IRAs

- Great research amenities

- Free real-time streaming quotes

- Virtual trading

- $0 to open cash account

- Free online classes

- Free DRIPs

OptionsXpress Disadvantages

- Somewhat high commissions on stocks

OptionsXpress Account Types

- General Investing

- Individual Accounts

- Joint Tenants

- Business

- Corporate and LLC

- Partnership

- Investment Club

- Minor

- Custodial

- Coverdell (educational IRA)

- Minor Roth

- MinorTraditional

- Individual Retirement Accounts

- Traditional IRA

- Rollover IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

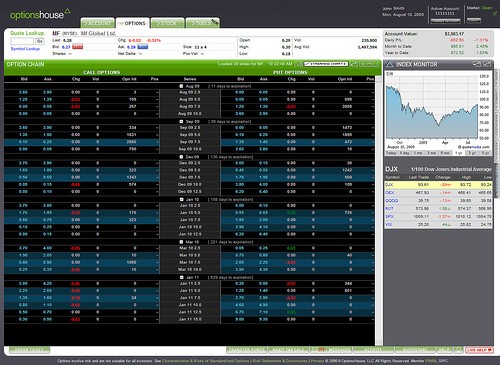

OptionsXpress Trading Tools Review

Options trading is what OptionsXpress is all about. The platform is great for any kind of trading but the tools and features make it a one of a kind trading station. First off, stock and index quotes are easy to read, the quote pages are filled with the information traders want to know such as volume, open interest, short ratio, earnings data and the latest news. Options chains are equally easy to read and quickly accessible from every page on the website from the quotes to the charts. Trading can be executed a number of ways starting with the actual trading screens and it is even possible to trade directly from the charts.

The platform is very versatile and allows for complex orders involving triggers, stops and limits. The charts are also top shelf; OptionsXpress uses interactive Java Charts which provide real time streaming access to any asset your account is enabled for. The charts include 100’s of standard technical analysis tools such as moving averages, Fibonacci Retracements, RSI, stochastic and MACD.

There are a number of versatile trading tools to compliment the charts. These include market and fundamental research as well as others attractive to active options traders. The Dragon may be the most useful but not the only one available. It allows you to input criteria according to your own strategies, no matter how advanced, and then scans the market looking for trade set ups. These could include calendar spreads, butterflies, iron condors and any other option strategy of your devise. The tool returns possible trades ranked in order and includes relevant options information so you can act as quickly as possible.

The Strategy Scan is a more focused version of the Dragon, it scans the market looking for trade set ups based on common strategies such as covered calls, calendar spreads, collars and strangles then lists the trades ranked by probability. Another useful tool, on a par with the Dragon, is the OptionsPricer. The Pricer is an interactive options chain that includes all the Option Greeks and allows you to change inputs to see how time, the price of the underlying asset and volatility affect the value of your target options.

OptionsXpress Review

The fees at OptionsXpress, which is now owned by Charles Schwab. are $8.95 flat for stock and ETF trades, and $9.95 for no-load mutual funds transactions. Options are at $12.95 for up to 10 contracts and $1.25 per contract when you buy or sell more than ten contracts. OptionsXpress also offers competitive pricing on futures and low rates on margin accounts. Minimum to open cash account is $0, margin account — $2,000.

OptionsXpress has remarkably few fees and surcharges — almost no other brokerage firm has so few. The only notable fee is a $10 options exercise and assignment fee (only options traders care about it). There are absolutely no hidden fees and no hefty trading platform charges, like at Tradestation or Choicetrade. The company offers fee-free individual retirement accounts as well as free dividend reinvestment — just call customer service to set it up.

OptionsXpress is known to provide users with excellent customer service. If you decide to call the firm, and place an order with a help of the broker, there is no surcharge for it (very rare among online brokers). The company also offers a bunch of very valuable features for free: virtual trading, streaming quotes (many brokers charge monthly fee for them) and online classes.

OptionsXpress is a necessity for any trader, regardless of experience or level. There is no account minimum except for margin and forex accounts. There is also no requirement for trading level. Anyone with valid identification information can open an account. Once the account is open all the tools and features are available to use. Trading can start as soon as the money transfer clears. It is also super easy to shift accounts from other brokerages.

OptionsXpress is an excellent option for mutual funds investors. Thanks to great trading and research tools, the company is also very popular among options traders. Retirement account seekers and buy and hold investors will be pleased with no IRA and account inactivity fees.

Open OptionsXpress Account

Get $100 when you open account at OptionsXpress